(b) Journalize the transactions. Do not provide explanations. E3-8 This information relates to McCall Real Estate Agency. Stockholders invest $30,000 in exchange for common stock of the corporation. Hires an administrative assistant at an annual salary of $36,000. Buys office furniture for $3,800, on account. Oct. 3 Sells a house and lot for E. C. Roads; commissions due from Roads, $10.800 6. (not paid by Roads at this time). Receives cash of $140 as commission for acting as rental agent renting an 10 apartment. Pays $700 on account for the office furniture purchased on October 3 Pays the administrative assistant $3,000 in salary for October. 27 30 Instructions Prepare the debit-credit analysis for each transaction, as illustrated on pages 111-6.

(b) Journalize the transactions. Do not provide explanations. E3-8 This information relates to McCall Real Estate Agency. Stockholders invest $30,000 in exchange for common stock of the corporation. Hires an administrative assistant at an annual salary of $36,000. Buys office furniture for $3,800, on account. Oct. 3 Sells a house and lot for E. C. Roads; commissions due from Roads, $10.800 6. (not paid by Roads at this time). Receives cash of $140 as commission for acting as rental agent renting an 10 apartment. Pays $700 on account for the office furniture purchased on October 3 Pays the administrative assistant $3,000 in salary for October. 27 30 Instructions Prepare the debit-credit analysis for each transaction, as illustrated on pages 111-6.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.10E: Effects of transactions on Accounting equation On Time Delivery Service had the following selected...

Related questions

Question

100%

Thanks

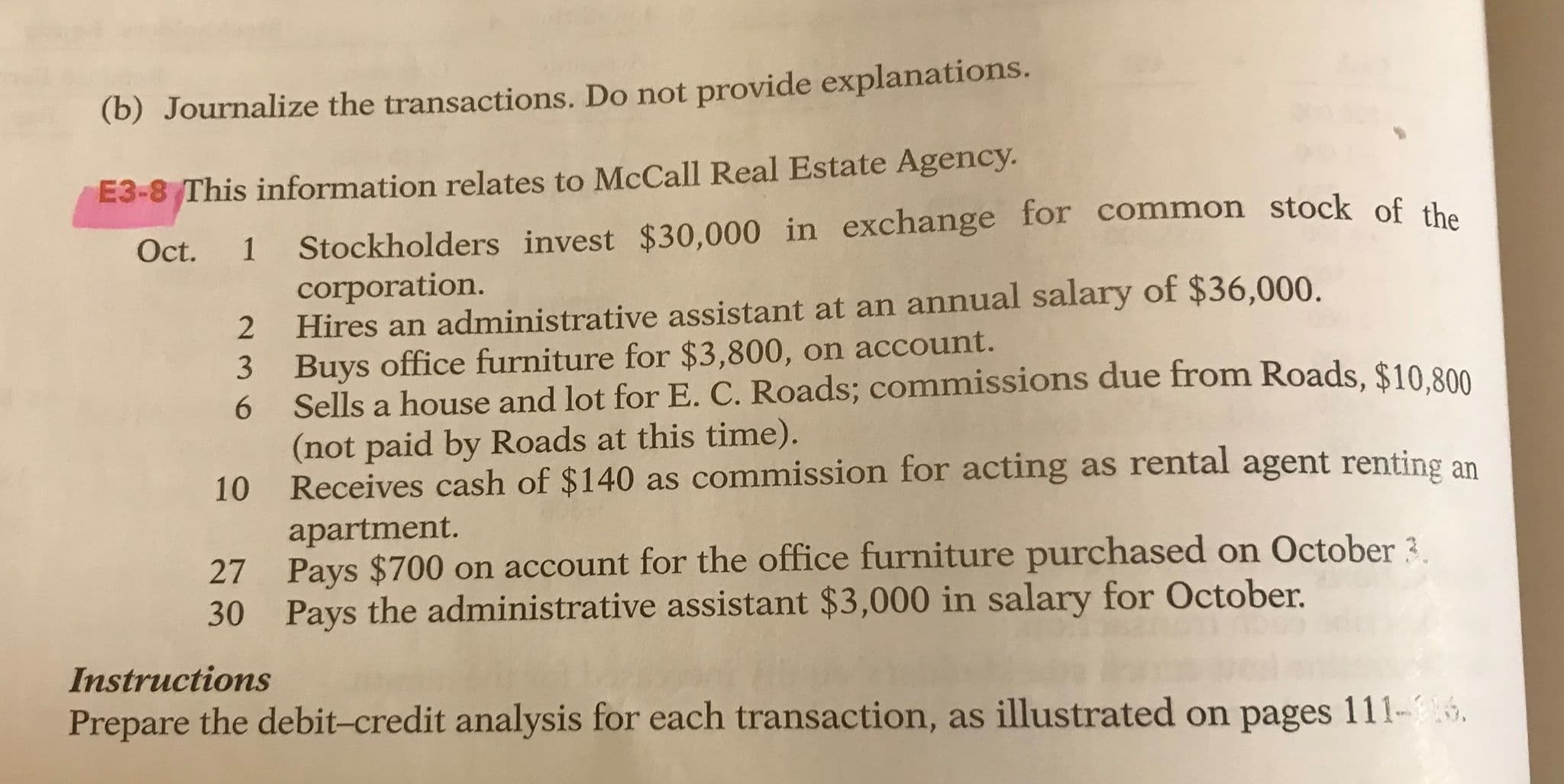

Transcribed Image Text:(b) Journalize the transactions. Do not provide explanations.

E3-8 This information relates to McCall Real Estate Agency.

Stockholders invest $30,000 in exchange for common stock of the

corporation.

Hires an administrative assistant at an annual salary of $36,000.

Buys office furniture for $3,800, on account.

Oct.

3

Sells a house and lot for E. C. Roads; commissions due from Roads, $10.800

6.

(not paid by Roads at this time).

Receives cash of $140 as commission for acting as rental agent renting an

10

apartment.

Pays $700 on account for the office furniture purchased on October 3

Pays the administrative assistant $3,000 in salary for October.

27

30

Instructions

Prepare the debit-credit analysis for each transaction, as illustrated on pages 111-6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning