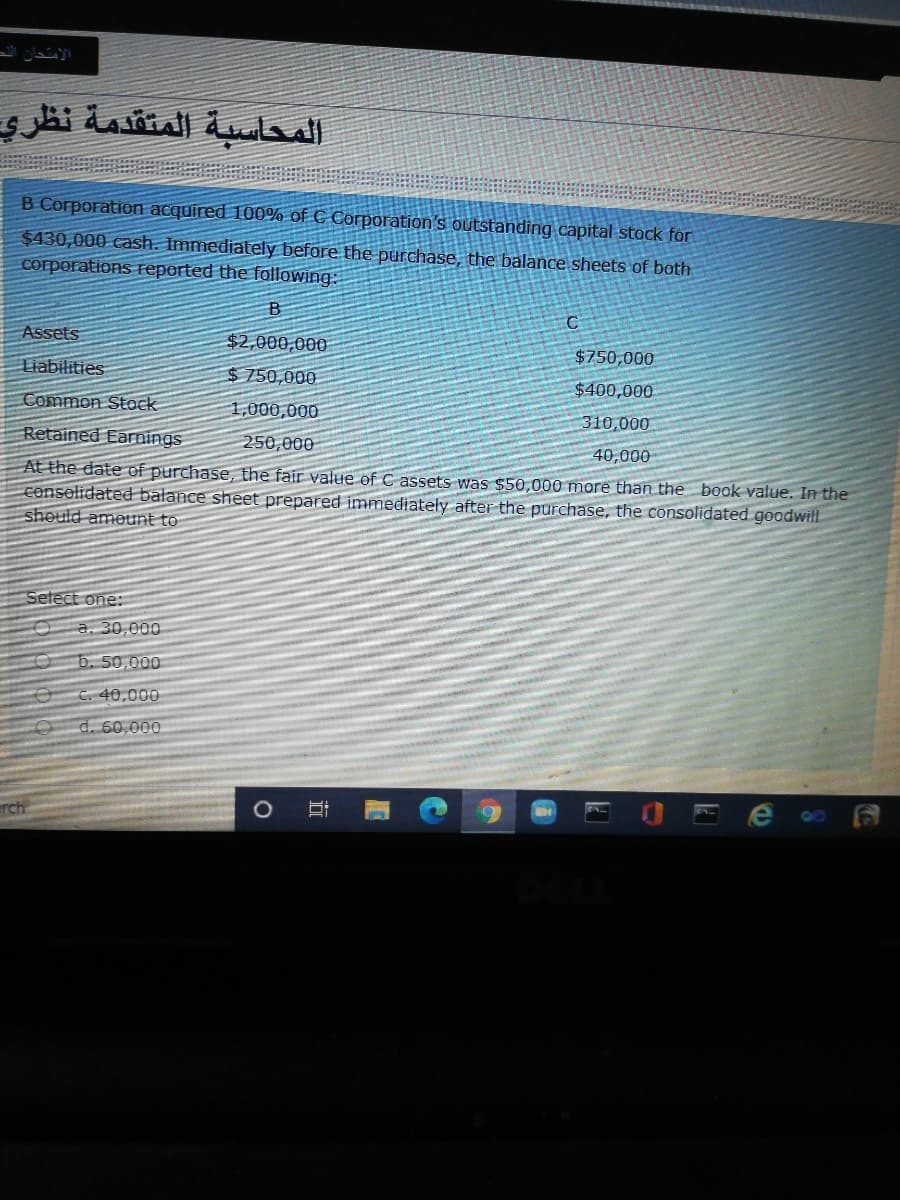

B Corporation acquired 100% of C Corporation's outstanding capital stock for $430,000 cash. Immediately before the purchase, the balance sheets of both corporations reported the following: B Assets $2,000,000 $750,000 Liabilities $ 750,000 $400,000 Common Stock 1,000,000 310,000 Retained Earnings 250,000 40,000 At the date of purchase, the fair value of C assets was $50,000 more than the book value. In conselidated balance sheet prepared immediately after the purchase, the consolidated goodwill should ameunt to Setect one: a. 30,000 b. 50,000 C. 40,000 d. 60,000

B Corporation acquired 100% of C Corporation's outstanding capital stock for $430,000 cash. Immediately before the purchase, the balance sheets of both corporations reported the following: B Assets $2,000,000 $750,000 Liabilities $ 750,000 $400,000 Common Stock 1,000,000 310,000 Retained Earnings 250,000 40,000 At the date of purchase, the fair value of C assets was $50,000 more than the book value. In conselidated balance sheet prepared immediately after the purchase, the consolidated goodwill should ameunt to Setect one: a. 30,000 b. 50,000 C. 40,000 d. 60,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 4MCQ

Related questions

Question

Transcribed Image Text:الامتحان الد

المحاسبة المتقدمة نظری

B Corporation acquired 100% of C Corporation's outstanding capital stock for

$430,000 cash. Immediately before the purchase, the balance sheets of both

corporations Feported the following:

Assets

$2,000,000

$750,000

Liabilities

$750,000

$400,000

Common Stock

1,000,000

310,000

Retained Earnings

250,000

40,000

At the date of purchase, the fair value of C assets was $50,000 more than the book value. In the

conselidated balance sheet prepared immediately after the purchase, the consolidated goodwill

should ameunt to

Setect one:

a. 30,000

b. 50,000

C. 40,000

d. 60,000

rch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning