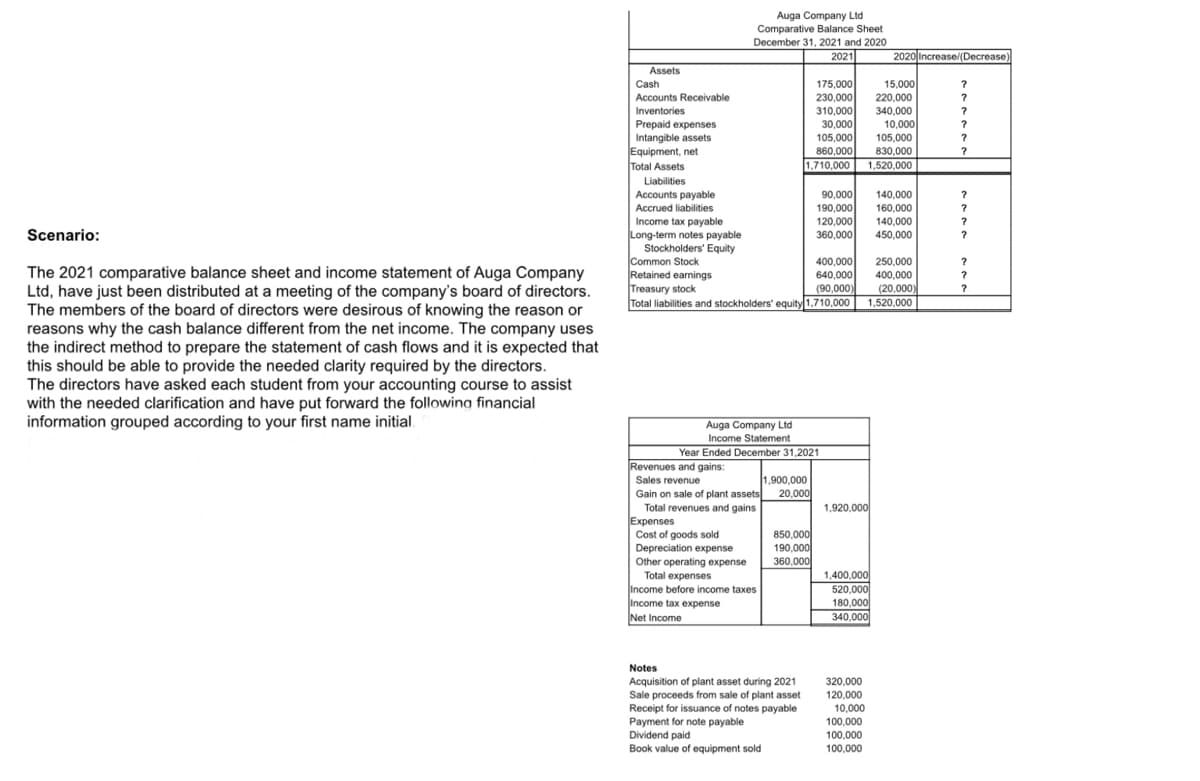

Auga Company Ltd Comparative Balance Sheet December 31, 2021 and 2020 2021 2020| Increase/(Decrease) Assets 175,000 230,000 310,000 15,000 220,000 340,000 Cash Accounts Receivable Inventories Prepaid expenses 30,000 105,000 860,000 10,000 105,000 Intangible assets Equipment, net Total Assets 830,000 1,710,000 1,520,000 Liabilities 90,000 190,000 120,000 360,000 Accounts payable Accrued liabilities 140,000 160,000 140,000 450,000 Income tax payable Long-term notes payable Stockholders' Equity Common Stock Retained earnings Treasury stock Total liabilities and stockholders' equity 1.710,000 Scenario: 400,000 640,000 (90,000) 250,000 The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been distributed at a meeting of the company's board of directors. The members of the board of directors were desirous of knowing the reason or reasons why the cash balance different from the net income. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the directors. The directors have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information grouped according to your first name initial. 400,000 (20,000) 1,520,000 Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue Gain on sale of plant assets 20,000 Total revenues and gains Expenses Cost of goods sold Depreciation expense Other operating expense 1,900,000 1,920,000 850,000 190,000 360,000 Total expenses Income before income taxes Income tax expense Net Income 1,400,000 520,000 180,000 340,000 Notes 320,000 120,000 Acquisition of plant asset during 2021 Sale proceeds from sale of plant asset Receipt for issuance of notes payable Payment for note payable Dividend paid Book value of equipment sold 10,000 100,000 100,000 100,000

Auga Company Ltd Comparative Balance Sheet December 31, 2021 and 2020 2021 2020| Increase/(Decrease) Assets 175,000 230,000 310,000 15,000 220,000 340,000 Cash Accounts Receivable Inventories Prepaid expenses 30,000 105,000 860,000 10,000 105,000 Intangible assets Equipment, net Total Assets 830,000 1,710,000 1,520,000 Liabilities 90,000 190,000 120,000 360,000 Accounts payable Accrued liabilities 140,000 160,000 140,000 450,000 Income tax payable Long-term notes payable Stockholders' Equity Common Stock Retained earnings Treasury stock Total liabilities and stockholders' equity 1.710,000 Scenario: 400,000 640,000 (90,000) 250,000 The 2021 comparative balance sheet and income statement of Auga Company Ltd, have just been distributed at a meeting of the company's board of directors. The members of the board of directors were desirous of knowing the reason or reasons why the cash balance different from the net income. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the directors. The directors have asked each student from your accounting course to assist with the needed clarification and have put forward the following financial information grouped according to your first name initial. 400,000 (20,000) 1,520,000 Auga Company Ltd Income Statement Year Ended December 31,2021 Revenues and gains: Sales revenue Gain on sale of plant assets 20,000 Total revenues and gains Expenses Cost of goods sold Depreciation expense Other operating expense 1,900,000 1,920,000 850,000 190,000 360,000 Total expenses Income before income taxes Income tax expense Net Income 1,400,000 520,000 180,000 340,000 Notes 320,000 120,000 Acquisition of plant asset during 2021 Sale proceeds from sale of plant asset Receipt for issuance of notes payable Payment for note payable Dividend paid Book value of equipment sold 10,000 100,000 100,000 100,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 98.3C

Related questions

Question

Transcribed Image Text:Auga Company Ltd

Comparative Balance Sheet

December 31, 2021 and 2020

2021

2020 Increase/(Decrease)

Assets

Cash

15,000

175,000

230,000

Accounts Receivable

220,000

310,000

30,000

105,000

Inventories

340,000

10,000

Prepaid expenses

Intangible assets

Equipment, net

Total Assets

105,000

?

830,000

1.520,000

860,000

?

1,710,000

Liabilities

Accounts payable

Accrued liabilities

Income tax payable

Long-term notes payable

Stockholders' Equity

Common Stock

Retained earnings

Treasury stock

Total liabilities and stockholders' equity 1,710,000

90,000

140,000

190,000

120,000

360,000

160,000

140,000

?

Scenario:

450,000

400,000

250,000

?

The 2021 comparative balance sheet and income statement of Auga Company

Ltd, have just been distributed at a meeting of the company's board of directors.

The members of the board of directors were desirous of knowing the reason or

reasons why the cash balance different from the net income. The company uses

the indirect method to prepare the statement of cash flows and it is expected that

this should be able to provide the needed clarity required by the directors.

The directors have asked each student from your accounting course to assist

with the needed clarification and have put forward the following financial

information grouped according to your first name initial.

640,000

400,000

(90,000)

(20,000

1,520,000

Auga Company Ltd

Income Statement

Year Ended December 31,2021

Revenues and gains:

Sales revenue

Gain on sale of plant assets 20,000

Total revenues and gains

Expenses

Cost of goods sold

Depreciation expense

Other operating expense

Total expenses

Income before income taxes

Income tax expense

Net Income

1,900,000

1,920,000

850,000

190,000

360,000

1,400.000

520,000

180,000

340,000

Notes

Acquisition of plant asset during 2021

320,000

Sale proceeds from sale of plant asset

Receipt for issuance of notes payable

Payment for note payable

Dividend paid

120,000

10,000

100,000

100,000

100,000

Book value of equipment sold

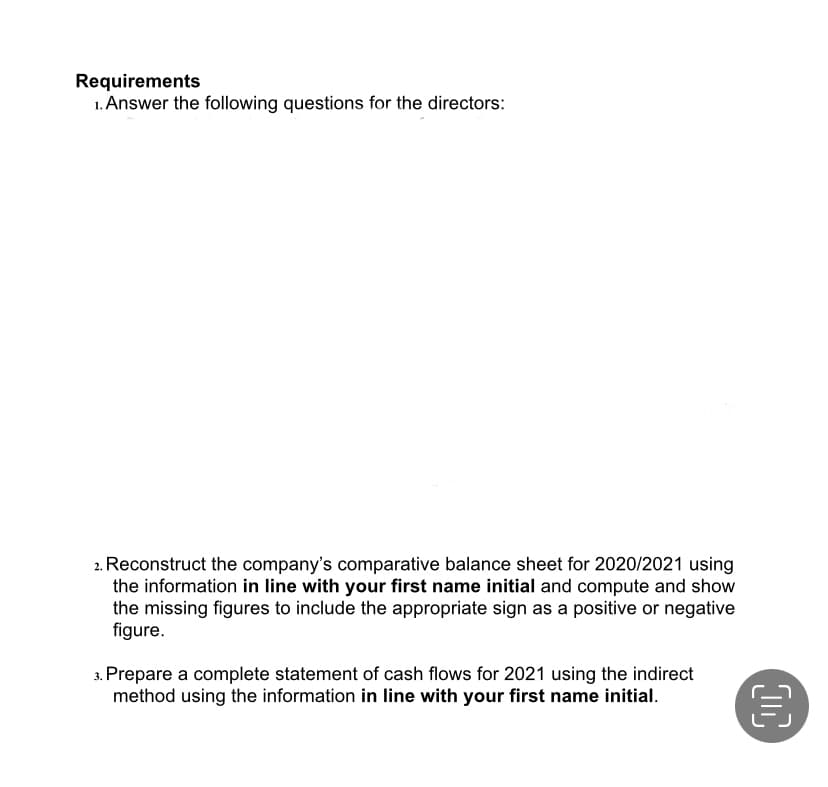

Transcribed Image Text:Requirements

1. Answer the following questions for the directors:

2. Reconstruct the company's comparative balance sheet for 2020/2021 using

the information in line with your first name initial and compute and show

the missing figures to include the appropriate sign as a positive or negative

figure.

3. Prepare a complete statement of cash flows for 2021 using the indirect

method using the information in line with your first name initial.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning