Your new audit client, Guimba Company prepared the trial balance below as of December 31, company started its operations on January 1, 2020. Your examination resulted in the necessity o the adjusting entries indicated in the additional data below. Guimba Company

Your new audit client, Guimba Company prepared the trial balance below as of December 31, company started its operations on January 1, 2020. Your examination resulted in the necessity o the adjusting entries indicated in the additional data below. Guimba Company

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter13: Auditing Debt, Equity, And Long-term Liabilities Requiring Management Estimates

Section: Chapter Questions

Problem 28RQSC

Related questions

Question

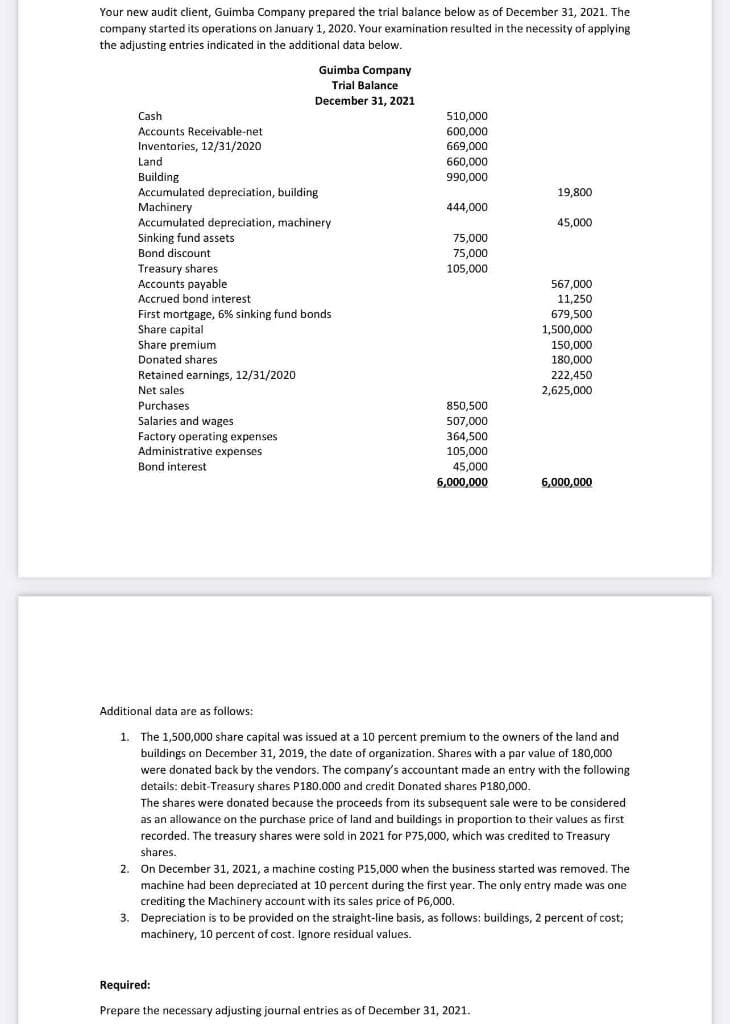

Transcribed Image Text:Your new audit client, Guimba Company prepared the trial balance below as of December 31, 2021. The

company started its operations on January 1, 2020. Your examination resulted in the necessity of applying

the adjusting entries indicated in the additional data below.

Guimba Company

Trial Balance

December 31, 2021

Cash

510,000

Accounts Receivable-net

600,000

Inventories, 12/31/2020

669,000

660,000

990,000

Land

Building

Accumulated depreciation, building

Machinery

Accumulated depreciation, machinery

Sinking fund assets

Bond discount

19,800

444,000

45,000

75,000

75,000

105,000

Treasury shares

Accounts payable

567,000

Accrued bond interest

11,250

First mortgage, 6% sinking fund bonds

Share capital

679,500

1,500,000

Share premium

Donated shares

150,000

180,000

Retained earnings, 12/31/2020

Net sales

Purchases

Salaries and wages

222,450

2,625,000

850,500

Factory operating expenses

Administrative expenses

507,000

364,500

105,000

Bond interest

45,000

6,000,000

6,000,000

Additional data are as follows:

1. The 1,500,000 share capital was issued at a 10 percent premium to the owners of the land and

buildings on December 31, 2019, the date of organization. Shares with a par value of 180,000

were donated back by the vendors. The company's accountant made an entry with the following

details: debit-Treasury shares P180.000 and credit Donated shares P180,000.

The shares were donated because the proceeds from its subsequent sale were to be considered

as an allowance on the purchase price of land and buildings in proportion to their values as first

recorded. The treasury shares were sold in 2021 for P75,000, which was credited to Treasury

shares.

2. On December 31, 2021, a machine costing P15,000 when the business started was removed. The

machine had been depreciated at 10 percent during the first year. The only entry made was one

crediting the Machinery account with its sales price of P6,000.

3. Depreciation is to be provided on the straight-line basis, as follows: buildings, 2 percent of cost;

machinery, 10 percent of cost. Ignore residual values.

Required:

Prepare the necessary adjusting journal entries as of December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub