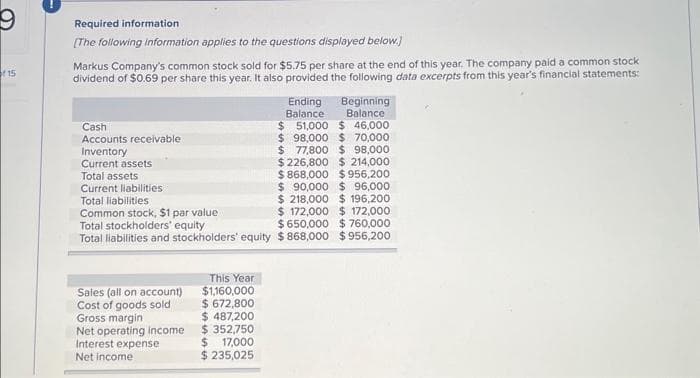

Required information [The following information applies to the questions displayed below.) Markus Company's common stock sold for $5.75 per share at the end of this year. The company paid a common stock dividend of $0.69 per share this year. It also provided the following data excerpts from this year's financial statements: Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income Ending Balance: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity $868,000 This Year $1,160,000 $ 672,800 $ 487,200 $352,750. $ 17,000 $ 235,025 Beginning Balance $ 51,000 $ 46,000 $ 98,000 $ 70,000 $ 77,800 $ 98,000 $226,800 $ 214,000 $868,000 $956,200 $90,000 $ 96,000 $218,000 $196,200 $ 172,000 $ 172,000 $650,000 $760,000 $956,200

Required information [The following information applies to the questions displayed below.) Markus Company's common stock sold for $5.75 per share at the end of this year. The company paid a common stock dividend of $0.69 per share this year. It also provided the following data excerpts from this year's financial statements: Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income Ending Balance: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity $868,000 This Year $1,160,000 $ 672,800 $ 487,200 $352,750. $ 17,000 $ 235,025 Beginning Balance $ 51,000 $ 46,000 $ 98,000 $ 70,000 $ 77,800 $ 98,000 $226,800 $ 214,000 $868,000 $956,200 $90,000 $ 96,000 $218,000 $196,200 $ 172,000 $ 172,000 $650,000 $760,000 $956,200

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.13AMCP

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:15

Required information

[The following information applies to the questions displayed below.)

Markus Company's common stock sold for $5.75 per share at the end of this year. The company paid a common stock

dividend of $0.69 per share this year. It also provided the following data excerpts from this year's financial statements:

Ending

Balance

$ 51,000

$ 98,000 $70,000

$ 77,800 $ 98,000

$226,800 $ 214,000

$868,000 $956,200

$ 90,000 $ 96,000

$218,000 $ 196,200

$ 172,000 $ 172,000

$650,000 $760,000

Common stock, $1 par value

Total stockholders' equity

Total liabilities and stockholders' equity $868,000 $956,200

Cash

Accounts receivable.

Inventory

Current assets

Total assets

Current liabilities

Total liabilities

Sales (all on account)

Cost of goods sold

Gross margin

Net operating income

Interest expense

Net income

This Year

$1,160,000

$ 672,800

$ 487,200

$ 352,750

$ 17,000

$ 235,025

Beginning

Balance

$ 46,000

Transcribed Image Text:4. What is the return on total assets (assuming a 30% tax rate) ? (Round your percentage answer to 1 decimal place (i.e., 0.1234

should be entered as 12.3).)

Return on total assets

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning