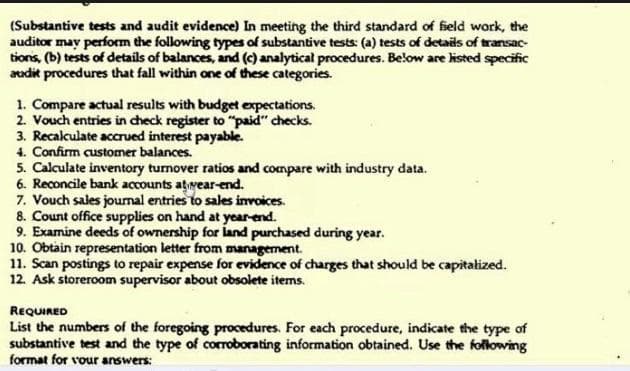

(Substantive tests and audit evidence) In meeting the third standard of field work, the auditor may perform the following types of substantive tests: (a) tests of details of transac- tions, (b) tests of details of balances, and (c) analytical procedures. Below are listed specific audit procedures that fall within one of these categories. 1. Compare actual results with budget expectations. 2. Vouch entries in check register to "paid" checks. 3. Recalculate accrued interest payable. 4. Confirm customer balances. 5. Calculate inventory turnover ratios and compare with industry data. 6. Reconcile bank accounts at year-end. 7. Vouch sales journal entries to sales invoices. 8. Count office supplies on hand at year-end. 9. Examine deeds of ownership for land purchased during year. 10. Obtain representation letter from management. 11. Scan postings to repair expense for evidence of charges that should be capitalized. 12. Ask storeroom supervisor about obsolete items. REQUIRED List the numbers of the foregoing procedures. For each procedure, indicate the type of substantive test and the type of corroborating information obtained. Use the following format for your answers:

(Substantive tests and audit evidence) In meeting the third standard of field work, the auditor may perform the following types of substantive tests: (a) tests of details of transac- tions, (b) tests of details of balances, and (c) analytical procedures. Below are listed specific audit procedures that fall within one of these categories. 1. Compare actual results with budget expectations. 2. Vouch entries in check register to "paid" checks. 3. Recalculate accrued interest payable. 4. Confirm customer balances. 5. Calculate inventory turnover ratios and compare with industry data. 6. Reconcile bank accounts at year-end. 7. Vouch sales journal entries to sales invoices. 8. Count office supplies on hand at year-end. 9. Examine deeds of ownership for land purchased during year. 10. Obtain representation letter from management. 11. Scan postings to repair expense for evidence of charges that should be capitalized. 12. Ask storeroom supervisor about obsolete items. REQUIRED List the numbers of the foregoing procedures. For each procedure, indicate the type of substantive test and the type of corroborating information obtained. Use the following format for your answers:

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter11: Auditing Inventory, Goods And Services, And Accounts Payable: The Acquisition And Payment Cycle

Section: Chapter Questions

Problem 35RQSC

Related questions

Question

Transcribed Image Text:(Substantive tests and audit evidence) In meeting the third standard of field work, the

auditor may perform the following types of substantive tests: (a) tests of details of transac-

tions, (b) tests of details of balances, and (c) analytical procedures. Below are kisted specific

audit procedures that fall within one of these categories.

1. Compare actual results with budget expectations.

2. Vouch entries in check register to "paid" checks.

3. Recalculate accrued interest payable.

4. Confirm customer balances.

5. Calculate inventory turnover ratios and compare with industry data.

6. Reconcile bank accounts ativear-end.

7. Vouch sales journal entries to sales invoices.

8. Count office supplies on hand at year-end.

9. Examine deeds of ownership for land purchased during year.

10. Obtain representation letter from management.

11. Scan postings to repair expense for evidence of charges that should be capitałized.

12. Ask storeroom supervisor about obsolete items.

REQUIRED

List the numbers of the foregoing procedures. For each procedure, indicate the type of

substantive test and the type of corroborating information obtained. Use the following

format for vour answers:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub