At December 31, 2014, George Weston Ltd. purchased 90% of the outstanding common shares of Bluenotes Ltd. for $8.55 million in cash. On that date, the shareholders' equity of Bluenotes totaled $8 million and consisted of $1 million in common shares and $7 million in retained earnings. Both companies use the straight-line method to calculate depreciation. Goodwill, if any arises as a result of this business combination, is written down when there is an impairment. Both George Weston and Bluenotes report under accounting standards for private enterprises and pay tax at the rate of 40%. For the year ending December 31, 2019, the statements of earnings for George Weston and Bluenotes were as follows: George Weston $22,500,000 16,000,000 Bluenotes $9,800,000 5,000,000 Sales and other revenue Cost of goods sold Depreciation expense Other expenses 2,500,000 2,000,000 1,800,000 $2,200,000 1,200,000 $1,600,000 Net income At December 31, 2019, the condensed statements of financial position for the two companies were as follows: George Weston $31,000,000 Bluenotes $13,500,000 Total assets Liabilities $5,000,000 12,100,000 $1,200,000 1,000,000 11,300,000 $13,500,000 No par common shares Retained earnings 13,900,000 $31,000,000 Total

At December 31, 2014, George Weston Ltd. purchased 90% of the outstanding common shares of Bluenotes Ltd. for $8.55 million in cash. On that date, the shareholders' equity of Bluenotes totaled $8 million and consisted of $1 million in common shares and $7 million in retained earnings. Both companies use the straight-line method to calculate depreciation. Goodwill, if any arises as a result of this business combination, is written down when there is an impairment. Both George Weston and Bluenotes report under accounting standards for private enterprises and pay tax at the rate of 40%. For the year ending December 31, 2019, the statements of earnings for George Weston and Bluenotes were as follows: George Weston $22,500,000 16,000,000 Bluenotes $9,800,000 5,000,000 Sales and other revenue Cost of goods sold Depreciation expense Other expenses 2,500,000 2,000,000 1,800,000 $2,200,000 1,200,000 $1,600,000 Net income At December 31, 2019, the condensed statements of financial position for the two companies were as follows: George Weston $31,000,000 Bluenotes $13,500,000 Total assets Liabilities $5,000,000 12,100,000 $1,200,000 1,000,000 11,300,000 $13,500,000 No par common shares Retained earnings 13,900,000 $31,000,000 Total

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

100%

Please include all steps of calculations for my reference. Thanks!

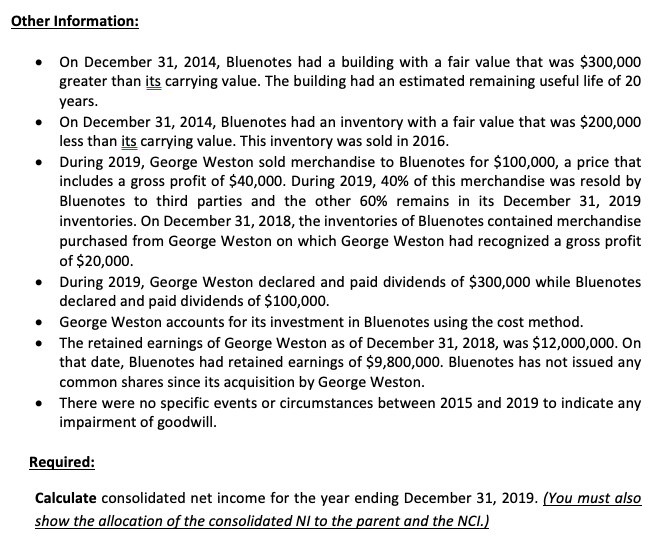

Transcribed Image Text:Other Information:

On December 31, 2014, Bluenotes had a building with a fair value that was $300,000

greater than its carrying value. The building had an estimated remaining useful life of 20

years.

• On December 31, 2014, Bluenotes had an inventory with a fair value that was $200,000

less than its carrying value. This inventory was sold in 2016.

• During 2019, George Weston sold merchandise to Bluenotes for $100,000, a price that

includes a gross profit of $40,000. During 2019, 40% of this merchandise was resold by

Bluenotes to third parties and the other 60% remains in its December 31, 2019

inventories. On December 31, 2018, the inventories of Bluenotes contained merchandise

purchased from George Weston on which George Weston had recognized a gross profit

of $20,000.

• During 2019, George Weston declared and paid dividends of $300,000 while Bluenotes

declared and paid dividends of $100,000.

• George Weston accounts for its investment in Bluenotes using the cost method.

• The retained earnings of George Weston as of December 31, 2018, was $12,000,000. On

that date, Bluenotes had retained earnings of $9,800,000. Bluenotes has not issued any

common shares since its acquisition by George Weston.

There were no specific events or circumstances between 2015 and 2019 to indicate any

impairment of goodwill.

Required:

Calculate consolidated net income for the year ending December 31, 2019. (You must also

show the allocation of the consolidated NI to the parent and the NCI.)

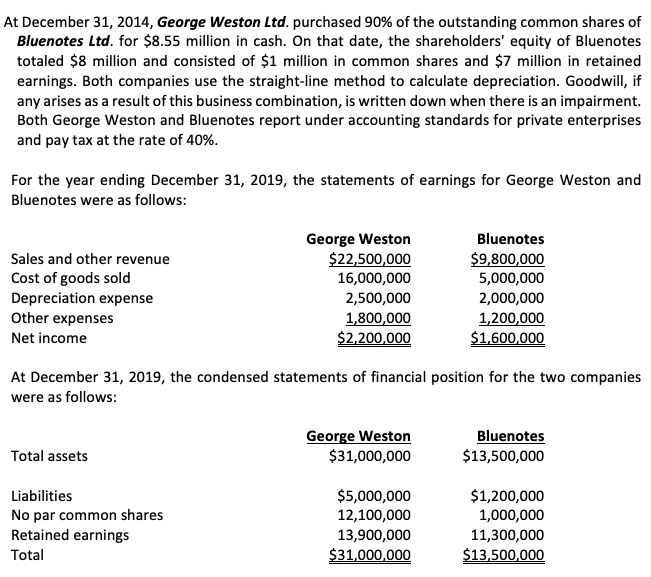

Transcribed Image Text:At December 31, 2014, George Weston Ltd. purchased 90% of the outstanding common shares of

Bluenotes Ltd. for $8.55 million in cash. On that date, the shareholders' equity of Bluenotes

totaled $8 million and consisted of $1 million in common shares and $7 million in retained

earnings. Both companies use the straight-line method to calculate depreciation. Goodwill, if

any arises as a result of this business combination, is written down when there is an impairment.

Both George Weston and Bluenotes report under accounting standards for private enterprises

and pay tax at the rate of 40%.

For the year ending December 31, 2019, the statements of earnings for George Weston and

Bluenotes were as follows:

George Weston

$22,500,000

16,000,000

Bluenotes

$9,800,000

5,000,000

Sales and other revenue

Cost of goods sold

Depreciation expense

Other expenses

2,500,000

2,000,000

1,800,000

1,200,000

Net income

$2,200,000

$1,600,000

At December 31, 2019, the condensed statements of financial position for the two companies

were as follows:

George Weston

$31,000,000

Bluenotes

$13,500,000

Total assets

$5,000,000

12,100,000

13,900,000

$1,200,000

1,000,000

Liabilities

No par common shares

Retained earnings

11,300,000

$13,500,000

Total

$31,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning