b. Who pays more of the tax incidence? O Consumers and producers split the tax. O Producers, because the price elasticity of supply exceeds the price elasticity of demand. O Consumers, because the price elasticity of supply exceeds the price elasticity of demand. O Consumers, because the price elasticity of supply is less than the price elasticity of demand.

b. Who pays more of the tax incidence? O Consumers and producers split the tax. O Producers, because the price elasticity of supply exceeds the price elasticity of demand. O Consumers, because the price elasticity of supply exceeds the price elasticity of demand. O Consumers, because the price elasticity of supply is less than the price elasticity of demand.

Chapter4: Supply And Demand: An Initial Look

Section: Chapter Questions

Problem 8TY

Related questions

Question

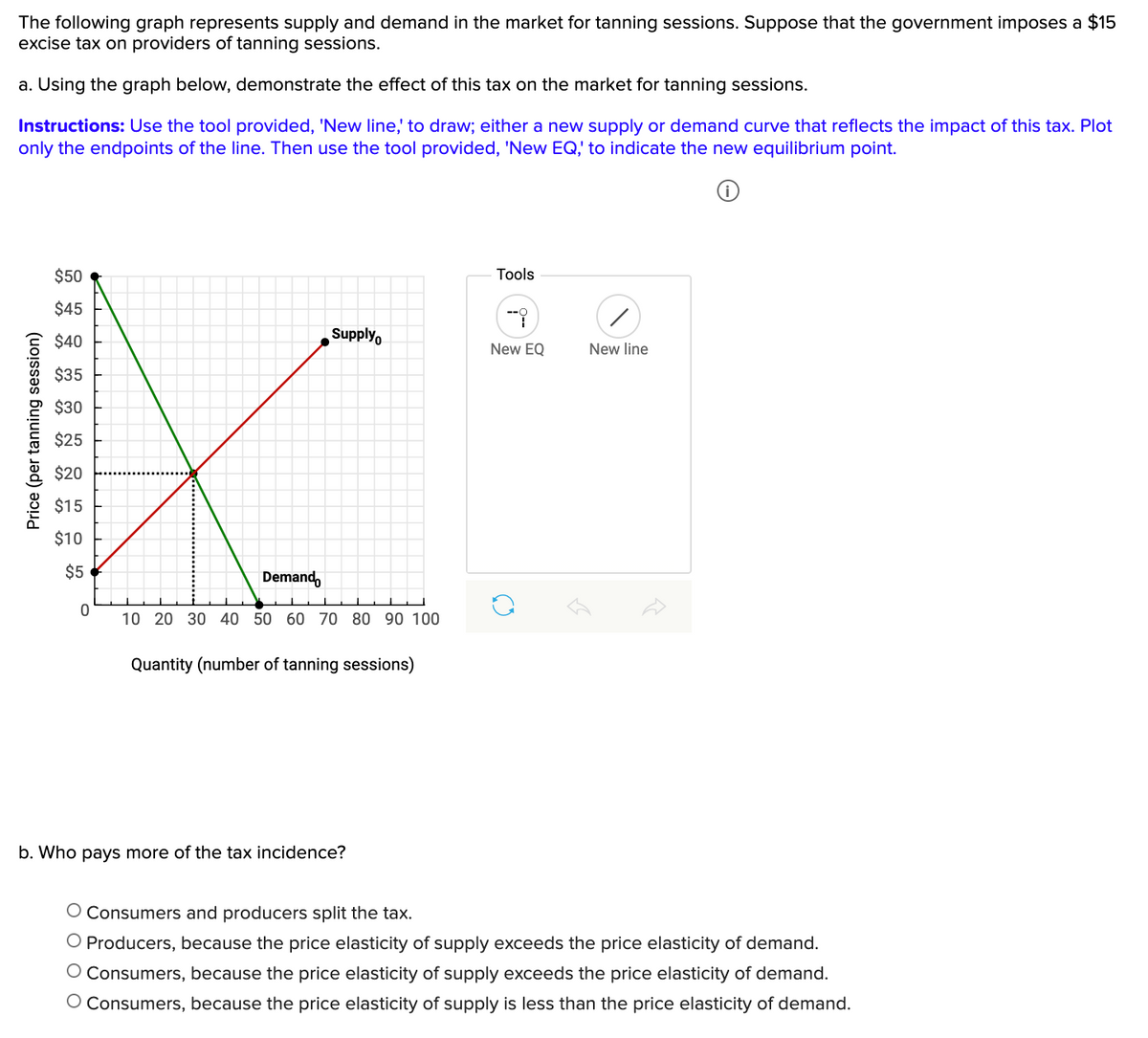

Transcribed Image Text:The following graph represents supply and demand in the market for tanning sessions. Suppose that the government imposes a $15

excise tax on providers of tanning sessions.

a. Using the graph below, demonstrate the effect of this tax on the market for tanning sessions.

Instructions: Use the tool provided, 'New line,' to draw; either a new supply or demand curve that reflects the impact of this tax. Plot

only the endpoints of the line. Then use the tool provided, 'New EQ,' to indicate the new equilibrium point.

$50

Tools

$45

$40

Supply,

New EQ

New line

$35

$30

$25

$20

$15

$10

$5

Demand,

10 20 30 40 50 60 70 80 90 100

Quantity (number of tanning sessions)

b. Who pays more of the tax incidence?

O Consumers and producers split the tax.

O Producers, because the price elasticity of supply exceeds the price elasticity of demand.

O Consumers, because the price elasticity of supply exceeds the price elasticity of demand.

O Consumers, because the price elasticity of supply is less than the price elasticity of demand.

Price (per tanning session)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning