b) Answer parts i and i based on the information below: Project C has the following cash flows. Years 1 2 3 4 Cashflows -$75,000 $13,000 $19,000 $22,000 $25,000 $26,000

b) Answer parts i and i based on the information below: Project C has the following cash flows. Years 1 2 3 4 Cashflows -$75,000 $13,000 $19,000 $22,000 $25,000 $26,000

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter16: Financial Planning And Forecasting

Section: Chapter Questions

Problem 2P: AFN EQUATION Refer to Problem 16-1. What additional funds would be needed if the companys year-end...

Related questions

Question

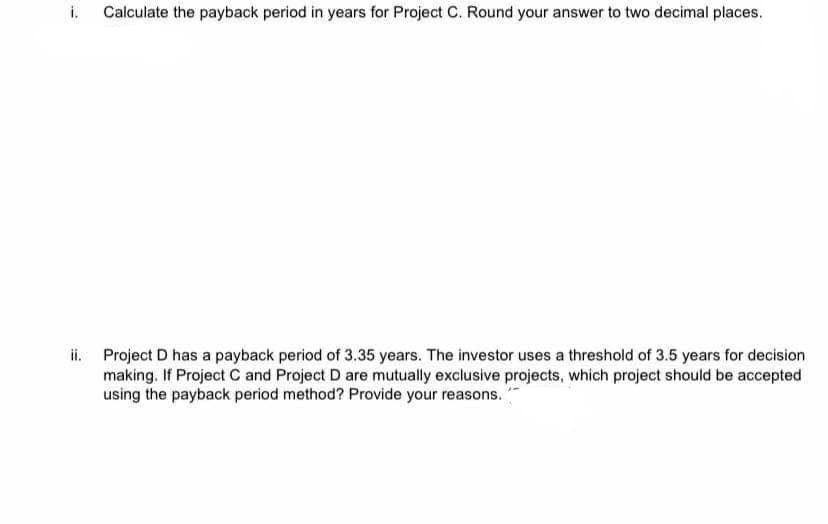

Transcribed Image Text:i.

Calculate the payback period in years for Project C. Round your answer to two decimal places.

ii. Project D has a payback period of 3.35 years. The investor uses a threshold of 3.5 years for decision

making. If Project C and Project D are mutually exclusive projects, which project should be accepted

using the payback period method? Provide your reasons.

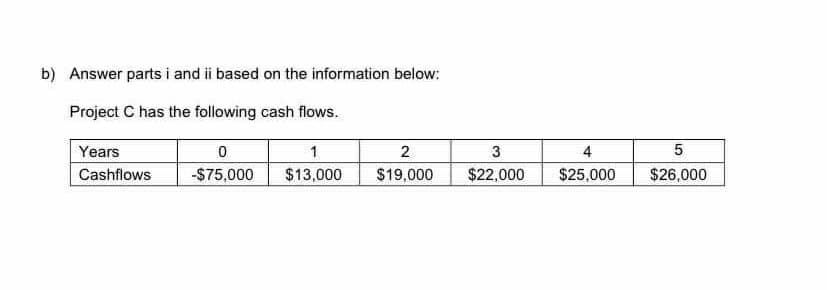

Transcribed Image Text:b) Answer parts i and i based on the information below:

Project C has the following cash flows.

Years

2

3

4

5

Cashflows

-$75,000

$13,000

$19,000

$22,000

$25,000

$26,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning