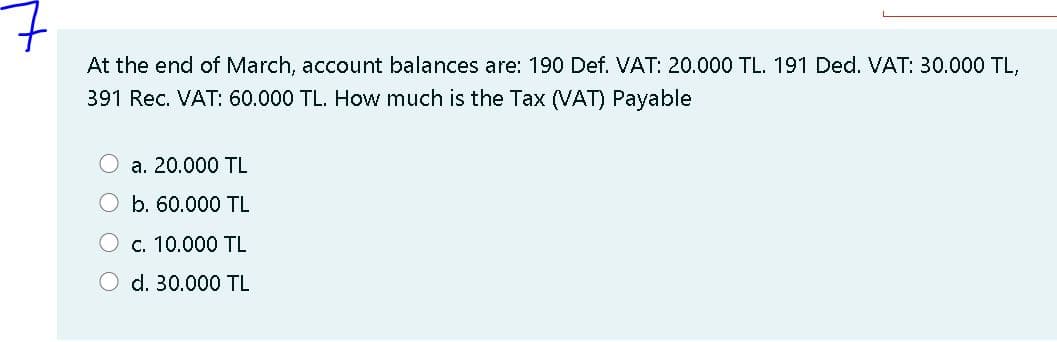

At the end of March, account balances are: 190 Def. VAT: 20.000 TL. 191 Ded. VAT: 30.000 TL, 391 Rec. VAT: 60.000 TL. How much is the Tax (VAT) Payable a. 20.000 TL O b. 60.000 TL c. 10.000 TL d. 30.000 TL

Q: Transactions Journal Entry Paid rent of the space for the month amounting to P10,000 less: 5%…

A: Journal entries are recorded as a first step of accounting process in which atleast one account is…

Q: Delivered monthly statements collected fee income of P52,000. What is the effect on the element?

A: Accounting equation is referred to the first step of an accounting cycle. It represents that the…

Q: Average Ledger Balance Deposit Float Reserve Requirement Earnings Credit Rate Service Charges for…

A: Average collected balance can be defined as the average balance of collected funds in the bank…

Q: A service provider had the following data during the month: Revenue, including VAT…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: At the end of March, account balances are: 190 Def. VAT: 20.000 TL. 191 Ded. VAT: 30.000 TL, 391…

A: Tax Payable:- It is the payment which one made on the income earned within the country or from…

Q: The company sells on terms 2/10, net 30. Total sales for the year are P1,000,000, of which P100,000…

A: Total sales is the combination of cash sales and credit sales. Accounts receivables is the amount to…

Q: The following information relates to Eva Co's sales tax for the month of March 20X3: $ 109,250 Sales…

A: We have the following information: Sales (including sales tax): $109,250 Purchases (net of sales…

Q: 15. The following are data available for the month of September 2021 of Saint James Corp. Gross…

A: A. Accrued payroll = Gross earnings - Total deductions = P8500000 - (425000 + 85000 + 85000 +…

Q: A credit sale of $2800 is made on July 15, terms 4/10, net/30, on which a return of $200 is granted…

A: Net Receivables = Credit sales made - Sales return = $2800 - $200 = $2600

Q: In January, gross earnings in Sheridan Company were $78,000. The 7.65% FICA tax rate consists of the…

A: FICA : It is a mandatory payroll tax and it includes Medicare tax and social security tax.

Q: A 90-day, 10% note for $10,000 dated March 15 is received from a customer on account. The face value…

A: The face Value of the note is the amount at which the note is issued. It is the Principal Amount.

Q: Vat Payable in January is? * Given the following date during the 1st quarter of 2022: Output Tax…

A: Vat payable is the amount of output tax collected payable to the taxation authority after setting…

Q: 2. Proud Co.'s records on Dec. 31, 20x1 show the following account balances: Trade accounts payable…

A: Current liabilities: Liabilities that have to be paid within one year or one operating cycle,…

Q: JYD Accounting Firm pays its employees at a rate of P50/hr. The tax and other deductions amount to…

A: Gross pay of the employees means amount of earnings gained by the employee either on the basis of…

Q: 1. 2. 3. 4. 5. 6. 7. Swifty's cash register showed the following totals at the end of the day on…

A: Given that, Total pre tax sales = $56,000 GST = $2,800 PST = $3,920 Sales tax remitted to…

Q: Compute the gross income

A: sales = 336000 assume VAT @12% VAT = 336000*12%/112% = 36000

Q: 10. Naronath & Co. has a.DSO of 30 days, and its annual sales are $6,500,000. What is its accounts…

A: DSO is days sales outstanding. DSO = Accounts Receivable/Sales * 365 Accounts receivable =…

Q: disbursements in a month in 2021: Non-life insurance P145,700 34,600 Life insurance P 150,000 45,000…

A: Here to taken consider the percentage of taxes for life insurance business which has the tax base…

Q: Goods totaling P100,000 were purchased February 2 with terms of 2/10, n/30. Returns of P20,000 were…

A: Formula: Net purchases = Purchases - Purchases returns

Q: At 30 June 20X4 a company's allowance for receivables was $39,000. At 30 June 20X5 trade…

A: Allowance for doubtful debts is considered as the contra asset item i.e used to decrease the value…

Q: 5. Agency XYZ collected the following income during the month: Income Taxes – Individual, P500,000;…

A: Revenue means the amount earned by selling the goods or services. Revenue in case of government…

Q: of adustingenty wal. accrued 500.he salaviel for the end. the fis year made an of first Paid co the…

A: Adjusting Entries:- Adjusting entries defined as those entries, that are occurred at the end of…

Q: capital accounts at the beginning of each year and after char salaries at the rate of RO 8,000; RO…

A: Machinery Manufactures Trading Account…

Q: Which of the following is the account and amount that should appear in the dotted places in the…

A: Given, The total of Receivables = TL 15,000 + TL 20,400 = TL 35,400 The total of Debts = TL 30,000 +…

Q: Salam Company has total receipts for the month of $16,170 including sales taxes. If the sales tax…

A: Sale tax means that tax levied by government on the sale or purchase of goods. Sale revenue means…

Q: The following information relates to Eva Co's sales tax for the month of March 2015: 2$ 109,250…

A: Sales tax on sales = [Sales / (1 + sales tax rate)] x sales tax rate = [109250/(1+0.15)]*15% =…

Q: - At 31 December 20X2 Bunting Co's receivables totalled $400,000 and an allowance for receivables of…

A: Allowance for receivables account: This account records the estimated amount of receivables that are…

Q: M Co., a VAT taxpayer, had the following data, VAT not included, in each of:…

A: Value Added Tax: It is an indirect tax charged on goods and services for value added at every…

Q: Martin Incorporated uses the percent-of-credit sales method to estimate uncollectibles. Total sales…

A: Bad debts expense = Credit sales x 5% Balance in allowance for uncollectible accounts after the…

Q: Pickett Company received a 90 day, six percent note receivable for $20,000 on November 1. How much…

A: Note receivable amount = $20,000 Due period = 90 days Note received date = November 1

Q: A credit sale of $4,000 is made on April 25, terms 2/10, n/30, on which a return of $250 is granted…

A: Formula: Net sales = Sales - sales returns and allowances

Q: Tax due P20,000 is 10 days past due. Compute the interest and surcharge. Use 365 days.

A: Interest is the charge which is levied by the tax authority on the tax amount if the same is not…

Q: Sly's Salon has total receipts for the month of $9,275 including sales taxes. If the sales tax rate…

A: Sales taxes are the amount of indirect taxes that are imposed on sale of goods and services.

Q: A credit sale of $4,000 is made on April 25, terms 2/10, n/30, on which a return of $250 is granted…

A: Formula used: Net sales = Sales - Sales returns. Deduction of sales returns from sales value derives…

Q: How much is the VAT Payable in May? Given the following data during the 2nd quarter of 2022 Month…

A: VAT or Value added tax is an Indirect tax which is imposed on Goods and Services. Net VAT payable is…

Q: 22. On July 1, Year 10, Cabaret Corporation factored P80,000 of its accounts receivable without…

A: Cash received from factor of receivables = Accounts receivable factored - Amount retained -…

Q: 1- Determine the VAT amounts which you should pay or return. 2- Record the entries for…

A: VAT:VAT stands for value added tax. It is the tax charged by the government on the goods and service…

Q: In credit terms of 3/15, n/45, the "3" represents the Oa. number of days in the discount period Ob.…

A: Credit terms: Credit terms are terms between a seller and buyer. These terms state the time and…

Q: A credit sale of $4,000 is made on April 25, terms 2/10, n/30, on which a return of $250 is granted…

A: Here terms 2/10, n/30 means 2% discount will be given if payment is made within 10 days. And final…

Q: c) An invoice of RO 50,000 with the terms 7/18, n/30, ROG is dated on May 10th. The goods are…

A: Bill payable: It can be defined as a document that presents the amount owed by an individual or an…

Q: What are the accounting entries required to record sales on credit of $10,000, on which sales tax is…

A: Lets understand the basics. Journal entry is required to make to record financial event and…

Q: Milford Company uses the percent-of-sales method to estimate uncollectibles. Netcredit sales for the…

A: As posted multiple independent questions we are answering only first question kindly repost the…

Q: 4. The following are data available for the month of September 2021 of Saint James Corp. Gross…

A: A. Accrued payroll = Gross earnings - Total deductions = P8500000 - (425000 + 85000 + 85000 +…

Q: Tax due P100,000 Is 60 days past due. Compute the Interest and surcharge. Use 365 days.

A: On late payment of tax due, Surcharge shall be charged at 25% of the amount due and Interest @ 12%…

Q: At 30 June 20X4 a company's allowance for receivables was $39,000. At 30 June 20X5 trade…

A: We have the following information: Allowance for receivables: $39,000 At 30 June 20X5 trade…

Q: s regi Complete the journal entry for the sales. sales. sales taX at a 107o rate. Account Debit…

A: 10. Journal Entry Date Particulars LF Debit ($) Credit ($) xxx Sales 436.36 Sales…

Step by step

Solved in 2 steps

- At the end of March, account balances are: 190 Def. VAT: 20.000 TL. 191 Ded. VAT: 30.000 TL, 391 Rec. VAT: 60.000 TL. How much is the Tax (VAT) Payable? a. 30.000 TL b. 60.000 TL c. 10.000 TL d. 20.000 TLThe following information relates to Eva Co's sales tax for the month of March 20X3:$Sales (including sales tax) 109,250Purchases (net of sales tax) 64,000Sales tax is charged at a flat rate of 15%. Eva Co's sales tax account showed an opening credit balanceof $4,540 at the beginning of the month and a closing debit balance of $2,720 at the end of themonth.What was the total sales tax paid to regulatory authorities during the month of March 20X3?NYFG, Inc.l has sales including sales taxes for the month of $445,200. If the sales tax rate is 6%, how much does NYFG owe for sales tax? Select one: a. $31,200 b. $26,712 c. $25,200 d. $45,200 e. $445,200

- 22-A company purchased goods worth RO 10,000 excluding VAT and sold to customers for RO 25,000 excluding VAT. Assume the VAT rate as 5%. How much will be the VAT collected by the government? a. RO 1,750 b. RO 750 c. RO 1,250 d. RO 500Tax due P20,000 is 10 days past due. Compute the interest and surcharge. Use 365 days.A seller of goods had the following details of sales and collection during the month: Receivables, beginning P 200,000.00 Gross sales 400,000.00 Less: Collection 500,000.00 Receivables, end P 100,000.00 1. What is the amount subject to business tax? a. P500,000 b. P400,000 c. P300,000 d. P200,000 2. In the immediately preceding problem, determine the amount subject to business tax if the taxpayer is a seller of services. a. P500,000 b. P400,000 c. P300,000 d. P200,000

- 16. Umasa Company reported rental revenue of P2,210,000 in the cash basis income tax return for the year ended November 30, 2020. Rent receivable – Nov. 30, 2020 is P1,060,000; Rent receivable – Nov. 30, 2019 is P800,000; and Uncollectible rent written off during the fiscal year is P30,000. Under accrual basis, what amount should be reported as rent revenue? a. P1,920,000 b. P2,240,000 c. P2,500,000 d. P1,980,000The company sells on terms 2/10, net 30. Total sales for the year are P1,000,000, of which P100,000 are on cash basis. Half of the customers pay on the tenth day and take discounts on average, 40 days after their purchases. What is the average amount of receivables?A seller of goods has the following details of sales and collection during the month: Receivables, beginning P 500,000.00 Gross sales 700,000.00 Less: Collection 450,000.00 Receivables, end P 750,000.00 1. What is the amount subject to business tax? 2. Determine the amount subject to business tax if the taxpayer is a seller of services.

- The annual sales of a company are $47,000 including sales tax at 17.5%. Half of the sales are on credit terms; half are cash sales. The receivables are $4,700. What is the trade receivables collection period (to the nearest day)? A 37 days B 43 days C 73 days D 86 daysThe company sells on terms 2/10, net 30. Total sales for the year are P1,000,000, of which P100,000 are on cash basis. Half of the customers pay on the tenth day and take discounts on average, 40 days after their purchases. What is the average amount of receivables? a. P62,500 b. P69,444.44 c. P20,408.16 d. P10,204.086 - Which of the following is the account and amount that should appear in the dotted places in the journal article above? a) 191 VAT Deductible 5.400 TL B) 391 VAT to be calculated Hs. 5.400 TL NS) 391 Calculated VAT Hs. 6.300 TL D) 360 Taxes and Funds Payable Hs. 5.400 TL TO) 191 VAT Deductible 5,000 TL