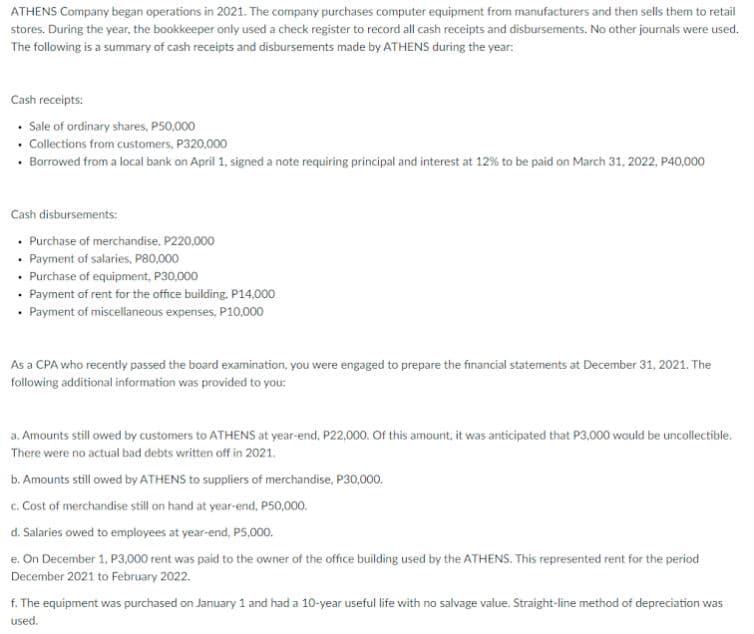

ATHENS Company began operations in 2021. The company purchases computer equipment from manufacturers and then sells them to retail stores. During the year, the bookkeeper only used a check register to record all cash receipts and disbursements. No other journals were used. The following is a summary of cash receipts and disbursements made by ATHENS during the year: Cash receipts: • Sale of ordinary shares, P50,000 • Collections from customers, P320,000 • Borrowed from a local bank on April 1, signed a note requiring principal and interest at 12% to be paid on March 31, 2022, P40,000 Cash disbursements: • Purchase of merchandise, P220,000 • Payment of salaries, P80,000 • Purchase of equipment, P30,000 • Payment of rent for the office building, P14,000 • Payment of miscellaneous expenses, P10.000 As a CPA who recently passed the board examination, you were engaged to prepare the financial statements at December 31, 2021. The following additional information was provided to you: a. Amounts still owed by customers to ATHENS at year-end, P22,000. Of this amount, it was anticipated that P3,000 would be uncollectible. There were no actual bad debts written off in 2021. b. Amounts still owed by ATHENS to suppliers of merchandise, P30,000. c. Cost of merchandise still on hand at year-end, P50,000. d. Salaries owed to employees at year-end, P5,000. e. On December 1, P3.000 rent was paid to the owner of the office building used by the ATHENS. This represented rent for the period December 2021 to February 2022. f. The equipment was purchased on January1 and had a 10-year useful life with no salvage value. Straight-line method of depreciation was used.

ATHENS Company began operations in 2021. The company purchases computer equipment from manufacturers and then sells them to retail stores. During the year, the bookkeeper only used a check register to record all cash receipts and disbursements. No other journals were used. The following is a summary of cash receipts and disbursements made by ATHENS during the year: Cash receipts: • Sale of ordinary shares, P50,000 • Collections from customers, P320,000 • Borrowed from a local bank on April 1, signed a note requiring principal and interest at 12% to be paid on March 31, 2022, P40,000 Cash disbursements: • Purchase of merchandise, P220,000 • Payment of salaries, P80,000 • Purchase of equipment, P30,000 • Payment of rent for the office building, P14,000 • Payment of miscellaneous expenses, P10.000 As a CPA who recently passed the board examination, you were engaged to prepare the financial statements at December 31, 2021. The following additional information was provided to you: a. Amounts still owed by customers to ATHENS at year-end, P22,000. Of this amount, it was anticipated that P3,000 would be uncollectible. There were no actual bad debts written off in 2021. b. Amounts still owed by ATHENS to suppliers of merchandise, P30,000. c. Cost of merchandise still on hand at year-end, P50,000. d. Salaries owed to employees at year-end, P5,000. e. On December 1, P3.000 rent was paid to the owner of the office building used by the ATHENS. This represented rent for the period December 2021 to February 2022. f. The equipment was purchased on January1 and had a 10-year useful life with no salvage value. Straight-line method of depreciation was used.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 46P: Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and...

Related questions

Question

How much is ATHENS' accrual basis purchases during the year?

Transcribed Image Text:ATHENS Company began operations in 2021. The company purchases computer equipment from manufacturers and then sells them to retail

stores. During the year, the bookkeeper only used a check register to record all cash receipts and disbursements. No other journals were used.

The following is a summary of cash receipts and disbursements made by ATHENS during the year:

Cash receipts:

• Sale of ordinary shares, P50,000

• Collections from customers, P320,000

· Borrowed from a local bank on April 1, signed a note requiring principal and interest at 12% to be paid on March 31, 2022, P40,000

Cash disbursements:

• Purchase of merchandise, P220,000

• Payment of salaries, P80,000

• Purchase of equipment, P30,000

Payment of rent for the office building. P14,000

• Payment of miscellianeous expenses, P10,000

As a CPA who recently passed the board examination, you were engaged to prepare the financial statements at December 31, 2021. The

following additional information was provided to you:

a. Amounts still owed by customers to ATHENS at year-end, P22,000. Of this amount, it was anticipated that P3,000 would be uncollectible.

There were no actual bad debts written off in 2021.

b. Amounts still owed by ATHENS to suppliers of merchandise, P30,000.

c. Cost of merchandise still on hand at year-end, P50,000.

d. Salaries owed to employees at year-end, P5,000.

e. On December 1, P3,000 rent was paid to the owner of the office building used by the ATHENS. This represented rent for the period

December 2021 to February 2022.

f. The equipment was purchased on January1 and had a 10-year useful life with no salvage value. Straight-line method of depreciation was

used.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning