Avicenna is a major insurer that offers five-year life insurance policies to 65 year-olds. If the holder of one of these policies dies before the age of 70 years, the company must pay $213,000 the beneficiary of the policy. Avicena executives are considering the possibility of offering these policies to $9,380 each one. Suppose there is a 4% probability that the insured will die before the 70 age of years and a 96% probability that she will live to 70 age. If Avicena executives know they will sell many of these policies, should they expect to make or lose money by offering them? How much would they win or lose? To respond, take into account the price of the policy and the expected value of the amount paid to the beneficiary.

Avicenna is a major insurer that offers five-year life insurance policies to 65 year-olds. If the holder of one of these policies dies before the age of 70 years, the company must pay $213,000 the beneficiary of the policy. Avicena executives are considering the possibility of offering these policies to $9,380 each one. Suppose there is a 4% probability that the insured will die before the 70 age of years and a 96% probability that she will live to 70 age.

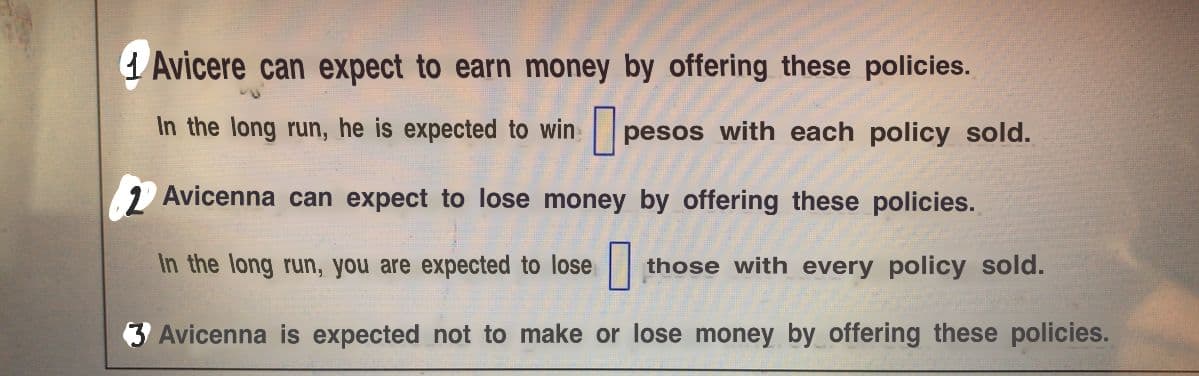

If Avicena executives know they will sell many of these policies, should they expect to make or lose money by offering them? How much would they win or lose?

To respond, take into account the price of the policy and the expected value of the amount paid to the beneficiary.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps