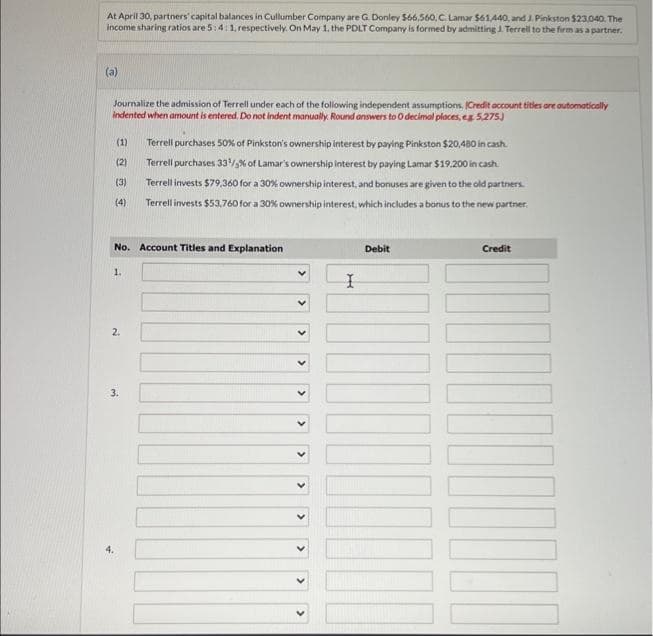

At April 30, partners' capital balances in Cullumber Company are G. Donley $66,560, C. Lamar $61,440, and J. Pinkston $23,040. The income sharing ratios are 5:4:1, respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner. (a) Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, eg 5,275) (2) (1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $20,480 in cash Terrell purchases 33% of Lamar's ownership interest by paying Lamar $19,200 in cash Terrell invests $79,360 for a 30% ownership interest, and bonuses are given to the old partners. Terrell invests $53,760 for a 30% ownership interest, which includes a bonus to the new partner. (3) (4) No. Account Titles and Explanation 1. 2. 3. I Debit Credit 0000000000⁰⁰

At April 30, partners' capital balances in Cullumber Company are G. Donley $66,560, C. Lamar $61,440, and J. Pinkston $23,040. The income sharing ratios are 5:4:1, respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner. (a) Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, eg 5,275) (2) (1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $20,480 in cash Terrell purchases 33% of Lamar's ownership interest by paying Lamar $19,200 in cash Terrell invests $79,360 for a 30% ownership interest, and bonuses are given to the old partners. Terrell invests $53,760 for a 30% ownership interest, which includes a bonus to the new partner. (3) (4) No. Account Titles and Explanation 1. 2. 3. I Debit Credit 0000000000⁰⁰

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter23: Accounting For Partnerships

Section: Chapter Questions

Problem 2.1AP

Related questions

Question

Don't give answer in image format

Transcribed Image Text:At April 30, partners' capital balances in Cullumber Company are G. Donley $66,560, C, Lamar $61,440, and J. Pinkston $23,040. The

income sharing ratios are 5:4:1, respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner.

(a)

Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically

indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275)

(2)

(1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $20,480 in cash.

Terrell purchases 33¹/ 5% of Lamar's ownership interest by paying Lamar $19.200 in cash.

Terrell invests $79,360 for a 30% ownership interest, and bonuses are given to the old partners.

Terrell invests $53,760 for a 30% ownership interest, which includes a bonus to the new partner.

(3)

(4)

No. Account Titles and Explanation

4.

1.

2.

3.

I

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning