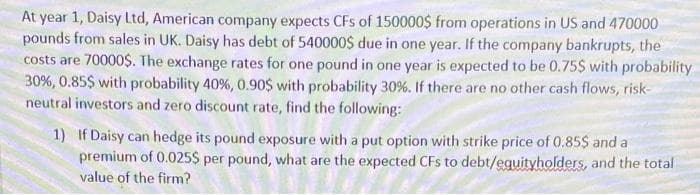

At year 1, Daisy Ltd, American company expects CFs of 150000$ from operations in US and 470000 pounds from sales in UK. Daisy has debt of 540000$ due in one year. If the company bankrupts, the costs are 70000$. The exchange rates for one pound in one year is expected to be 0.75$ with probability 30%, 0.85$ with probability 40 %, 0.90$ with probability 30 %. If there are no other cash flows, risk- neutral investors and zero discount rate, find the following: 1) If Daisy can hedge its pound exposure with a put option with strike price of 0.85$ and a premium of 0.025$ per pound, what are the expected CFs to debt/eguityholders, and the total value of the firm?

At year 1, Daisy Ltd, American company expects CFs of 150000$ from operations in US and 470000 pounds from sales in UK. Daisy has debt of 540000$ due in one year. If the company bankrupts, the costs are 70000$. The exchange rates for one pound in one year is expected to be 0.75$ with probability 30%, 0.85$ with probability 40 %, 0.90$ with probability 30 %. If there are no other cash flows, risk- neutral investors and zero discount rate, find the following: 1) If Daisy can hedge its pound exposure with a put option with strike price of 0.85$ and a premium of 0.025$ per pound, what are the expected CFs to debt/eguityholders, and the total value of the firm?

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.8: Probabilities Of Disjoint And Overlapping Events

Problem 2C

Related questions

Question

12

Transcribed Image Text:At year 1, Daisy Ltd, American company expects CFs of 150000$ from operations in US and 470000

pounds from sales in UK. Daisy has debt of 540000$ due in one year. If the company bankrupts, the

costs are 70000$. The exchange rates for one pound in one year is expected to be 0.75$ with probability

30%, 0.85$ with probability 40 %, 0.90$ with probability 30 %. If there are no other cash flows, risk-

neutral investors and zero discount rate, find the following:

1) If Daisy can hedge its pound exposure with a put option with strike price of 0.85$ and a

premium of 0.025$ per pound, what are the expected CFs to debt/eguityholders, and the total

value of the firm?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL