At what amount will the following accounts appear in the consolidated financial statements? Note: Do not use negative signs with any answers. Account Amount a. Sales $ b. Investment Income $ c. Operating expenses $ d. Inventories $ $ $ $ $ i. Retained Earnings $ e. Equity investment f. PPE, net g. Goodwill h. Common Stock

At what amount will the following accounts appear in the consolidated financial statements? Note: Do not use negative signs with any answers. Account Amount a. Sales $ b. Investment Income $ c. Operating expenses $ d. Inventories $ $ $ $ $ i. Retained Earnings $ e. Equity investment f. PPE, net g. Goodwill h. Common Stock

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter14: Intercorporate Investments In Common Stock

Section: Chapter Questions

Problem 28P

Related questions

Topic Video

Question

Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.

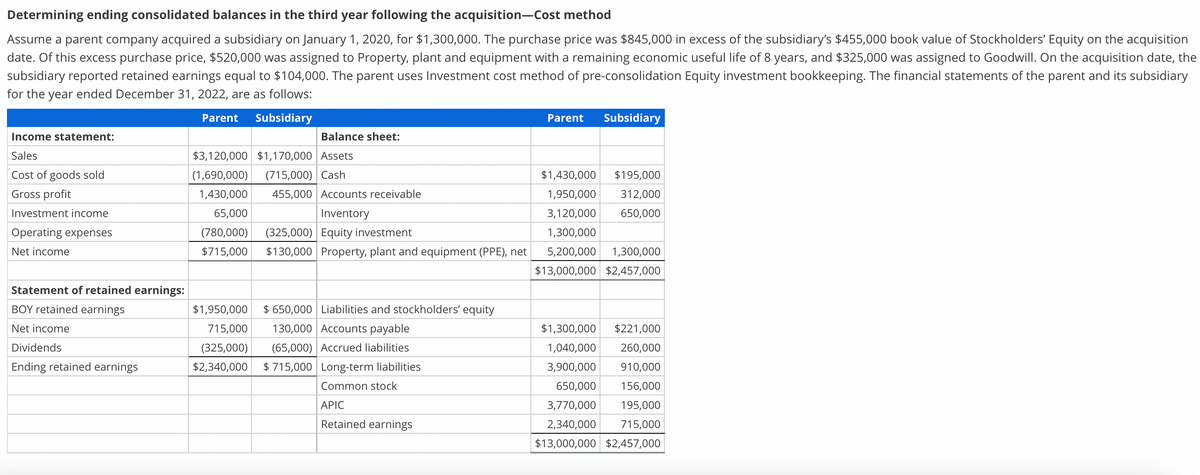

Transcribed Image Text:Determining ending consolidated balances in the third year following the acquisition-Cost method

Assume a parent company acquired a subsidiary on January 1, 2020, for $1,300,000. The purchase price was $845,000 in excess of the subsidiary's $455,000 book value of Stockholders' Equity on the acquisition

date. Of this excess purchase price, $520,000 was assigned to Property, plant and equipment with a remaining economic useful life of 8 years, and $325,000 was assigned to Goodwill. On the acquisition date, the

subsidiary reported retained earnings equal to $104,000. The parent uses Investment cost method of pre-consolidation Equity investment bookkeeping. The financial statements of the parent and its subsidiary

for the year ended December 31, 2022, are as follows:

Parent Subsidiary

Income statement:

Sales

Cost of goods sold

Gross profit

Investment income

Operating expenses

Net income

Statement of retained earnings:

BOY retained earnings

Net income

Dividends

Ending retained earnings

Balance sheet:

$3,120,000 $1,170,000 Assets

(1,690,000) (715,000) Cash

1,430,000

455,000 Accounts receivable

65,000

Inventory

(780,000) (325,000) Equity investment

$715,000 $130,000 Property, plant and equipment (PPE), net

$1,950,000

$ 650,000 Liabilities and stockholders' equity

130,000 Accounts payable

715,000

(325,000)

(65,000) Accrued liabilities

$2,340,000 $715,000 Long-term liabilities

Common stock

APIC

Retained earnings

Parent

Subsidiary

$1,430,000

$195,000

1,950,000

312,000

3,120,000 650,000

1,300,000

5,200,000 1,300,000

$13,000,000 $2,457,000

$1,300,000 $221,000

1,040,000 260,000

3,900,000 910,000

650,000 156,000

3,770,000 195,000

2,340,000 715,000

$13,000,000 $2,457,000

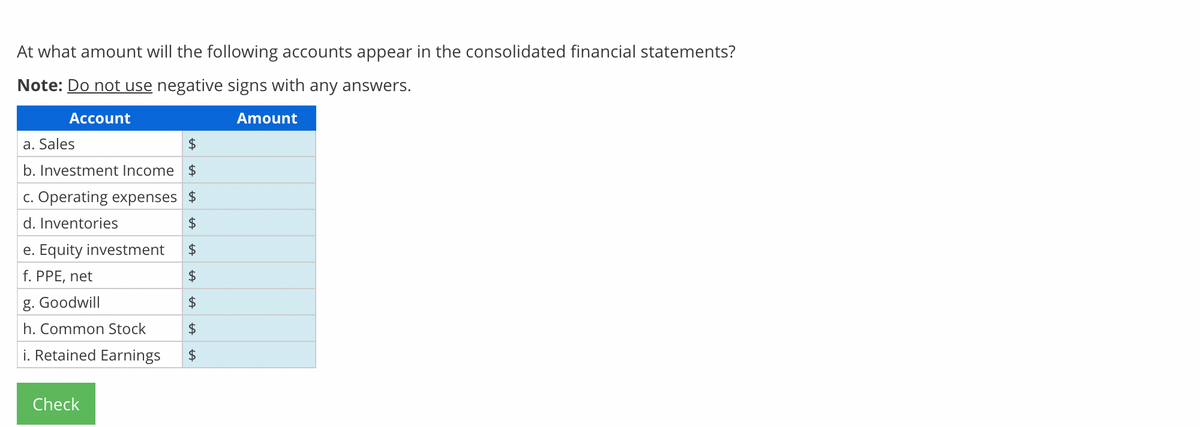

Transcribed Image Text:At what amount will the following accounts appear in the consolidated financial statements?

Note: Do not use negative signs with any answers.

Account

a. Sales

$

b. Investment Income $

c. Operating expenses $

d. Inventories

$

$

$

$

$

$

e. Equity investment

f. PPE, net

g. Goodwill

h. Common Stock

i. Retained Earnings

Check

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning