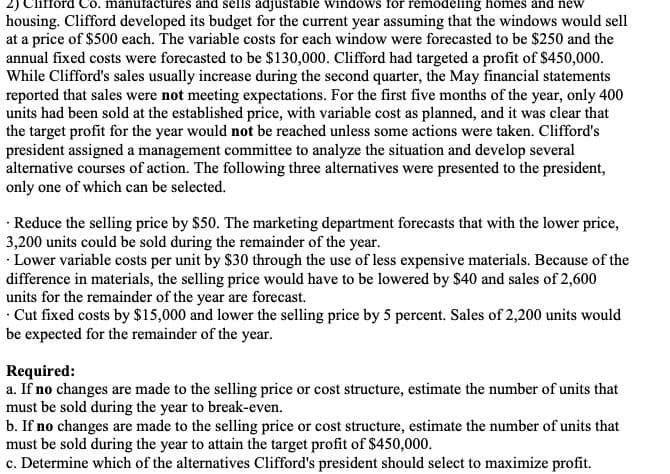

housing. Clifford developed its budget for the current year assuming that the windows would sell at a price of $500 each. The variable costs for each window were forecasted to be $250 and the annual fixed costs were forecasted to be $130,000. Clifford had targeted a profit of $450,000. While Clifford's sales usually increase during the second quarter, the May financial statements reported that sales were not meeting expectations. For the first five months of the year, only 400 units had been sold at the established price, with variable cost as planned, and it was clear that the target profit for the year would not be reached unless some actions were taken. Clifford's president assigned a management committee to analyze the situation and develop several alternative courses of action. The following three alternatives were presented to the president, only one of which can be selected. Reduce the selling price by $50. The marketing department forecasts that with the lower price, 3,200 units could be sold during the remainder of the year. Lower variable costs per unit by $30 through the use of less expensive materials. Because of the difference in materials, the selling price would have to be lowered by $40 and sales of 2,600 units for the remainder of the year are forecast. Cut fixed costs by $15,000 and lower the selling price by 5 percent. Sales of 2,200 units would be expected for the remainder of the year. Required: a. If no changes are made to the selling price or cost structure, estimate the number of units that must be sold during the year to break-even. b. If no changes are made to the selling price or cost structure, estimate the number of units that must be sold during the year to attain the target profit of $450,000. c. Determine which of the alternatives Clifford's president should select to maximize profit.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 2 steps with 4 images