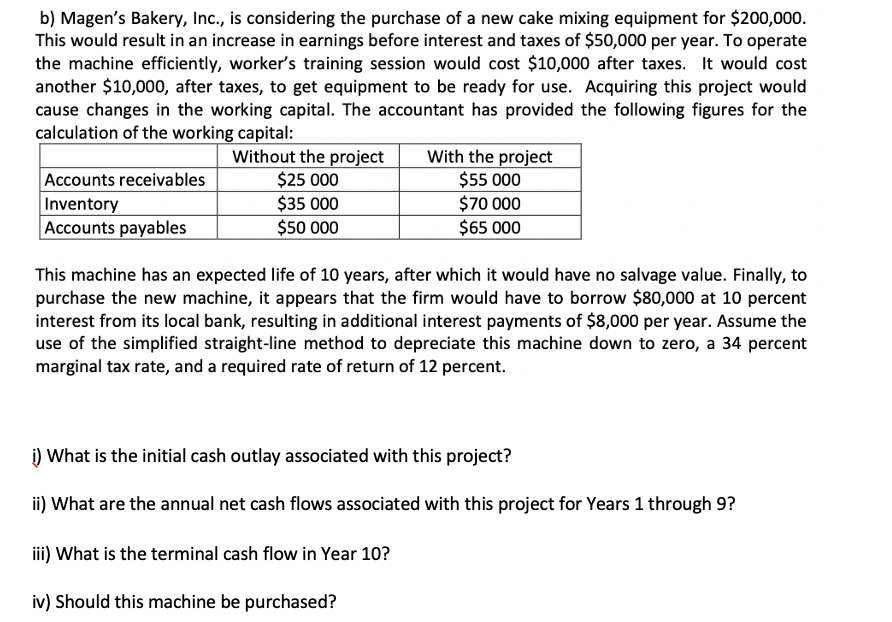

b) Magen's Bakery, Inc., is considering the purchase of a new cake mixing equipment for $200,000. This would result in an increase in earnings before interest and taxes of $50,000 per year. To operate the machine efficiently, worker's training session would cost $10,000 after taxes. It would cost another $10,000, after taxes, to get equipment to be ready for use. Acquiring this project would cause changes in the working capital. The accountant has provided the following figures for the calculation of the working capital: Without the project $25 000 $35 000 $50 000 With the project $55 000 Accounts receivables Inventory Accounts payables $70 000 $65 000 This machine has an expected life of 10 years, after which it would have no salvage value. Finally, to purchase the new machine, it appears that the firm would have to borrow $80,000 at 10 percent interest from its local bank, resulting in additional interest payments of $8,000 per year. Assume the use of the simplified straight-line method to depreciate this machine down to zero, a 34 percent marginal tax rate, and a required rate of return of 12 percent. What is the initial cash outlay associated with this project? i) What are the annual net cash flows associated with this project for Years 1 through 9? ii) What is the terminal cash flow in Year 10?

b) Magen's Bakery, Inc., is considering the purchase of a new cake mixing equipment for $200,000. This would result in an increase in earnings before interest and taxes of $50,000 per year. To operate the machine efficiently, worker's training session would cost $10,000 after taxes. It would cost another $10,000, after taxes, to get equipment to be ready for use. Acquiring this project would cause changes in the working capital. The accountant has provided the following figures for the calculation of the working capital: Without the project $25 000 $35 000 $50 000 With the project $55 000 Accounts receivables Inventory Accounts payables $70 000 $65 000 This machine has an expected life of 10 years, after which it would have no salvage value. Finally, to purchase the new machine, it appears that the firm would have to borrow $80,000 at 10 percent interest from its local bank, resulting in additional interest payments of $8,000 per year. Assume the use of the simplified straight-line method to depreciate this machine down to zero, a 34 percent marginal tax rate, and a required rate of return of 12 percent. What is the initial cash outlay associated with this project? i) What are the annual net cash flows associated with this project for Years 1 through 9? ii) What is the terminal cash flow in Year 10?

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1bM

Related questions

Question

Transcribed Image Text:b) Magen's Bakery, Inc., is considering the purchase of a new cake mixing equipment for $200,000.

This would result in an increase in earnings before interest and taxes of $50,000 per year. To operate

the machine efficiently, worker's training session would cost $10,000 after taxes. It would cost

another $10,000, after taxes, to get equipment to be ready for use. Acquiring this project would

cause changes in the working capital. The accountant has provided the following figures for the

calculation of the working capital:

Accounts receivables

Inventory

Accounts payables

Without the project

$25 000

$35 000

$50 000

With the project

$55 000

$70 000

$65 000

This machine has an expected life of 10 years, after which it would have no salvage value. Finally, to

purchase the new machine, it appears that the firm would have to borrow $80,000 at 10 percent

interest from its local bank, resulting in additional interest payments of $8,000 per year. Assume the

use of the simplified straight-line method to depreciate this machine down to zero, a 34 percent

marginal tax rate, and a required rate of return of 12 percent.

i) What is the initial cash outlay associated with this project?

ii) What are the annual net cash flows associated with this project for Years 1 through 9?

iii) What is the terminal cash flow in Year 10?

iv) Should this machine be purchased?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning