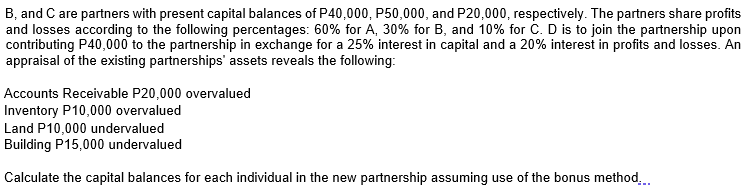

B, and C are partners with present capital balances of P40,000, P50,000, and P20,000, respectively. The partners share profits and losses according to the following percentages: 60% for A, 30% for B, and 10% for C. D is to join the partnership upon contributing P40,000 to the partnership in exchange for a 25% interest in capital and a 20% interest in profits and losses. An appraisal of the existing partnerships' assets reveals the following: Accounts Receivable P20,000 overvalued Inventory P10,000 overvalued Land P10,000 undervalued Building P15,000 undervalued Calculate the capital balances for each individual in the new partnership assuming use of the bonus method,.

B, and C are partners with present capital balances of P40,000, P50,000, and P20,000, respectively. The partners share profits and losses according to the following percentages: 60% for A, 30% for B, and 10% for C. D is to join the partnership upon contributing P40,000 to the partnership in exchange for a 25% interest in capital and a 20% interest in profits and losses. An appraisal of the existing partnerships' assets reveals the following: Accounts Receivable P20,000 overvalued Inventory P10,000 overvalued Land P10,000 undervalued Building P15,000 undervalued Calculate the capital balances for each individual in the new partnership assuming use of the bonus method,.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Transcribed Image Text:B, and C are partners with present capital balances of P40,000, P50,000, and P20,000, respectively. The partners share profits

and losses according to the following percentages: 60% for A, 30% for B, and 10% for C. D is to join the partnership upon

contributing P40,000 to the partnership in exchange for a 25% interest in capital and a 20% interest in profits and losses. An

appraisal of the existing partnerships' assets reveals the following:

Accounts Receivable P20,000 overvalued

Inventory P10,000 overvalued

Land P10,000 undervalued

Building P15,000 undervalued

Calculate the capital balances for each individual in the new partnership assuming use of the bonus method,.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT