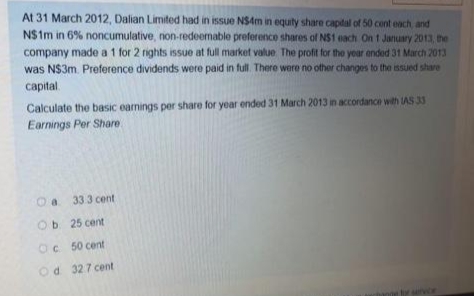

At 31 March 2012, Dalian Limited had in issue NS4m in equity share capital of 50 cent each and N$1m in 6% noncumulative, non-redeemable preference shares of NS1 each On 1 January 2013, the company made a 1 for 2 rights issue at full market value. The profit for the year anded 31 March 2013 was N$3m. Preference dividends were paid in full. There were no other changes to the issued share capital Calculate the basic earnings per share for year ended 31 March 2013 in accordance with IAS 33 Earnings Per Share

Q: Units produced and sold 150 300 Selling price per unit $400 $200 Variable expenses per…

A: Fixed costs are those costs which generally do not change with change in activity level. Variable…

Q: Which of the following dividend income is tax exempt? Dividend income received from

A: As per BIR, Dividend received by domestic or resident foreign corporation from another domestic…

Q: A company manufactures and sells one product. It plans to sell 25,000 units for the period. The…

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods…

Q: In 2005 waste from Flash Limited destroyed a section of Fletcher’s Land. Members of the community…

A:

Q: Statement 1: Consolidated operating expenses will not be affected, in any capacity, by an…

A: Intercompany transactions are those transactions which are made between two related companies. In…

Q: The following data pertain to a taxpayer’s request for refund: Date tax erroneously paid, January…

A:

Q: Selected data from Decco Company are presented below: Total assets $1,600,000 Average assets…

A: Formula used: Profit Margin = ( Net income / Net sales ) x 100

Q: 1. Given the information, determine the annual cost of hiring the outside accountant. $ X What is…

A: Annual cost of hiring the outside accountant means that the work has been outsourced by the company…

Q: PLEASE NOTE: For units, use commas as needed (i.e. 1,234). Units to Account For: Units Accounted…

A: Equivalent unit of production (EUP) refers to the process of using partially completed units as full…

Q: A Pizza store in a pizza chain Profit Centre A food service function at a nursing home #

A: The four responsibility center are: Profit Center, Cost Center, Revenue Center and investment center…

Q: Why do S Corporation owner/employees generally prefer to pay themselves a low salary for services…

A: S corporation is a type of corporation which pays lower corporate taxes in comparison to other…

Q: Direct labor Overhead 30,200 27,500 The revenues from each product are as follows: sirloin roasts,…

A: Cost of goods sold is the actual cost of goods that are being sold to the customers. Gross profit is…

Q: Projected sales Projected variable costs Projected fixed costs Projected unit sales price 60,000…

A: Degree of operating leverage (DOL): DOL reflects variable and fixed cost relationship of an…

Q: 5 An investor has borrowed $126,000 in the current year at 4.5% interest rate, with a commitment…

A:

Q: Stock Dividend Comparison Although Oriole Company has enough retained earnings legally to declare a…

A: Stock Dividend - Stock Dividend is made by the company in the form of shares rather than cash. It…

Q: Question 3 Coces, a furniture shop owner, buys a new set of cabinet worth $9,850. He receives an…

A: Trade discount is the discount, which is actually deduct from the original cost but it is not shown…

Q: Credit Sales 2. Purchase of Merchandise " 2/10, N/30" 3. Refund from supplier for returned…

A: under the double entry system they are many type of journals in which recording of transactions is…

Q: stment project which gives him 4.2% (compounded onthly) per year. How many quarters will it take for…

A: Given Pv= 7669 Fv=3pv=3*7669 n=? i= 4.2% year = 4.2%*3/12= 1.05%quaterly

Q: Although Oriole Company has enough retained earnings legally to declare a dividend, its working…

A: 1. Oriole Company Stockholders Equity Common Stock $10 Par 575,000…

Q: Zyra Company is conducting an initial public offering of 2,500,000 shares. Zyra Company already had…

A: In the context of the given question, we compute the tax on the initial public offer. First, we need…

Q: Dawn Company purchased a machine on January 1, 2018 for P3,000,000. At the date of acquisition, the…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: Princess Thea started a business on February 1, 2018 with a capital of P750 000. The following…

A: Transaction Worksheet: The Accounting Transactions worksheet includes the unadjusted Trail Balance,…

Q: A Corp has the following data:• Prime cost of 800,000• Variable Mfg OH of 100,000• Fixed Mfg OH of…

A: Inventoriable cost means the cost which is included in the valuation of inventory. In variable…

Q: 6 Power Manufacturing recorded operating data for its shoe division for the year. Sales Contribution…

A: Note: As per our guidelines, only the first question should be answered. 6. Controllable margin =…

Q: 1. The PowerPoint Corporation has two classes of share capital outstanding: 9% (dividend rate), P20…

A: A share split is a situation in which the management of the company increases the number of shares…

Q: This refers to earnings derive from depositing or lending money, goods or credits. O Dividend income…

A: Lets understand all options. Dividend income is a income derived from the investing in any entity.…

Q: Tyler Hawes and Piper Albright formed a partnership, investing $210,000 and $70,000, respectively.…

A: Introduction:- Partnership is an agreement between two or more persons to forma business with the…

Q: Starting from the separate inventory balances of the affiliates, the consolidated inventory balance…

A: Starting from the separate inventory balances of the affiliates, the consolidated inventory balance…

Q: Enter your answer in the space provided below. (Do not enter a dollar sign, and round to the nearest…

A: Capital gains deduction is the deduction which is given to taxpayer in the country of Canada which…

Q: Required information [The following information applies to the questions displayed below.] The…

A: Retained earnings is the amount of earnings which is accumulated over the period of time. Net Income…

Q: Which of these activities are in the scope of IAS 41?

A: The vines are covered by the definition of biological asset as it generates crops of grapes. when…

Q: Use the template below to prepare the Operating Cash Flows section of Brace's Statement of Cash…

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the…

Q: 3: An employee works 50 hours (50-40 were overtime hours) during a workweek in December of 2021, He…

A: Taxable Income: It is the base income upon which tax is levied and includes a few items of income…

Q: 4. Use the same information given in Problem 1. After the split, the par value per share of the…

A: Under share split of 2 for 1 , the shareholders will received 2 shares for every one share held.

Q: 1-33 Planning and Control, Management by Exception Study the framework for planning and control of a…

A: The income statement shows the net income or net loss that is calculated by deducting the expenses…

Q: FIXED COSTS One (1) Game Fixed Cost for Food (P100,000) Space (P240,000) Booth Space (P1,750) Total…

A: In the context of the given question, we compute the break-even point using the given table's data.…

Q: a. Compute the maximum depreciation deduction that Redwood can take in 2021 and igen 2022 on each of…

A: Item Cost Year of acquisition Year of Property Sec 179 deduction (half) Balance Depreciation rate…

Q: On January 1, 2016, Ritter Company bought 10% of the outstanding ordinary shares of Bear…

A:

Q: Carla Vistas, Inc. provided the following budgeted information for March through July: March…

A: Budgets are the forecasts or estimates that are made for future period. These reflect future…

Q: Ocean Ltd is the parent entity to the wholly owned subsidiaries of River Ltd, Creek Ltd, and Puddle…

A: The carrying value of equipment in the books of Ocean Ltd at the date of sale is $550,000 and the…

Q: Net cash provided by operating activities Net cash provided by investing activities Net cash flow…

A: The cash flow statement is prepared to record cash flow from various activities during the period…

Q: You are required to enter the following transactions in the books of Mo Ryan: SS

A: Solution Journal entry Journal is the book in which the transactions are first recorded Journal…

Q: Inc. (SII) developed standard costs for direct material and direct labour. In 2019, SII estimated…

A: If the actual rate is more than the standard rate than the rate variance is unfavorable , if however…

Q: The amount of discount to be recorded if the invoice is paid within the discount period on a…

A: Trade discount is that discount which is being given to all the customers on the list price of the…

Q: how much do the contest sponsors have to deposit in the escrow account? (Round your answer to the…

A: $6,231,105 amount do the contest sponsors have to deposit in the escrow account.

Q: opines on the professional responsibilities of the accountant in his practice of accounting and…

A: Professional Responsibility of Accountant: An Accountant assists organizations in making key…

Q: SM Food Company distributes to consumers coupons which may be presented (on or before a stated…

A: Liabilities are the dues and obligations which are being settled by the business. These can be short…

Q: Mazomanie Farm completed 20,000 units during the quarter and has 2,500 units still in process. The…

A: Statement of equivalent production 1. This statement means that to convert the incomplete units into…

Q: When company reduced its inventories to zero, then • Variable costing income > Absorption costing…

A: Variable cost means the cost which vary with the level of output where the fixed cost means the cost…

Q: Required:1. Calculate the cost per unit for each product using direct labor hours to assign all…

A: Activity based costing is more popular and better way to allocate the overhead and cost. In case of…

Step by step

Solved in 2 steps

- Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). Open the file EPS from the website for this book at cengagebrain.com. Enter all input items (AF) in the appropriate cells in the Data Section. Enter all formulas in the appropriate cells in the Answer Section. Enter your name in cell A1. Save the completed file as EPS2. Print the worksheet when done. Also print your formulas. Check figure: Basic earnings per share from continuing operations (cell D29), 5.94.Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). As vice president of finance for the firm, you have been asked to calculate earnings per share for 2011. The worksheet EPS has been provided to assist you.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.On January 2015, ABC had 5 million RM 1 ordinary shares in issue. On 1 March 2015, ABC made a 1 for every 2 bonus issue from the share premium account. On 1 August 2015, ABC issued 3 million RM 1 ordinary shares for RM 4.10 each at full market price. The profit after tex for the year ended 31 December 2015 is RM 3.8 million. The basic EPS for the year ended 31 December 2014 is 48.2 sen. At January 2015, the ordinary shareholders of ABC held options to purchase 1 million RM 1 ordinary shares at RM 3.10 per share. The options are exercisable between 1 January 2017 and 31 December 2018. The average market value of one RM 1 ordinary share of ABC for the year ended 31 December 2015 was RM 4. a) Calculate the basic EPS of ABC for the year ended 31 December 2015, including the comparative figure. b) Calculate the diluted EPS of ABC for the year ended 31 December 2015.

- Dolf Corporatiom’s equity at December 31, 2012, consisted of thefollowing: Preference share, P50 par value, 10% non-cumulative; 10,000 shares issuedand outstanding P 500,000Ordinary share, P10 par value, 80,000shares issued and outstanding 10,000 shares 800, 000 Retained Earnings p. 300,000 the preference share has a liquidating value of P55 per share. At December 31, 2012,the book value per share isa. P14.38 c. P13.13 b. P13.75 d. P10.00Jupiter corporation had the following shares outstanding at December 31. 2018: Ordinary shares, par P80 - 320.000: 6% preference shares, par P80 - 160.000. Accumulated profits for dividend distribution amounted to P64.400. No dividends were declared for 2016 and 2017. If the preference share capital is cumulative and fully participating, what is the dividends per share of the preference share? (Round off answers to two decimal places.)On July 1, 2010, Bettina Company's board of directors declared a 10% share dividend. The market price of Bettina's 400.000 outstanding ordinary shares, P50 par value, was P80 per share on the date of declaration. The share dividend was distributed on September 1, 2010 when the market price of the shares was P100 per share. What amount should be charged to the Accumulated Profits and Losses account as a result of the share dividend?

- The capital accounts of Britannia Company as of yearend 2014 are as follows: Ordinary Share Capital (P10 par) - 500,000 Share Premium - 250,000 Retained Earnings - 3,135,000 The company's ordinary shares are currently selling at P20 How much is the net effect of a 4-for-1 share split to the company's legal capital?Jupiter corporation had the following shares outstanding at December 31, 2018: Ordinary shares, par P80 – 320,000; 6% preference shares, par P80 – 160,000. Accumulated profits for dividend distribution amounted to P64,400. No dividends were declared for 2016 and 2017. If the preference share capital is cumulative and fully participating, what is the dividends per share of the preference share?On December 31, 20x1, Cassy Co. issued 10,000 shares with par value of P400 per share insettlement of a P4,000,000 loan payable with a related unamortized discount of P80,000, andaccrued interest of P360,000. On December 31, 20x1, the shares are selling at P480 per share. Howmuch is the gain(loss) on the extinguishment of the debt?