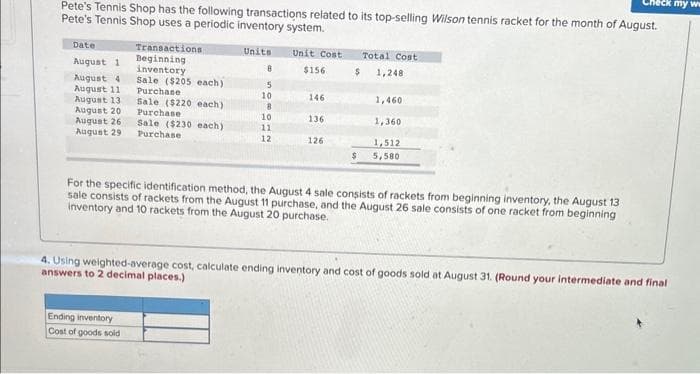

ate gust 1 august 4 ugust 11 gust 13 ugust 20 august 26 ugust 29 Transactions Beginning inventory Sale ($205 each). Purchase Sale ($220 each) Purchase Sale ($230 each) Purchase Units 8 5 10 8 10 11 12 Unit Cost $156 146 136 126 $ To

Q: The cost of electricity for running production equipment is classified as: A) B) C) D) Prime cost…

A: The overall direct costs, which may be fixed or variable, associated with producing a product for…

Q: E8.2 (LO 1), AP Eckert Company is involved in producing and selling high-end golf equipment. The…

A: Target costing : It is a system of profit planning and cost management.Target costing allows the…

Q: Clothing Company has two service departments-purchasing and maintenance, and two production…

A: Methods used to allocate service department costs: Direct method,step down method and repeated…

Q: (4) Able is a shareholder in the QRS Corp. QRS has accumulated earnings and profits of $200,000, and…

A: A corporation's governing board decides whether to pay a dividend to its shareholders. Quarterly…

Q: Larned Corporation recorded the following transactions for the just completed month. a. $78,000 in…

A: The direct costs incurred for production are debited to work in process account. The indirect costs…

Q: Which of these audit evidence is more reliable for an auditor to use in gathering evidence than the…

A: Audit evidence: It includes all the information or data that is gathered by an auditor from all the…

Q: You are engaged to perform an audit of the accounts of the Butterfly Corporation for the year ended…

A: Cut-off arrangement - Since business runs continuously, also accounting is done continuously.…

Q: Rondeau, Incorporated, manufactures and sells two products: Product V9 and Product M6. Data…

A: ABC method of costing is the method adopted by the management where the overhead costs of incurred…

Q: Adria Company recently implemented an activity-based costing system. At the beginning of the year,…

A: The overhead rate is calculated as estimated overhead cost divided by estimated base activity. The…

Q: Last month when Holiday Creations, Incorporated, sold 41,000 units, total sales were $164,000, total…

A:

Q: Please Create A Flexible Budget Column based on the provided information and show all your work.

A: We have, information relevant to 1,000 units of original budget : 1.) Material required = 400 kg…

Q: On January 1, 2022, Nichols Enterprises paid $100,000 for 6,200 shares of Elliott Electronics common…

A: When the entity do not have significant influence in the investment then it uses the fair value…

Q: The 2017 balance sheet of Dream, Incorporated, showed current assets of $1,290 and current…

A: Introduction: Net working capital (NWC) is the difference between company's current assets and…

Q: Required information [The following information applies to the questions displayed below.] In 2024,…

A: Financial Statement The %…

Q: BLOCK E/2018/2 Rimz AG is a luxury car wheel manufacturer, which in a two-stage production…

A: The sales are assumed to be made on credit basis. The profit related entry is not passed. cost of 10…

Q: KINDLY ANSWER ASSP PLEASE. THANK YOOUU!! 1.Classifications of government grants. Explain each…

A: “Since you have posted multiple questions, we will provide the solution to the first question.…

Q: Kane Candy Company sells candy bars for $1 each. In addition, Kane offers its customers a coffee mug…

A: In any organization's accounting system, a journal entry documents a commercial transaction. The…

Q: A firm is selling two products-chairs and bar stools-each at $60 per unit. Chairs have a variable…

A: The break-even point is reached when overall costs and gross profits are equal, leaving your small…

Q: List the 3 main factors that will be present in committing fraud (Hint: The Fraud Triangle):

A: The three main factors that are present in committing fraud are often referred to as the "Fraud…

Q: post the journal entries to their respective ledger accounts

A: Ledger: In accounting, a ledger is a book with many accounts used to record transactions involving a…

Q: Heron Company purchases commercial realty on November 13, 2003, for $650,000. Straight-line…

A: The extra profit a company makes when it sells a non-inventory asset for more than it is worth is…

Q: Maxwell Company manufactures and sells a single product. The following costs were incurred during…

A: The question is based on the concept of Cost Accounting. Absorption costing considers all the…

Q: Krawczek Company will enter into a lease agreement with Heavy Equipment Co. where Krawczek will make…

A: ANSWER:- a. Operating lease is correct option PV of lease payment < fair value of equipment.Lease…

Q: Problem 1-11 (AICPA Adapted) Dean Company had a P2,000,000 note payable due June 30, 2023. On…

A: The borrowings in problem 1-11 hasn't been taken yet. The entity has only signed the agreement and…

Q: The following information pertains to Trenton Glass Works for the year just ended. Budgeted…

A: ANSWER Predetermined overhead rate= Estimated manufacturing overhead /Estimated direct labor hour…

Q: le batteries, the heavy-duty HD-240. The 2022 sales forecast is as follow Quarter HD-240 1 5,000 2…

A: Production budget is prepared after the sales budget to estimate the units required for production.…

Q: duction process for desks and cabinets is similar, although machines must be retooled for each…

A: The overhead is applied to the production on the basis of predetermined overhead rate. Using…

Q: What amount of the note payable should be included in current liabilities on December 31, 2022?

A: The current liabilities are the portion of the liabilities which a company have taken and whose…

Q: Mills Company prepared the following balance sheet at the beginning of 2016: Balance Sheet January…

A: Balance sheet: It is a financial statement that states the value of assets, liabilities, and equity…

Q: Daily Driver, Incorporated (DDI), operates a driving service through a popular ride-sharing app. DDI…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: Zachary Home Maintenance Company earned operating income of $6,565,300 on operating assets of…

A: Return on investment or the ROI helps in determining how efficiently the investment was put to use.…

Q: [The following information applies to the questions displayed below.] The Township of Thomasville’s…

A: The non-spendable funds are part of funds that are not in spendable form or cannot be spent because…

Q: Required: For each account balance above show in the table below whether it should be treated in the…

A: Income statement holds items of expense and income nature. Balance sheet holds items of asset and…

Q: What disclosures should be made by lessees and lessors related to future payments?

A: The lease payment is the sum of all payments paid by the lessee to the asset's owner in exchange for…

Q: Which in § 252 Abs. 1 HGB is exceptionally not observed in a legally permissible manner in the…

A: German accounting rules and the commercial legislation known as the Handelsgesetzbuch (HGB) govern…

Q: Ana Carillo and Associates is a medium-sized company located near a large metropolitan area in the…

A: You have asked more than three subparts as per guidelines we can only solve first three subparts, if…

Q: How are you coming up with $9300 *0.05%? wouldn't it be $9900 x .05%?

A: Interest or late payment charges are levied on the amount which is remaining to be paid/discharges…

Q: On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions…

A: Journal Entries -Journal Entries are used to record transactions entered into by the company. It is…

Q: Capacity planning has to be done well in advance. If the demand exceeds capacity it can lead to lost…

A: Capacity planning is considered a strategic decision because it has a significant impact on a…

Q: Complete accounting cycle, Part 1 Instructions Chart of Accounts Instructions For the past several…

A: Journal entries refer to those entries which are recorded for the transactions of the business in…

Q: 4. MusicPlayerz Sales Projections MusicPlayerz is a wholesale MP3 distributor headquartered in…

A: Gross Sales :- The formula used to calculate gross sales is Total Units Sold x Original Sale Price.…

Q: 19.4A A business, which started trading on 1 January 2022, adjusted its allowance for doubtful debts…

A: Allowance for bad debts for 2022 = £92,000 × 4% = £3,680 Allowance for bad debts for 2023 = £136,000…

Q: Tiny's Toys has the following financial information for the month of July available: Revenues…

A: The phrase "cost of goods sold" refers to the direct costs a business incurs when producing the…

Q: You run a business out of your dorm room selling ACC2020 textbooks in both paper and digital…

A: Contribution margin The amount of profit earned by a company after deducting cost of variables from…

Q: The adjusted trial balance for Rowdy Profits Corporation reports that its equipment cost $340,000.…

A: Balance sheet is the financial statement which show the financial health of the entity whereas…

Q: Halola Insurance Corporation, a domestic corporation, received the following premiums (net of any…

A: In Phillipines 2% premium tax is [instead of VAT ] collected from every person…

Q: 5-42 A North City must choose between two new snow-removal machines. The SuperBlower has a $70,000…

A: We will use Net Present Value of cash outflows method to determine which project will be more…

Q: Cincinnati Supply Corp., a supplier to Kraft Foods, provided the following data related to two major…

A: Solution : Contribution margin = Sales revenue - Variable expenses Contribution margin ratio =…

Q: Raw materials to be used in production are considered inventory,

A: Asset is anything being controlled and managed by the business. Asset have some monetary value and…

Q: formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor…

A: The variances are the difference between the actual production costs and budgeted production costs.…

Please do not give solution in image format thanku

Step by step

Solved in 2 steps

- Jessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.On April 5, a customer returns 20 bicycles with a sales price of $250 per bike to Barrio Bikes. Each bike cost Barrio Bikes $100. The customer had yet to pay on their account. The bikes are in sellable condition. Prepare the journal entry or entries to recognize this return if the company uses A. the perpetual inventory system B. the periodic inventory system

- Review the following transactions, and prepare any necessary journal entries for Renovation Goods. A. On May 12, Renovation Goods purchases 750 square feet of flooring (Flooring Inventory) at $3.00 per square foot from a supplier, on credit. Terms of the purchase are 2/10, n/30 from the invoice date of May 12. B. On May 15, Renovation Goods purchases 200 measuring tapes (Tape Inventory) at $5.75 per tape from a supplier, on credit. Terms of the purchase are 4/15, n/60 from the invoice date of May 15. C. On May 22, Renovation Goods pays cash for the amount due to the flooring supplier from the May 12 transaction. D. On June 3, Renovation Goods pays cash for the amount due to the tape supplier from the May 15 transaction.Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.Review the following transactions, and prepare any necessary journal entries for Sewing Masters Inc. A. On October 3, Sewing Masters Inc. purchases 800 yards of fabric (Fabric Inventory) at $9.00 per yard from a supplier, on credit. Terms of the purchase are 1/5, n/40 from the invoice date of October 3. B. On October 8, Sewing Masters Inc. purchases 300 more yards of fabric from the same supplier at an increased price of $9.25 per yard, on credit. Terms of the purchase are 5/10, n/20 from the invoice date of October 8. C. On October 18, Sewing Masters pays cash for the amount due to the fabric supplier from the October 8 transaction. D. On October 23, Sewing Masters pays cash for the amount due to the fabric supplier from the October 3 transaction.

- Mays Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Mays Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 2Bought nine Matte Nail Color Kits from Mejia, Inc., 450, invoice no. 4521, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 87.50 (total 537.50). 5Bought 30 Perfume Cocktail Rings from Braun, Inc., 1,200, invoice no. 37A, dated January 3; terms 2/10, n/30; FOB destination. 8Sold two Matte Nail Color Kits on account to J. Herbert, sales slip no. 113, 110, plus sales tax of 8.80, total 118.80. 11Received credit memo no. 455 from Braun, Inc., for merchandise returned, 315.25. 18Bought 15 Eye Palettes from Vargas, Inc., 660, invoice no. 910, dated January 14; terms net 30; FOB destination. 23Sold four Eye Palettes on account to T. Cantrell, sales slip no. 114, 200, plus sales tax of 16, total 216. 26Issued credit memo no. 12 to T. Cantrell for merchandise returned, 50 plus 4 sales tax, total 54. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: T. Cantrell, 86.99; J. Hebert, 63.47. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Braun, Inc., 513.20; Mejia, Inc., 113.40; Vargas, Inc., 67.15. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 150.46; Accounts Payable 212 controlling account, 693.75; Sales Tax Payable 214, 237.89. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 17. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.Carla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.Recording Sale and Purchase Transactions Jordan Footwear sells athletic shoes and uses the perpetual inventory system. During June, Jordan engaged in the following transactions its first month of operations: a. On June1, Jordan purchased, on credit, 100 pairs of basketball shoes and 210 pairs of running shoes with credit terms of 2/10, n/30. The basketball shoes were purchased at a cost of $85 per pair, and the running shoes were purchased at a cost of $60 per pair. Jordan paid Mole Trucking $310 cash to transport the shoes from the manufacturer to Jordans warehouse, shipping terms were F.O.B. shipping point, and the items were shipped on June 1 and arrived on June 4. b. On June 2, Jordan purchased 88 pairs of cross-training shoes for cash. The shoes cost Jordan $65 per pair. c. On June 6, Jordan purchased 125 pairs of tennis shoes on credit. Credit terms were 2/10, n/25. The shoes were purchased at a cost of $45 per pair. d. On June 10, Jordan paid for the purchase of the basketball shoes and the running shoes in Transaction a. e. On June 12, Jordan determined that $585 of the tennis shoes were defective. Jordan returned the defective merchandise to the manufacturer. f. On June 18, Jordan sold 50 pairs of basketball shoes at $116 per pair, 92 pairs of running shoes for S85 per pair, 21 pairs of cross-training shoes for $100 per pair, and 48 pairs of tennis shoes for $68 per pair. All sales were for cash. The cost of the merchandise sold was $13,295. No sales returns are expected. g. On June 21, customers returned 10 pairs of the basketball shoes purchased on June 18. The cost of the merchandise returned was $850. h. On June 23, Jordan sold another 20 pairs of basketball shoes, on credit, for $116 per pair and 15 pairs of cross-training shoes for $100 cash per pair. The cost of the merchandise sold was $2,675. i. On June 30, Jordan paid for the June 6 purchase of tennis shoes minus the return on June 12. j. On June 30, Jordan purchased 60 pairs of basketball shoes, on credit, for S85 each. The shoes were shipped F.O.B. destination and arrived at Jordan on July 3. Required: 1. Prepare the journal entries to record the sale and purchase transactions for Jordan during June 2019. 2. Assuming operating expenses of $5,300 and income taxes of $365, prepare Jordans income statement for June 2019.

- Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.Preston Company sells candy wholesale, primarily to vending machine operators. Terms of sales on account are 2/10, n/30, FOB shipping point. The following transactions involving cash receipts and sales of merchandise took place in May of this year: Required 1. Journalize the transactions for May in the cash receipts journal and the sales journal. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals and prove the equality of the debit and credit totals.West Bicycle Shop uses a three-column purchases journal. The company is located in Topeka, Kansas. In addition to a general ledger, the company also uses an accounts payable ledger. Transactions for January related to the purchase of merchandise are as follows: Jan. 4 Bought fifty 10-speed bicycles from Nielsen Company, 4,775, invoice no. 26145, dated January 3; terms net 60 days; FOB Topeka. 7 Bought tires from Barton Tire Company, 792, invoice no. 9763, dated January 5; terms 2/10, n/30; FOB Topeka. 8 Bought bicycle lights and reflectors from Gross Products Company, 384, invoice no. 17317, dated January 6; terms net 30 days; FOB Topeka. 11 Bought hand brakes from Bray, Inc., 470, invoice no. 291GE, dated January 9; terms 1/10, n/30; FOB Kansas City, freight prepaid and added to the invoice, 36 (total 506). 19 Bought handle grips from Gross Products Company, 96.50, invoice no. 17520, dated January 17; terms net 30 days; FOB Topeka. 24 Bought thirty 5-speed bicycles from Nielsen Company, 1,487, invoice no. 26942, dated January 23; terms net 60 days; FOB Topeka. 29 Bought knapsacks from Davila Manufacturing Company, 304.80, invoice no. 762AC, dated January 26; terms 2/10, n/30; FOB Topeka. 31 Bought locks from Lamb Safety Net, 415.47, invoice no. 27712, dated January 26; terms 2/10, n/30; FOB Dodge City, freight prepaid and added to the invoice, 22 (total 437.47). Required 1. If using Working Papers, open the following accounts in the accounts payable ledger and record the January 1 balances, if any, as given: Barton Tire Company, 156; Bray, Inc.; Davila Manufacturing Company, 82.88; Gross Products Company; Lamb Safety Net, 184.20; Nielsen Company. For the accounts having balances, write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow or CLGL. 2. If using Working Papers, record the balance of 423.08 in the Accounts Payable 212 controlling account as of January 1. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow or CLGL. 3. Record the transactions in the purchases journal. If using Working Papers, begin on page 81. 4. Post to the accounts payable ledger daily. Skip this step if using CLGL. 5. Post to the general ledger at the end of the month. Skip this step if using CLGL. 6. Prepare a schedule of accounts payable, and compare the balance of the Accounts Payable controlling account with the total of the schedule of accounts payable.