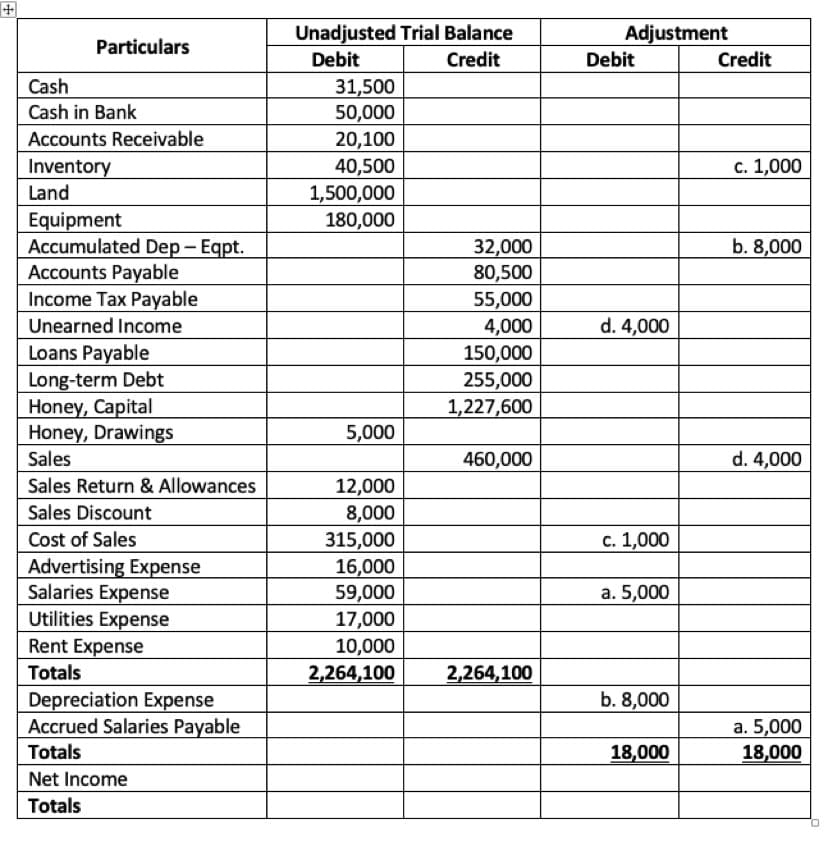

At the end of the year, on December 31, 2019, the bookkeeper of Honey Company prepared an Unadjusted Trial Balance with corresponding adjustments at the end of the year. Complete the worksheet below.

Q: Your new audit client, Guimba Company prepared the trial balance below as of December 31, company…

A:

Q: Although entries have been recorded all year, adjusting entries have not been recorded since…

A: Journal Entry - A journal entry records the business transaction in systematic manner either…

Q: For each of the following independent situations, give the journal entries to adjust and correct the…

A: These are the Journal entries that are recorded in a Company's General Ledger that occurs at the end…

Q: Benderson, Inc. makes adjusting journal entries (AJEs) at the end of every month when they prepare…

A: As per the accrual method of accounting, all the revenues and expenses incurred in relation for…

Q: The McDaniel Company operates using a calendar year-end. The following information pertains to…

A: Adjusting entries are the entries that are passed at the year-end but before the finalization of the…

Q: he end of the year, the company records an adjusting entry to accrue $125,000 of wages owed to its…

A: The accrued wages are yet to be paid at the end of the year . The wage expense has been incurred but…

Q: On June 1, 2019, Herbal Co. received $22,440 for the rent of land for 12 months. Journalize the…

A: Rent received in advance is not recognized as revenue and is shown as a liability in the balance…

Q: At the end of the current year, $17,555 of fees have been earned but have not been billed to…

A: Journal entries are the building blocks of accounting, which is the act of recording the economic or…

Q: On January 18, 2019, Big City Co, paid $36,000 for a two-year insurance premium that covers February…

A: 1.

Q: On July 1, 2022, Blossom Company pays $22,500 to Ivanhoe Company for a 1-year insurance contract.…

A: In this Numerical has covered the concept of Journal Entry, Adjusting Entry, and T-Accounts.

