aTAND Assets SECTION 2 390 Connect Problems Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. At the fiscal vear-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2020, accounts receivable were $574.000 and the allowance account had a credit balance of $54,000. Accounts receivable activity for 2021 was as follows: P 7-1 Uncollectible accounts; allowance method; income statement and onsl balance sheet $ 574,000 2,620,000 (2,483,000)oS (68,000) Beginning balance eusCt approach • LO7-5, LO7-6 IEadme Credit sales ober Collections Write-offs onta To pue Ending balance Elo 643,000 sd to The company's controller prepared the following aging summary of year-end accounts receivable: Summary 00e,ES 003,8 Percent Uncollectible Amount Age Group $430,000 4% 0-60 days 98,000 60,000 15 61-90 days 91-120 days 000.05 25 bnsl 55,000 40 Over 120 days $643,000 Total 000,30 COA CE 000 Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the vear 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3. What is total bad debt expense for 2021? How would accounts receivable appear in the 2021 balance sheet? EMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report the balance sheet included the following information ($ in millions): P 7-2 Uncollectible accounts; EMC Corporation • LO7-5 2015 2014 Current assets: Receivables, less allowances of $90 in 2015 and $72 in 2014 $3,977 Real World Financials $4,413 ue of $24,704 ($ in millions) for the current year. All sales In addition, the income statement reported sales reven are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $25,737 ($ in millions). There were no recoveries of accounts receivable previously written off. Required: 1. Compute the following ($ in millions): a. The amount of bad debts written off by EMC during 2015. b. The amount of bad debt expense that EMC included in its income statement for 2015 c. The approximate percentage that EMC used to estimate bad debts for 2015, assuming that it ueed et income statement approach o bovious 2. Suppose that EMC had used the direct write-off method to account for bad debts. Compute the followie c0 in millions):

aTAND Assets SECTION 2 390 Connect Problems Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. At the fiscal vear-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2020, accounts receivable were $574.000 and the allowance account had a credit balance of $54,000. Accounts receivable activity for 2021 was as follows: P 7-1 Uncollectible accounts; allowance method; income statement and onsl balance sheet $ 574,000 2,620,000 (2,483,000)oS (68,000) Beginning balance eusCt approach • LO7-5, LO7-6 IEadme Credit sales ober Collections Write-offs onta To pue Ending balance Elo 643,000 sd to The company's controller prepared the following aging summary of year-end accounts receivable: Summary 00e,ES 003,8 Percent Uncollectible Amount Age Group $430,000 4% 0-60 days 98,000 60,000 15 61-90 days 91-120 days 000.05 25 bnsl 55,000 40 Over 120 days $643,000 Total 000,30 COA CE 000 Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the vear 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3. What is total bad debt expense for 2021? How would accounts receivable appear in the 2021 balance sheet? EMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report the balance sheet included the following information ($ in millions): P 7-2 Uncollectible accounts; EMC Corporation • LO7-5 2015 2014 Current assets: Receivables, less allowances of $90 in 2015 and $72 in 2014 $3,977 Real World Financials $4,413 ue of $24,704 ($ in millions) for the current year. All sales In addition, the income statement reported sales reven are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $25,737 ($ in millions). There were no recoveries of accounts receivable previously written off. Required: 1. Compute the following ($ in millions): a. The amount of bad debts written off by EMC during 2015. b. The amount of bad debt expense that EMC included in its income statement for 2015 c. The approximate percentage that EMC used to estimate bad debts for 2015, assuming that it ueed et income statement approach o bovious 2. Suppose that EMC had used the direct write-off method to account for bad debts. Compute the followie c0 in millions):

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 5C: Receivables Issues Magrath Company has an operating cycle of less than one year and provides credit...

Related questions

Question

100%

P7-1

Transcribed Image Text:aTAND

Assets

SECTION 2

390

Connect

Problems

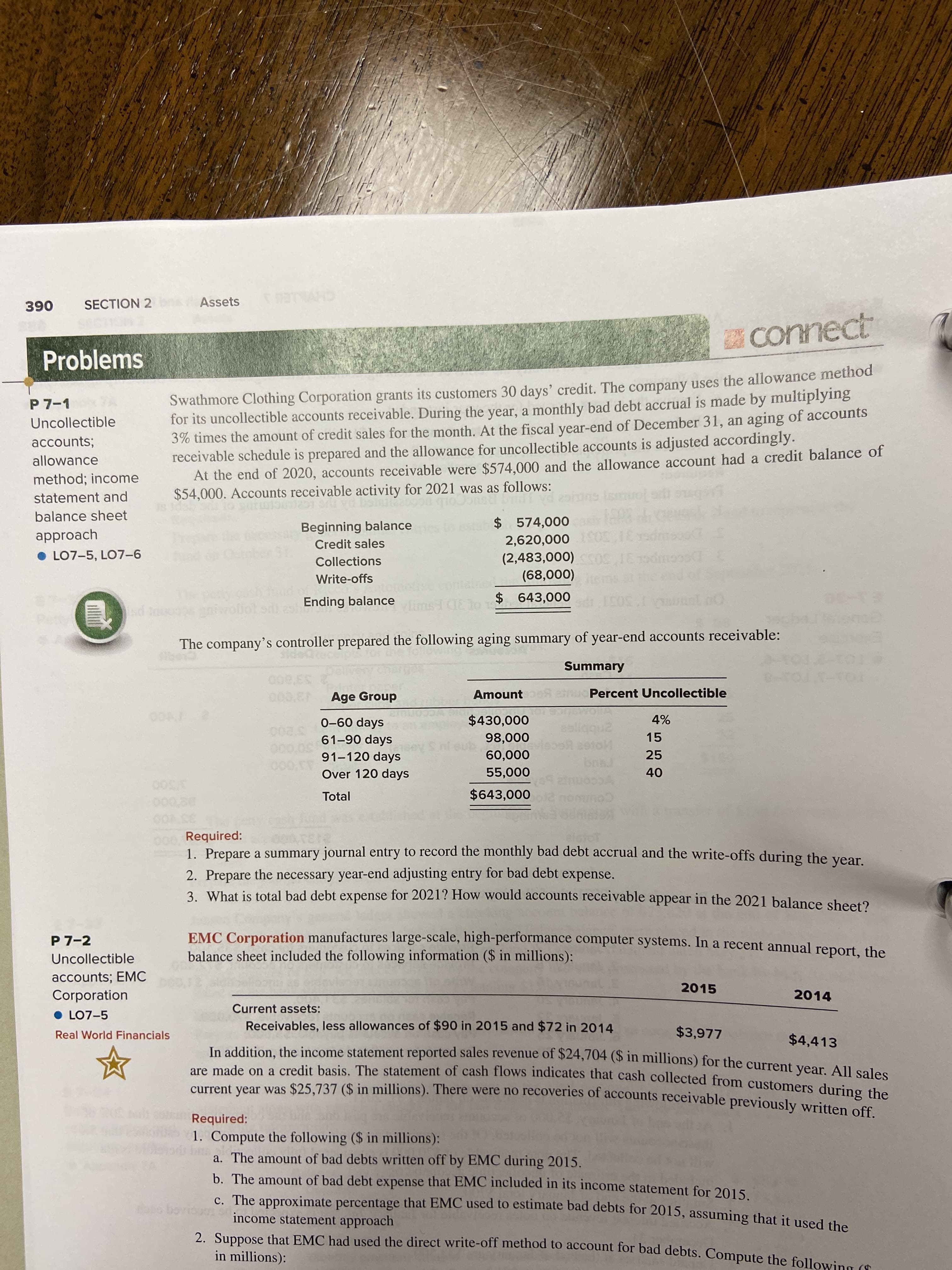

Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method

for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying

3% times the amount of credit sales for the month. At the fiscal vear-end of December 31, an aging of accounts

receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly.

At the end of 2020, accounts receivable were $574.000 and the allowance account had a credit balance of

$54,000. Accounts receivable activity for 2021 was as follows:

P 7-1

Uncollectible

accounts;

allowance

method; income

statement and

onsl

balance sheet

$ 574,000

2,620,000

(2,483,000)oS

(68,000)

Beginning balance

eusCt

approach

• LO7-5, LO7-6

IEadme

Credit sales

ober

Collections

Write-offs

onta

To pue

Ending balance

Elo 643,000

sd to

The company's controller prepared the following aging summary of year-end accounts receivable:

Summary

00e,ES

003,8

Percent Uncollectible

Amount

Age Group

$430,000

4%

0-60 days

98,000

60,000

15

61-90 days

91-120 days

000.05

25

bnsl

55,000

40

Over 120 days

$643,000

Total

000,30

COA CE

000 Required:

1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the vear

2. Prepare the necessary year-end adjusting entry for bad debt expense.

3. What is total bad debt expense for 2021? How would accounts receivable appear in the 2021 balance sheet?

EMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report the

balance sheet included the following information ($ in millions):

P 7-2

Uncollectible

accounts; EMC

Corporation

• LO7-5

2015

2014

Current assets:

Receivables, less allowances of $90 in 2015 and $72 in 2014

$3,977

Real World Financials

$4,413

ue of $24,704 ($ in millions) for the current year. All sales

In addition, the income statement reported sales reven

are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the

current year was $25,737 ($ in millions). There were no recoveries of accounts receivable previously written off.

Required:

1. Compute the following ($ in millions):

a. The amount of bad debts written off by EMC during 2015.

b. The amount of bad debt expense that EMC included in its income statement for 2015

c. The approximate percentage that EMC used to estimate bad debts for 2015, assuming that it ueed et

income statement approach

o bovious

2. Suppose that EMC had used the direct write-off method to account for bad debts. Compute the followie c0

in millions):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,