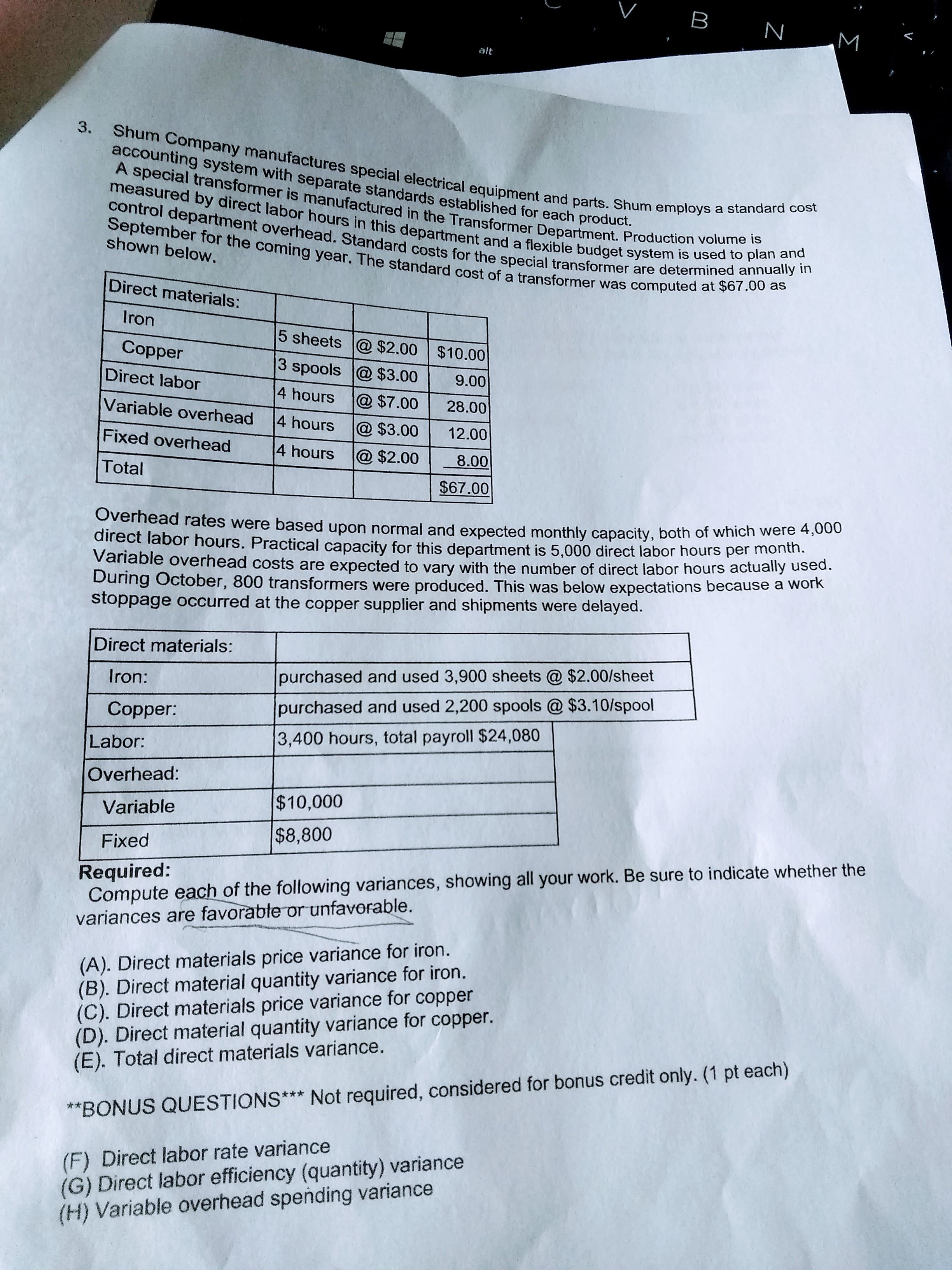

B N alt 3. Shum Company manufactures special electrical equipment and parts. Shum employs a standard cost accounting system with separate standards established for each product. A special transformer is manufactured in the Transformer Department. Production volume is measured by direct labor hours in this department and a flexible budget system is used to plan and control department overhead. Standard costs for the special transformer are determined annually in September for the coming year. The standard cost of a transformer was computed at $67.00 as shown below. Direct materials: Iron 5 sheets @ $2.00 $10.00 Copper 3 spools @ $3.00 Direct labor 9.00 4 hours @ $7.00 28.00 Variable overhead 4 hours @ $3.00 12.00 Fixed overhead 4 hours @ $2.00 8.00 Total $67.00 Overhead rates were based upon normal and expected monthly capacity, both of which were 00 direct labor hours. Practical capacity for this department is 5.000 direct labor hours per month. Variable overhead costs are expected to vary with the number of direct labor hours actually used. During October, 800 transformers were produced. This was below expectations because a work stoppage occurred at the copper supplier and shipments were delayed. Direct materials: Iron: purchased and used 3,900 sheets @ $2.00/sheet Copper: purchased and used 2,200 spools @ $3.10/spool Labor: 3,400 hours, total payroll $24,080 Overhead: $10,000 Variable $8,800 Fixed Required: Compute each of the following variances, showing all your work. Be sure to indicate whether the variances are favorable or unfavorable. (A). Direct materials price variance for iron. (B). Direct material quantity variance for iron. (C). Direct materials price variance for copper (D). Direct material quantity variance for copper. (E). Total direct materials variance. **BONUS QUESTIONS*** Not required, considered for bonus credit only. (1 pt each) (F) Direct labor rate variance (G) Direct labor efficiency (quantity) variance (H) Variable overhead spending variance Σ

B N alt 3. Shum Company manufactures special electrical equipment and parts. Shum employs a standard cost accounting system with separate standards established for each product. A special transformer is manufactured in the Transformer Department. Production volume is measured by direct labor hours in this department and a flexible budget system is used to plan and control department overhead. Standard costs for the special transformer are determined annually in September for the coming year. The standard cost of a transformer was computed at $67.00 as shown below. Direct materials: Iron 5 sheets @ $2.00 $10.00 Copper 3 spools @ $3.00 Direct labor 9.00 4 hours @ $7.00 28.00 Variable overhead 4 hours @ $3.00 12.00 Fixed overhead 4 hours @ $2.00 8.00 Total $67.00 Overhead rates were based upon normal and expected monthly capacity, both of which were 00 direct labor hours. Practical capacity for this department is 5.000 direct labor hours per month. Variable overhead costs are expected to vary with the number of direct labor hours actually used. During October, 800 transformers were produced. This was below expectations because a work stoppage occurred at the copper supplier and shipments were delayed. Direct materials: Iron: purchased and used 3,900 sheets @ $2.00/sheet Copper: purchased and used 2,200 spools @ $3.10/spool Labor: 3,400 hours, total payroll $24,080 Overhead: $10,000 Variable $8,800 Fixed Required: Compute each of the following variances, showing all your work. Be sure to indicate whether the variances are favorable or unfavorable. (A). Direct materials price variance for iron. (B). Direct material quantity variance for iron. (C). Direct materials price variance for copper (D). Direct material quantity variance for copper. (E). Total direct materials variance. **BONUS QUESTIONS*** Not required, considered for bonus credit only. (1 pt each) (F) Direct labor rate variance (G) Direct labor efficiency (quantity) variance (H) Variable overhead spending variance Σ

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 6E: Eclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a...

Related questions

Question

Transcribed Image Text:B

N

alt

3.

Shum Company manufactures special electrical equipment and parts. Shum employs a standard cost

accounting system with separate standards established for each product.

A special transformer is manufactured in the Transformer Department. Production volume is

measured by direct labor hours in this department and a flexible budget system is used to plan and

control department overhead. Standard costs for the special transformer are determined annually in

September for the coming year. The standard cost of a transformer was computed at $67.00 as

shown below.

Direct materials:

Iron

5 sheets @ $2.00 $10.00

Copper

3 spools @ $3.00

Direct labor

9.00

4 hours

@ $7.00

28.00

Variable overhead

4 hours

@ $3.00

12.00

Fixed overhead

4 hours

@ $2.00

8.00

Total

$67.00

Overhead rates were based upon normal and expected monthly capacity, both of which were 00

direct labor hours. Practical capacity for this department is 5.000 direct labor hours per month.

Variable overhead costs are expected to vary with the number of direct labor hours actually used.

During October, 800 transformers were produced. This was below expectations because a work

stoppage occurred at the copper supplier and shipments were delayed.

Direct materials:

Iron:

purchased and used 3,900 sheets @ $2.00/sheet

Copper:

purchased and used 2,200 spools @ $3.10/spool

Labor:

3,400 hours, total payroll $24,080

Overhead:

$10,000

Variable

$8,800

Fixed

Required:

Compute each of the following variances, showing all your work. Be sure to indicate whether the

variances are favorable or unfavorable.

(A). Direct materials price variance for iron.

(B). Direct material quantity variance for iron.

(C). Direct materials price variance for copper

(D). Direct material quantity variance for copper.

(E). Total direct materials variance.

**BONUS QUESTIONS*** Not required, considered for bonus credit only. (1 pt each)

(F) Direct labor rate variance

(G) Direct labor efficiency (quantity) variance

(H) Variable overhead spending variance

Σ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning