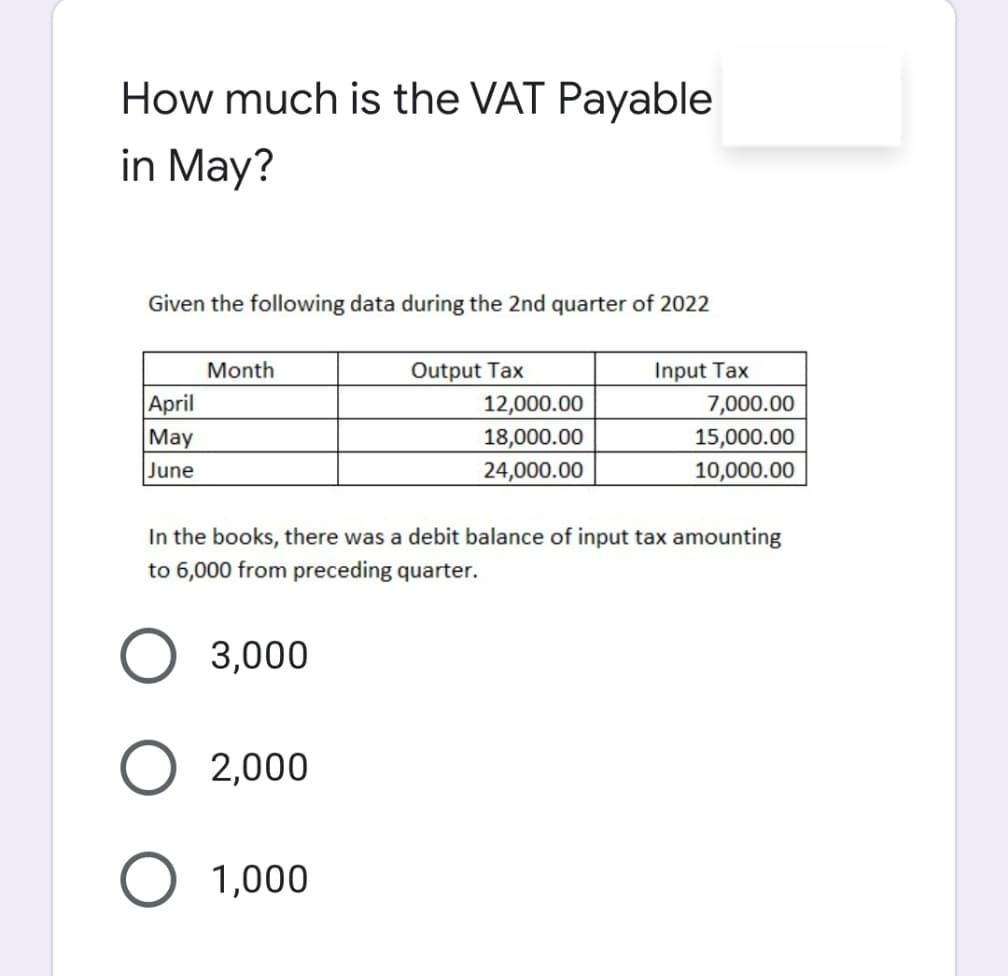

How much is the VAT Payable in May? Given the following data during the 2nd quarter of 2022 Month Output Tax 12,000.00 18,000.00 24,000.00 Input Tax April May June 7,000.00 15,000.00 10,000.00 In the books, there was a debit balance of input tax amounting to 6,000 from preceding quarter. 3,000 O 2,000 O 1,000

How much is the VAT Payable in May? Given the following data during the 2nd quarter of 2022 Month Output Tax 12,000.00 18,000.00 24,000.00 Input Tax April May June 7,000.00 15,000.00 10,000.00 In the books, there was a debit balance of input tax amounting to 6,000 from preceding quarter. 3,000 O 2,000 O 1,000

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 6Q: What amount is payable to a state tax board if the original sales price is $3,000, and the tax rate...

Related questions

Question

Transcribed Image Text:How much is the VAT Payable

in May?

Given the following data during the 2nd quarter of 2022

Output Tax

12,000.00

Month

Input Tax

April

May

June

7,000.00

18,000.00

15,000.00

24,000.00

10,000.00

In the books, there was a debit balance of input tax amounting

to 6,000 from preceding quarter.

3,000

2,000

1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning