B Fill in the blanks: La Pagayo Corporation commenced business operations in calendar year 2001. It is subject to MCIT beginning 2005. Income taxes during the years from 2005 to 2 Normal Corporate Minimum Corporate Year Income Tax Excess of MCIT over NCIT Income Tax 2005 P25,000 P100,000 P75,000 2006 130,000 150.000 20,000 2007 200,000 190,000 0 2008 0 300,000 300,000 2009 10,000 50,000 40,000 2010 15,000 60,000 45,000 8,000 2011 32000 40,000 49,000 50 000 1,000 2012 REQUIRED: Determine Income Tax still due and payable for the 2005 to 2012 Income tax still due and payable for 2006 is 2 Income tax still due and payable for 2008 is B income tax still due and payable for 2011 s NOTETATS ers are in numerical form, COMMA PESC BIG endommer characters are NOT REQUIRED Task View O 8: hn

B Fill in the blanks: La Pagayo Corporation commenced business operations in calendar year 2001. It is subject to MCIT beginning 2005. Income taxes during the years from 2005 to 2 Normal Corporate Minimum Corporate Year Income Tax Excess of MCIT over NCIT Income Tax 2005 P25,000 P100,000 P75,000 2006 130,000 150.000 20,000 2007 200,000 190,000 0 2008 0 300,000 300,000 2009 10,000 50,000 40,000 2010 15,000 60,000 45,000 8,000 2011 32000 40,000 49,000 50 000 1,000 2012 REQUIRED: Determine Income Tax still due and payable for the 2005 to 2012 Income tax still due and payable for 2006 is 2 Income tax still due and payable for 2008 is B income tax still due and payable for 2011 s NOTETATS ers are in numerical form, COMMA PESC BIG endommer characters are NOT REQUIRED Task View O 8: hn

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 2P

Related questions

Question

100%

Transcribed Image Text:Fill in the blanks:

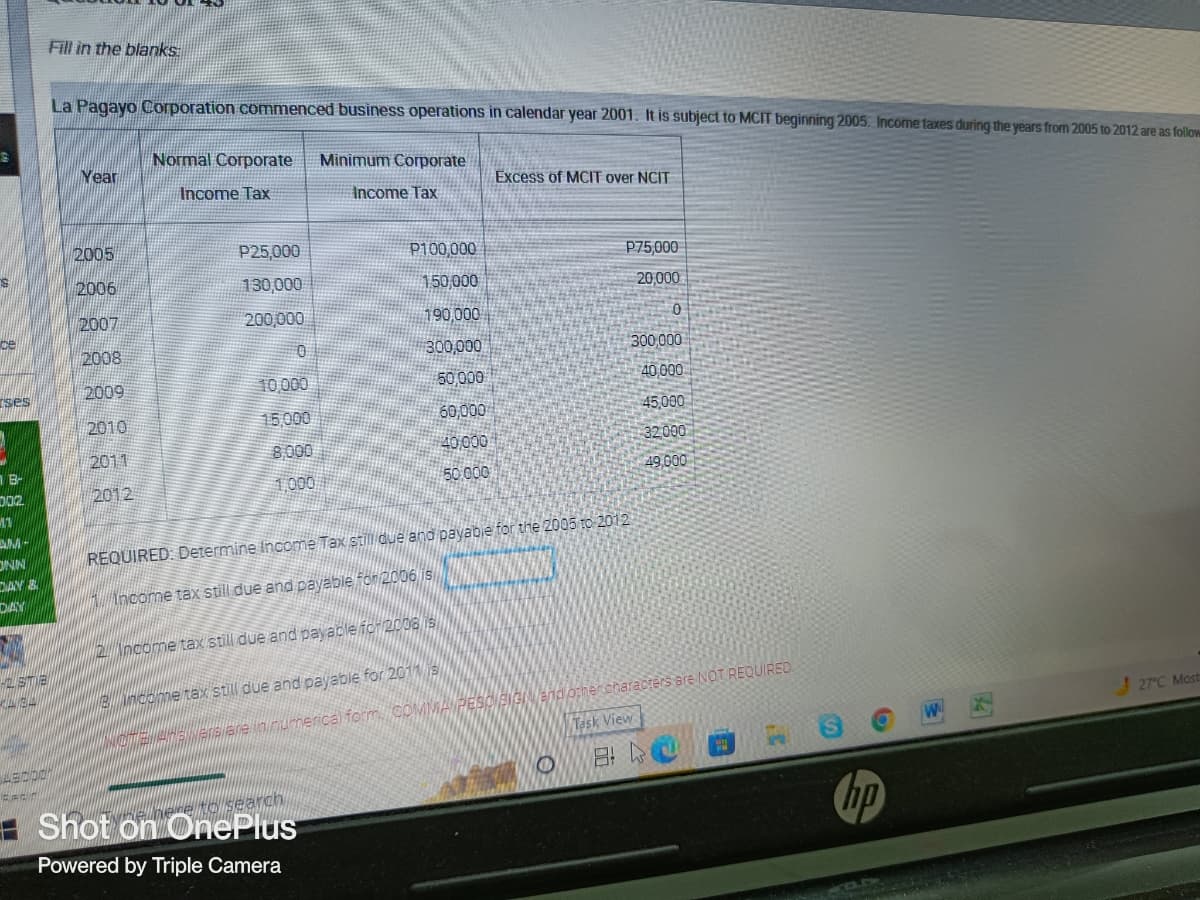

La Pagayo Corporation commenced business operations in calendar year 2001. It is subject to MCIT beginning 2005. Income taxes during the years from 2005 to 2012 are as follow

S

Normal Corporate Minimum Corporate

Year

Excess of MCIT over NCIT

Income Tax

Income Tax

2005

P25,000

P100,000

P75,000

2006

130,000

150,000

20,000

2007

200,000

190,000

0

2008

0

300,000

300,000

2009

10,000

50,000

40,000

15,000

2010

45,000

60,000

40,000

8,000

32000

2011

50.000

1,000

49,000

2012

REQUIRED: Determine Income Tax still due and payable for the 2005 to 2012

Income tax still due and payable for 2006 is

2 Income tax still due and payable for 2008 is

2 income tax still due and payable for 2011 is

27°C Most

lotta tré ers are in numerical form, COMMA PESO Big and other characters are NOT REQUIRED.

Task View

O

8:

here to search

Shot on OnePlus

Powered by Triple Camera

ce

ses

1 B-

002

11

AM-

ONN

DAY &

DAY

12 STE

184

LEDDON

BRAN

+

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning