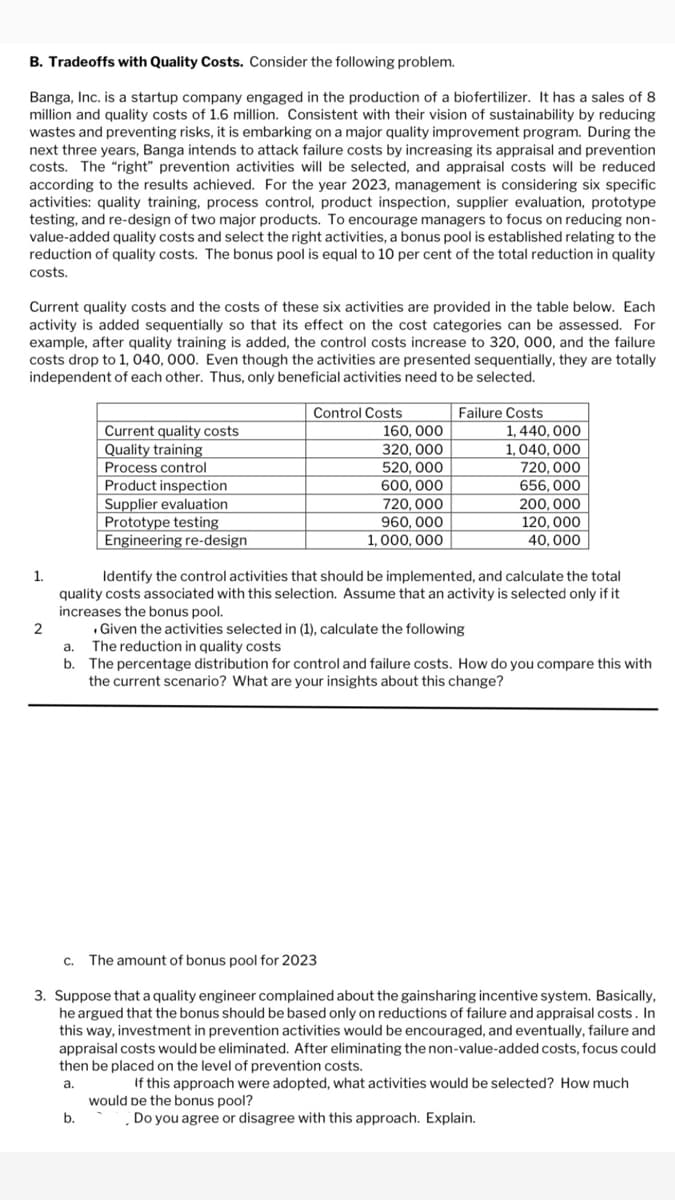

B. Tradeoffs with Quality Costs. Consider the following problem. Banga, Inc. is a startup company engaged in the production of a biofertilizer. It has a sales of 8 million and quality costs of 1.6 million. Consistent with their vision of sustainability by reducing wastes and preventing risks, it is embarking on a major quality improvement program. During the next three years, Banga intends to attack failure costs by increasing its appraisal and prevention costs. The "right" prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the year 2023, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and re-design of two major products. To encourage managers to focus on reducing non- value-added quality costs and select the right activities, a bonus pool is established relating to the reduction of quality costs. The bonus pool is equal to 10 per cent of the total reduction in quality costs. Current quality costs and the costs of these six activities are provided in the table below. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320, 000, and the failure costs drop to 1, 040, 000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need to be selected. Control Costs 1. 2 Current quality costs Quality training Process control Product inspection Supplier evaluation. Prototype testing Engineering re-design 160,000 320,000 520, 000 600,000 720,000 960,000 1,000,000 Failure Costs b. .Given the activities selected in (1), calculate the following a. The reduction in quality costs 1,440,000 1,040,000 Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 720,000 656,000 200,000 120,000 40,000 b. The percentage distribution for control and failure costs. How do you compare this with the current scenario? What are your insights about this change? c. The amount of bonus pool for 2023 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. a. If this approach were adopted, what activities would be selected? How much would be the bonus pool? Do you agree or disagree with this approach. Explain.

B. Tradeoffs with Quality Costs. Consider the following problem. Banga, Inc. is a startup company engaged in the production of a biofertilizer. It has a sales of 8 million and quality costs of 1.6 million. Consistent with their vision of sustainability by reducing wastes and preventing risks, it is embarking on a major quality improvement program. During the next three years, Banga intends to attack failure costs by increasing its appraisal and prevention costs. The "right" prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the year 2023, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and re-design of two major products. To encourage managers to focus on reducing non- value-added quality costs and select the right activities, a bonus pool is established relating to the reduction of quality costs. The bonus pool is equal to 10 per cent of the total reduction in quality costs. Current quality costs and the costs of these six activities are provided in the table below. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320, 000, and the failure costs drop to 1, 040, 000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need to be selected. Control Costs 1. 2 Current quality costs Quality training Process control Product inspection Supplier evaluation. Prototype testing Engineering re-design 160,000 320,000 520, 000 600,000 720,000 960,000 1,000,000 Failure Costs b. .Given the activities selected in (1), calculate the following a. The reduction in quality costs 1,440,000 1,040,000 Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 720,000 656,000 200,000 120,000 40,000 b. The percentage distribution for control and failure costs. How do you compare this with the current scenario? What are your insights about this change? c. The amount of bonus pool for 2023 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. a. If this approach were adopted, what activities would be selected? How much would be the bonus pool? Do you agree or disagree with this approach. Explain.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Transcribed Image Text:B. Tradeoffs with Quality Costs. Consider the following problem.

Banga, Inc. is a startup company engaged in the production of a biofertilizer. It has a sales of 8

million and quality costs of 1.6 million. Consistent with their vision of sustainability by reducing

wastes and preventing risks, it is embarking on a major quality improvement program. During the

next three years, Banga intends to attack failure costs by increasing its appraisal and prevention

costs. The "right" prevention activities will be selected, and appraisal costs will be reduced

according the results achieved. For the year 2023, management is considering six specific

activities: quality training, process control, product inspection, supplier evaluation, prototype

testing, and re-design of two major products. To encourage managers to focus on reducing non-

value-added quality costs and select the right activities, a bonus pool is established relating to the

reduction of quality costs. The bonus pool is equal to 10 per cent of the total reduction in quality

costs.

Current quality costs and the costs of these six activities are provided in the table below. Each

activity is added sequentially so that its effect on the cost categories can be assessed. For

example, after quality training is added, the control costs increase to 320, 000, and the failure

costs drop to 1,040, 000. Even though the activities are presented sequentially, they are totally

independent of each other. Thus, only beneficial activities need to be selected.

1.

2

Current quality costs

Quality training

Process control

Product inspection

Supplier evaluation

Prototype testing

Engineering re-design

b.

Control Costs

160, 000

320, 000

520, 000

600,000

720,000

960, 000

1,000,000

Failure Costs

.Given the activities selected in (1), calculate the following

a. The reduction in quality costs

b.

1,440,000

1,040,000

720,000

656, 000

Identify the control activities that should be implemented, and calculate the total

quality costs associated with this selection. Assume that an activity is selected only if it

increases the bonus pool.

200,000

120,000

40,000

The percentage distribution for control and failure costs. How do you compare this with

the current scenario? What are your insights about this change?

c. The amount of bonus pool for 2023

3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically,

he argued that the bonus should be based only on reductions of failure and appraisal costs. In

this way, investment in prevention activities would be encouraged, and eventually, failure and

appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could

then be placed on the level of prevention costs.

a.

If this approach were adopted, what activities would be selected? How much

would be the bonus pool?

Do you agree or disagree with this approach. Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.