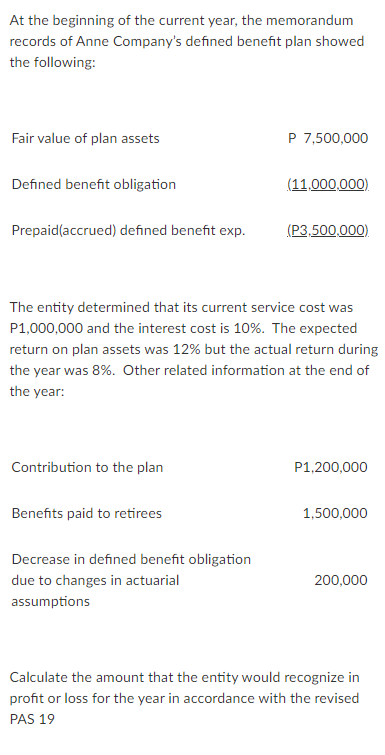

At the beginning of the current year, the memorandum records of Anne Company's defined benefit plan showed the following: Fair value of plan assets P 7,500,000 Defined benefit obligation (11,000,000) Prepaid(accrued) defined benefit exp. (P3.500,000) The entity determined that its current service cost was P1,000,000 and the interest cost is 10%. The expected return on plan assets was 12% but the actual return during the year was 8%. Other related information at the end of the year: Contribution to the plan P1,200,000 Benefits paid to retirees 1,500,000 Decrease in defined benefit obligation due to changes in actuarial 200,000 assumptions Calculate the amount that the entity would recognize in profit or loss for the year in accordance with the revised PAS 19

At the beginning of the current year, the memorandum records of Anne Company's defined benefit plan showed the following: Fair value of plan assets P 7,500,000 Defined benefit obligation (11,000,000) Prepaid(accrued) defined benefit exp. (P3.500,000) The entity determined that its current service cost was P1,000,000 and the interest cost is 10%. The expected return on plan assets was 12% but the actual return during the year was 8%. Other related information at the end of the year: Contribution to the plan P1,200,000 Benefits paid to retirees 1,500,000 Decrease in defined benefit obligation due to changes in actuarial 200,000 assumptions Calculate the amount that the entity would recognize in profit or loss for the year in accordance with the revised PAS 19

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 7RE

Related questions

Question

Transcribed Image Text:At the beginning of the current year, the memorandum

records of Anne Company's defined benefit plan showed

the following:

Fair value of plan assets

P 7,500,000

Defined benefit obligation

(11,000,000)

Prepaid(accrued) defined benefit exp.

(P3,500,000)

The entity determined that its current service cost was

P1,000,000 and the interest cost is 10%. The expected

return on plan assets was 12% but the actual return during

the year was 8%. Other related information at the end of

the year:

Contribution to the plan

P1,200,000

Benefits paid to retirees

1,500,000

Decrease in defined benefit obligation

due to changes in actuarial

200,000

assumptions

Calculate the amount that the entity would recognize in

profit or loss for the year in accordance with the revised

PAS 19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT