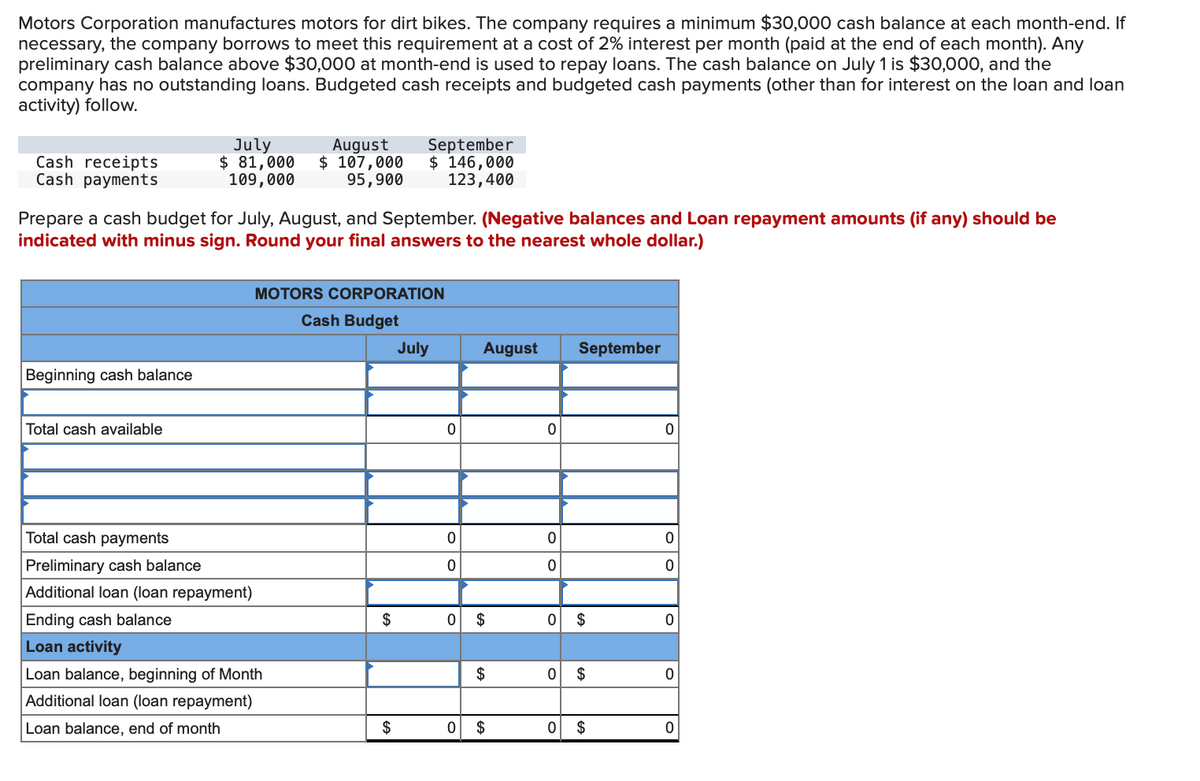

Motors Corporation manufactures motors for dirt bikes. The company requires a minimum $30,000 cash balance at each month-end. If necessary, the company borrows to meet this requirement at a cost of 2% interest per month (paid at the end of each month). Any preliminary cash balance above $30,000 at month-end is used to repay loans. The cash balance on July 1 is $30,000, and the company has no outstanding loans. Budgeted cash receipts and budgeted cash payments (other than for interest on the loan and loan activity) follow. Cash receipts Cash payments Beginning cash balance July $ 81,000 109,000 Total cash available Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) August $ 107,000 95,900 Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance Loan activity Loan balance, beginning of Month Additional loan (loan repayment) Loan balance, end of month MOTORS CORPORATION Cash Budget September $ 146,000 123,400 $ $ July 0 0 0 August September 0 $ 0 $ $ 0 0 0 0 $ 0 $ 0 $ 0 0 0 0 0 0

Motors Corporation manufactures motors for dirt bikes. The company requires a minimum $30,000 cash balance at each month-end. If necessary, the company borrows to meet this requirement at a cost of 2% interest per month (paid at the end of each month). Any preliminary cash balance above $30,000 at month-end is used to repay loans. The cash balance on July 1 is $30,000, and the company has no outstanding loans. Budgeted cash receipts and budgeted cash payments (other than for interest on the loan and loan activity) follow. Cash receipts Cash payments Beginning cash balance July $ 81,000 109,000 Total cash available Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) August $ 107,000 95,900 Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance Loan activity Loan balance, beginning of Month Additional loan (loan repayment) Loan balance, end of month MOTORS CORPORATION Cash Budget September $ 146,000 123,400 $ $ July 0 0 0 August September 0 $ 0 $ $ 0 0 0 0 $ 0 $ 0 $ 0 0 0 0 0 0

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 26P

Related questions

Question

Transcribed Image Text:Motors Corporation manufactures motors for dirt bikes. The company requires a minimum $30,000 cash balance at each month-end. If

necessary, the company borrows to meet this requirement at a cost of 2% interest per month (paid at the end of each month). Any

preliminary cash balance above $30,000 at month-end is used to repay loans. The cash balance on July 1 is $30,000, and the

company has no outstanding loans. Budgeted cash receipts and budgeted cash payments (other than for interest on the loan and loan

activity) follow.

Cash receipts

Cash payments

Beginning cash balance

July August

$ 81,000 $ 107,000

109,000

95,900

Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be

indicated with minus sign. Round your final answers to the nearest whole dollar.)

Total cash available

MOTORS CORPORATION

Cash Budget

Total cash payments

Preliminary cash balance

Additional loan (loan repayment)

Ending cash balance

Loan activity

Loan balance, beginning of Month

Additional loan (loan repayment)

Loan balance, end of month

September

$ 146,000

123,400

$

$

July

0

0

0

August September

0 $

0

$

$

0

0

0

0

0

$

$

$

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College