Q: The Mazzanti Wholesale Food Company’s fiscal year-end is June 30. The company issues quarterly…

A: Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to…

Q: At the end of the current year, $16,460 of fees have been earned but have not been billed to…

A: Adjusting journal entry: At year end when company finalise its accounts then any unrecognized income…

Q: At the end of the year, on December 31, 2019, the bookkeeper of the Jonny Company prepared an…

A: Statement of changes in owners equity shows all changes in the equity balance of the business for…

Q: Record the necessary adjusting journal entry at December 31, 2020 for Purple Company using the…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: Assume that a company’s fiscal year ends on December 31. Which of the following events involves an…

A: Adjusting Entries: Adjusting entries are accounting journal entries made after a trial balance is…

Q: Prepare the necessary adjusting entries at December 31, 2021, for the Microchip Company for each of…

A: Working Notes: Calculation of Interest : 90000 x 8% x ( 3 / 12 ) = 7200 x 0.25 = $ 1800 Calculation…

Q: On December 1, 2019, an advance rent payment of $25,800, representing a three-month prepayment for…

A: The revenue and expenses are recognised when they are incurred irrespective of cash transaction.

Q: Which of the following statements concerning reversing entries is true? Reversing entries are…

A: Reversing entries are those entries that are passed on the very first day of an accounting period in…

Q: The unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year,…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: At the end of the current year, $23,570 of fees have been earned but have not been billed to…

A: Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to…

Q: The following information relates to the Muscat Company at the end of 2019. The accounting period is…

A: Prepaid expense is the expense which is paid in advance and not incurred yet. Such expense are not…

Q: Prepare the company’s Post-Closing Trial Balance as at December 31, 2021

A: Post closing trail balance is the trail balance which as the name suggests is the post closing of…

Q: The unadjusted trial balance of the Supplies account was $9,312 on December 31, 2019. a physical…

A: The Numerical has covered the concept of Adjusting Entries. The Adjusting Entries are prepared at…

Q: For each of the following independent situations, give the journal entries to adjust and correct the…

A: These are the Journal entries that are recorded in a Company's General Ledger that occurs at the end…

Q: Company received RO 20,000 for services to be provided in the

A: Ans. Initially the entry which the company would have passed should be as follows: Cash a/c Dr.…

Q: On July 1, 2019, Splish Brothers Inc. pays $24,900 to Kalter Insurance Co. for a 3-year insurance…

A: From July 1 to Dec 31: 6 months Out of 36 months of insurance, the amount for 6 months has been…

Q: Prepare the journal entries to record the following adjustment information of September 30, 2019 and…

A: Adjusting journal entries are used to record transactions that have occurred but have not yet been…

Q: The trial balance columns of the worksheet for Marigold at March 31, 2019, are as follows.

A: Solution: Marigold Worksheet Adjustments Adjusted Trial Balance Income Statement Balance…

Q: Pitman Company is a small editorial services company owned and operated by Jan Pitman. On October…

A: Introduction: Adjusting Entries are the journal entries that are made at the end of a given…

Q: On May 1, a company with a July 31 fiscal year-end receives an advance payment of $24,000 from a…

A: Revenue earned on July 31 = Total amount received x no. of months / 12 = $24,000 x 3 months / 12…

Q: equired: With respect to wages, provide the adjusting entry required at the end of Year 1 and the…

A:

Q: Prepare the December 31 year-end entry that companies record to adjust the Revenue and the Unearned…

A: Unearned revenue is the money received by the enterprises for which the service/ product are yet to…

Q: Happy Travel Company was set up by Janet Chan two years ago. December 31, 2021, after adjusting…

A: The balance sheet shows the financial position of the company that includes the assets, liabilities,…

Q: After 5 years of operations Svenson’s tutoring clinic showed the following post-closing balances at…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: the following information to provide the adjusting journal entry that Chipotle should have made on…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: Chantelle Chance is a hair dresser who stated in business on October 1, 2018 and has not registered…

A: Every individual needs to register in GST; if their turnover crosses the limit prescribes the…

Q: At the end of the current year, $17,555 of fees have been earned but have not been billed to…

A: Journal Entry is record of Transaction in accounting Records and Adjusting entry is made at the end…

Q: Prepare the adjusting entries on December 31, 2019, the end of the annual accounting period,on the…

A: At the end of the year, after completion of books, the corporation evaluates some accrued incomes…

Q: The Piper Ventura Illustrators presented the following information pertaining to accounts that will…

A: Solution: Journal entry : An act of recording the daily transaction of a firm in the journal is…

Q: During the year ended December 31, 2021 the following transactions occurred: The table is in the…

A: Debit the receiver, credit the giver. Debit what comes in, credit what goes out. Debit all expenses…

Q: At the end of the year, the company records an adjusting entry to accrue $125,000 of wages owed to…

A: Under accrual basis of accounting transactions are recorded and when they occur irrespective of cash…

Q: Snoopy Enterprises provides collection services to its customers. Year- end adjusting journal…

A: Journal entries refers to the official book of a firm/company which is used to record the day to day…

Q: Assume that rent of P14,400 was paid on September 1, 2021 to cover a one-year period from that date.…

A: Prepaid rent is the amount of rent paid in advance. Rent of 14,400 is for 1 year paid in advance on…

Q: On July 1, 2022, Wildhorse Co. pays $19,500 to Blossom Company for a 2-year insurance contract. Both…

A: Journal Entries Service revenue to be recognized on 31st December= 19500*6/24= 4875 ACCOUNT…

Q: Mely Bhd commenced their business on 1 April 2021 and prepared its first set of accounts to 30 June…

A: Given: Mely Bhd commenced their business on 1 April 2021 First Set = 1 April 2021 to 30 June 2022…

Q: Clint Still more operates a private investigating agency called Still more Investigations. Some…

A: 1) Preparation of Adjusting Entries: Date Particulars Debit Credit Dec 31, 2019 Accounts…

Q: The unadjusted trial balance of Epicenter Laundry at June 30, 2019, the end of the fiscal year,…

A: "Since you have asked multiple sub part question we will solve the first three sub part question for…

Q: Clint Still more operates a private investigating agency called Still more Investigations. Some…

A: Adjusting entries:- Adjusting entries are generally occurred at the end of accounting period, in…

Q: On December 31, 2021, the Home Office Account on HIJ Branch has a balance of P52,800. Compute the…

A: Investment is the amount which is spent by the producer for the purchase of those goods which…

At the end of the year, on December 31, 2019, the bookkeeper of Honey Company prepared an Unadjusted

Step by step

Solved in 3 steps with 2 images

- Question The following are the balances extracted from the public Accounts on the consolidated fund from the year ended 31 December 2016. GHS000 Direct Tax 1044460 compensation of employee 808672 Goods and Services 404336 Non-financial Assets 134779 Indirect tax 939556 Grants 28110 Interest Expenses 398138 Social benefits 238882 Other Expenses 159255 Other revenue…*see attached What amount of income tax payable should be reported?a. P 385,000b. P 498,000c. P 425,000d. P 305,000Unusual income statement items Assume that the amount of each of the following items is material to the financial statements. Classify each item as either normally recurring (NR) or unusual (U) items. If unusual item, then specify if it is a discontinued operations item (DO). a. Interest revenue on notes receivable. b. Gain on sale of segment of the company's operations that manufactures bottling equipment. c.Loss on sale of investments in stocks and bonds. d. Uncollectible accounts expense. e. Uninsured flood loss. (Hood insurance is unavailable because of periodic Hooding in the area.)

- a.) For the current year temporary differences existed between the financial statement carrying amounts and the tax basis of the following: Carrying Amount Tax Basis Future Taxable or(Deductible)Amount Buildings andequipment $ 50,000,000 $ 36,000,000 $ 14,000,000 Prepaid insurance 3,000,000 0 3,000,000 Liability-losscontingency 12,000,000 0 (12,000,000 ) (b.) No temporary differences existed at the beginning of the year. (c.) Pretax accounting income was $200,000,000 and taxable income was $110,000,000 for the year and the tax rate is 40%. Permanent differences are the cause of any difference between pretax accounting income and taxable income that are not due to temporary differences. Required:Prepare the journal entry to record the tax provision for the current year.An example of an item which is not a liability isa. The portion of a long termdebt due within one yearb. Estimated warranty costsc. Dividends payable common shares of the issuing corporationd. Customers’ deposits Which of the following statements relating to the recognition of liabilities is falseI. Liabilities are recognized when obligations to transfer assets or provide services in the future are incurred in exchangesII. Liabilities arising from non-reciprocal transfers are recognized when the corresponding money, goods, or services are received.III. Mutually unexecuted contracts are generally not recognized as accounting liabilitiesa. I only c. I and II onlyb. II only d. I, II, and III The following statements relate to liabilities. Which statement is true?I. Liabilities may also be measured by estimates of a definitive character when the amount of the liability cannot be measured preciselyII. A long term, non-interest bearing note payable should be recorded at present discounted…Taxpayer: Domestic Corporation (SME) It year of operation: 2017 Taxable period: 2021 Year 2017 2018 2019 2020 2021 2022 Gross Income 7,000,000 8,000,000 8,000,000 5,000,000 7,000,000 7,000,000 Deductions 8,000,000 7,500,000 6,000,000 6,000,000 5,900,000 6,000,000 Net (1,000,000) 500,000 2,000,000 (1,000,000) 1,100,000 1,000,000 Compute the corporate income tax should be paid in 2022?

- *see attached What amount of permanent difference between accounting income and taxable income existed at year-end?a. P 520,000b. P 360,000c. P 800,000d. P 280,000identify deferred tax assets/liabilioties in the following figure Total Current Assets - - - - Total Assets 1057734 1014060 979868 976502 Cash & Due from Banks 96610 81786 73246 65619 Other Earning Assets, Total 144765 123145 118007 118805 Net Loans 759118 742473 737033 727002 Property/Plant/Equipment, Total - Net 5468 5602 5205 2383 Property/Plant/Equipment, Total - Gross - - - - Accumulated Depreciation, Total - - - - Goodwill, Net 5269 5284 5997 5974 Intangibles, Net 1674 1660 1732 1991 Long Term Investments 2865 3034 3054 3001 Other Long Term Assets, Total 4139 3830 3098 18226 Other Assets, Total 37826 47246 32496 33501 Total Current Liabilities - - - - Total Liabilities 982736 942052 908766 906908 Accounts Payable 9826 13188 9998 10285 Payable/Accrued - - - - Accrued Expenses - - - - Total Deposits 750843 701551 666300 640311 Other Bearing Liabilities, Total - - - 32 Total Short Term Borrowings 26633 16877 20346 19099…In determining Ordinary and Capital Gain tax rates to usea. Use only Federal RatesD. Use Federal and Local City Ratesc. Use Federal and State Ratesd. Use Federal, State & Local rates if applicable. Market Analysisa. Is not necessary to perform a cashflow analysisb. Adds quality to the numbersc. Used only if for court purposesd. Delineates a trade area A location quotient is developed to estimatea. YTotal employmentb. Total Populationc. Basic employmentd. Number of households

- In the case of grants related to income, which of these accounting treatments is prescribed by IAS 20? (a) Credit the grant to “general reserve” under shareholders’ equity. (b) Present the grant in the income statement as “other income”’ or as a separate line item, or deduct it from the related expense. (c) Credit the grant to “retained earnings” on the balance sheet. (d) Credit the grant to sales or other revenue from operations in the income statement.P18-1 Definitions The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions. Code Letter Term A Future deductible amount B Income tax payable (or refund) C Effective tax rate D Valuation allowance E Deferred tax asset F Operating loss carryforward G Taxable income H Deferred tax consequences I Future taxable amount J Deferred tax liability K Temporary difference L Income tax expense (or benefit) M Deferred tax expense (or benefit) _________1. The deferred tax consequences of future deductible amounts and operating loss carryforwards _________2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported…1. What amount of permanent difference between book income and taxable income existed at year end?a. 520,000b. 360,000c. 800,000d. 280,0002. What amount of current tax expense should be reported? a. 786,000b. 510,000c. 750,000d. 678,0003. What amount of income tax payable should be reported?a. 498,000b. 606,000c. 330,000d. 570,0004. What amount of total tax expense should be reported?a. 714,000b. 726,000c. 642,000d. 594,000