b. Batch-level activity center. d. acility-le ity center. 27. Lilium Company uses activity-based costing to determine unit product costs for external reports. The company has two products: A and B. The annual production and sales of Product A is 10,000 units and of Product B is 4,000 units. There are three overhead activity centers, with estimated overhead costs and expected activity as follows: Estimated Activity Overhead Expected Activity Product A Center Costs Total Product B Activity 1 P25,000 250 150 100 Activity 2 P65,000 1,000 800 200 Activity 3 P90,000 3,000 1,000 2,000 The overhead cost per unit of Product A under activity-based costing is closest to: a. P6.00. c. P1.50. b. P9.70. d. P3.00. 7 20

b. Batch-level activity center. d. acility-le ity center. 27. Lilium Company uses activity-based costing to determine unit product costs for external reports. The company has two products: A and B. The annual production and sales of Product A is 10,000 units and of Product B is 4,000 units. There are three overhead activity centers, with estimated overhead costs and expected activity as follows: Estimated Activity Overhead Expected Activity Product A Center Costs Total Product B Activity 1 P25,000 250 150 100 Activity 2 P65,000 1,000 800 200 Activity 3 P90,000 3,000 1,000 2,000 The overhead cost per unit of Product A under activity-based costing is closest to: a. P6.00. c. P1.50. b. P9.70. d. P3.00. 7 20

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter3: Cost Behavior And Cost Forecasting

Section: Chapter Questions

Problem 68P: (Appendix 3A) Scattergraph, High-Low Method, Method of Least Squares, Use of Judgment The management...

Related questions

Question

ans the 27, 28 and 29. Provide solution

Transcribed Image Text:Chapter 9

Production order processing is an example of a:

Product-level activity.

C.

a.

Unit-level activity.

Batch-level activity.

d.

Facility-level activity.

b.

The power costs associated with running machines is an example of a

24.

cost that can be traced to a:

Product-level activity center.

C.

a.

Unit-level activity center.

Batch-level activity center.

d.

Facility-level activity center.

b.

25.

Labor setup cost is an example of a cost that can be traced to a:

a. Unit-level activity center.

Product-level activity center.

C.

d.

Facility-level activity center.

b. Batch-level activity center.

26.

The plant manager's salary is an example of a cost that would be

traced to a:

a.

C.

Unit-level activity center.

Batch-level activity center.

Product-level activity center.

d. Facility-level activity center.

b.

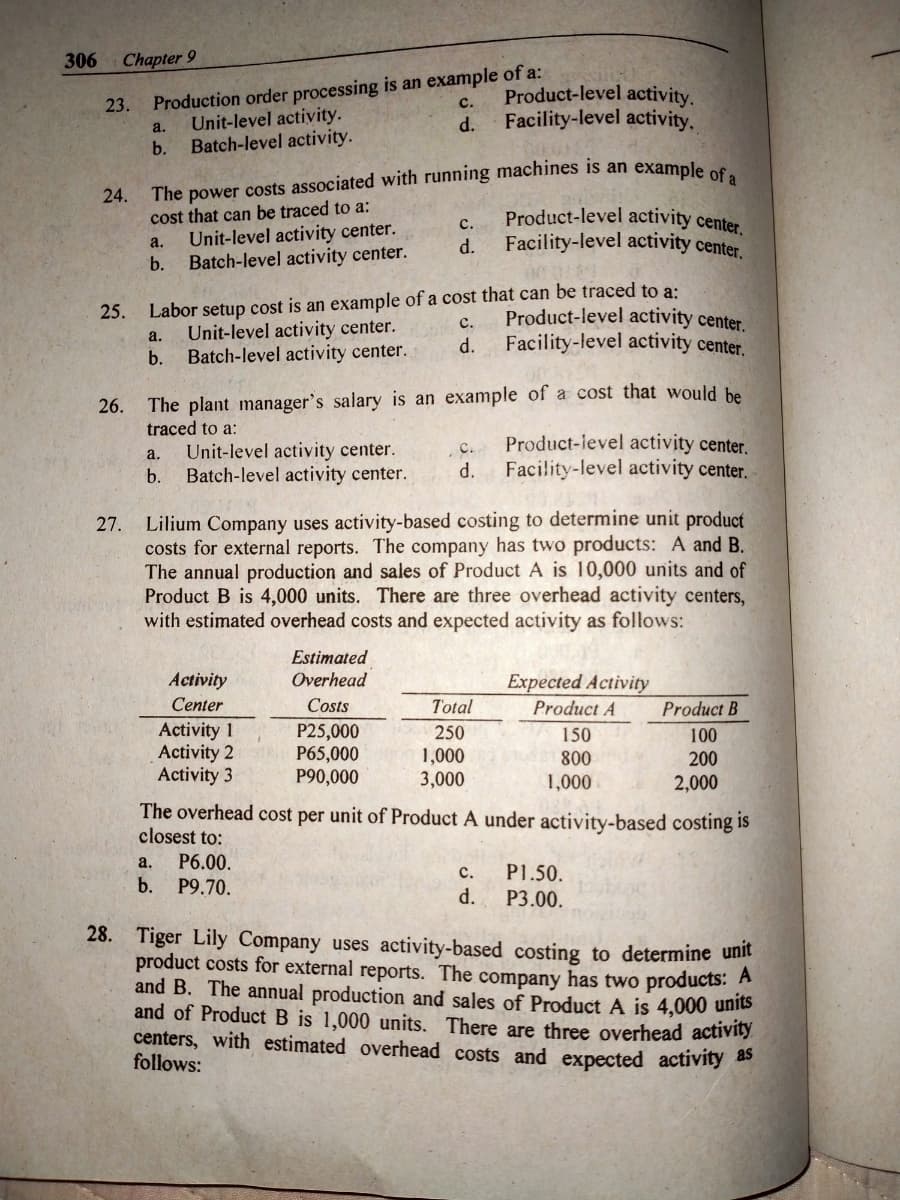

27. Lilium Company uses activity-based costing to determine unit product

costs for external reports. The company has two products: A and B.

The annual production and sales of Product A is 10,000 units and of

Product B is 4,000 units. There are three overhead activity centers,

with estimated overhead costs and expected activity as follows:

Estimated

Activity

Overhead

Center

Expected Activity

Product A

Costs

Total

Product B

Activity 1

P25,000

250

150

100

Activity 2

P65,000

1,000

800

200

Activity 3

P90,000

3,000

1,000

2,000

The overhead cost per unit of Product A under activity-based costing is

closest to:

a.

P6.00.

C.

P1.50.

b. P9.70.

d.

P3.00.

28. Tiger Lily Company uses activity-based costing to determine unit

product costs for external reports. The company has two products: A

and B. The annual production and sales of Product A is 4,000 units

and of Product B is 1,000 units. There are three overhead activity

centers, with estimated overhead costs and expected activity as

follows:

306

23.

Transcribed Image Text:Activity-Based Costing and Management 307

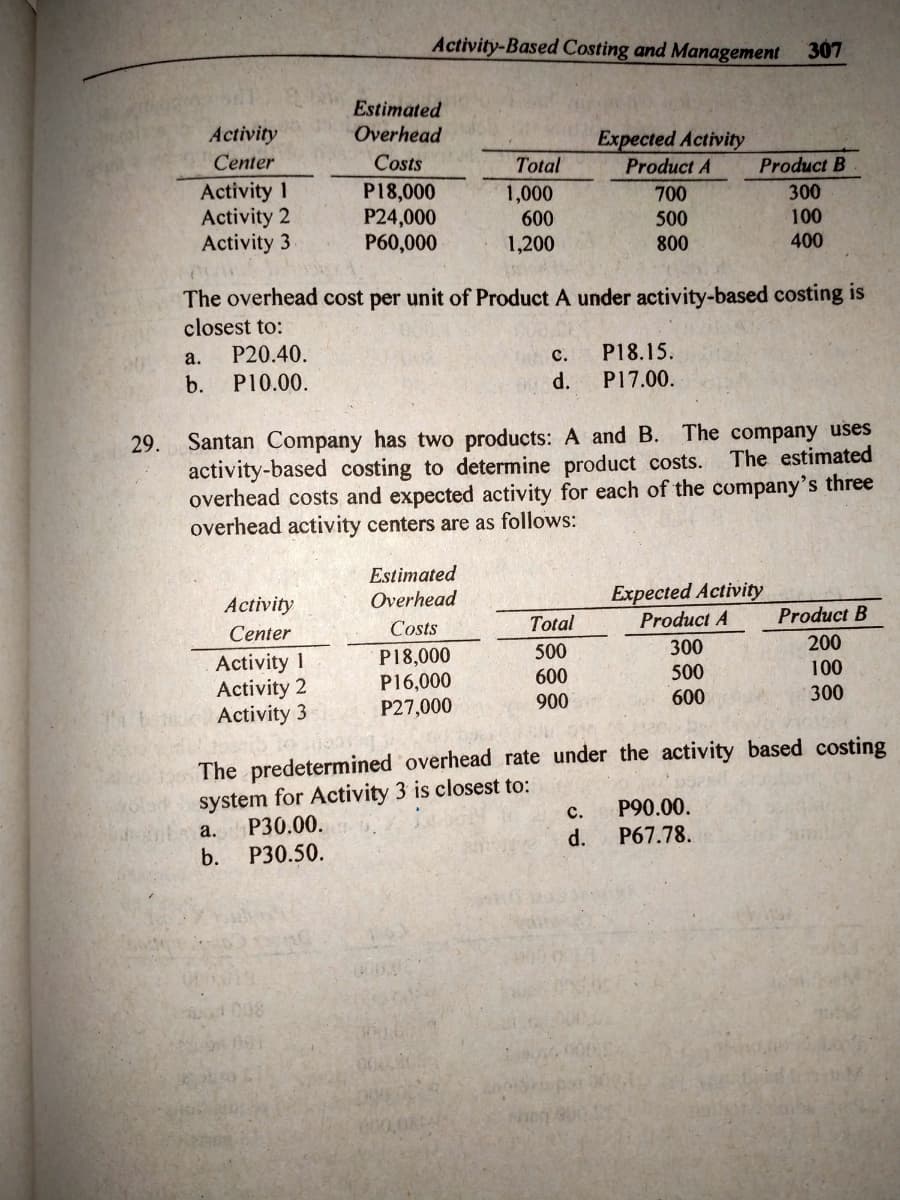

Estimated

Activity

Overhead

Expected Activity

Center

Costs

Total

Product A

Product B

Activity 1

P18,000

1,000

700

300

Activity 2

P24,000

600

500

100

Activity 3

P60,000

1,200

800

400

The overhead cost per unit of Product A under activity-based costing is

closest to:

a.

P20.40.

C.

P18.15.

b. P10.00.

d.

P17.00.

29. Santan Company has two products: A and B. The company uses

The estimated

activity-based costing to determine product costs.

overhead costs and expected activity for each of the company's three

overhead activity centers are as follows:

Estimated

Activity

Overhead

Expected Activity

Product A

Center

Costs

Total

Product B

P18,000

300

500

Activity 1

200

P16,000

500

600

Activity 2

100

900

P27,000

600

300

Activity 3

The predetermined overhead rate under the activity based costing

system for Activity 3 is closest to:

C.

P90.00.

P30.00.

a.

b. P30.50.

P67.78.

od 008

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,