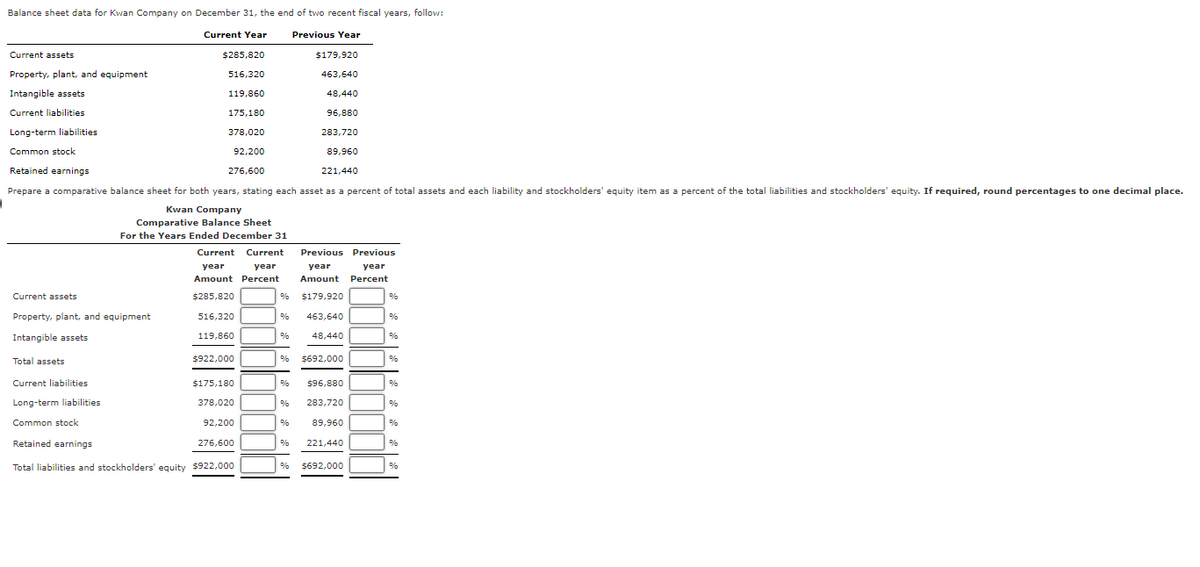

Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow: Current Year Previous Year Current assets $285,820 $179,920 Property. plant, and equipment 516.320 462,640 Intangible assets 119.860 48,440 Current liabilities 175.180 96,880 Long-term liabilities 378.020 283,720 Common stock 92.200 89.960 Retained earnings 276.600 221,440 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Kwan Company Comparative Balance Sheet For the Years Ended December 31 Current Current Previous Previous year year year year Amount Percent Amount Percent Current assets $285,820 % $179,920 Property, plant, and equipment 516,320 463,640 Intangible assets 119,860 48.440 Total assets $922.000 % $692.000 Current liabilities $175,180 $96.880 Long-term liabilities 378,020 283,720 Common stock 92,200 89,960 Retained earnings 276,600 221,440 Total liabilities and stockholders' equity $922,000 $692.000

Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow: Current Year Previous Year Current assets $285,820 $179,920 Property. plant, and equipment 516.320 462,640 Intangible assets 119.860 48,440 Current liabilities 175.180 96,880 Long-term liabilities 378.020 283,720 Common stock 92.200 89.960 Retained earnings 276.600 221,440 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Kwan Company Comparative Balance Sheet For the Years Ended December 31 Current Current Previous Previous year year year year Amount Percent Amount Percent Current assets $285,820 % $179,920 Property, plant, and equipment 516,320 463,640 Intangible assets 119,860 48.440 Total assets $922.000 % $692.000 Current liabilities $175,180 $96.880 Long-term liabilities 378,020 283,720 Common stock 92,200 89,960 Retained earnings 276,600 221,440 Total liabilities and stockholders' equity $922,000 $692.000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

100%

Transcribed Image Text:Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow:

Current Year

Previous Year

Current assets

$285,820

$179,920

Property, plant, and equipment

516,320

463,640

Intangible assets

119,860

48,440

Current liabilities

175,180

96,880

Long-term liabilities

378,020

283,720

Common stock

92,200

89,960

Retained earnings

276,600

221,440

Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place.

Kwan Company

Comparative Balance Sheet

For the Years Ended December 31

Current

Current

Previous Previous

year

year

year

year

Amount Percent

Amount

Percent

Current assets

$285,820

$179,920

Property, plant, and equipment

516,320

%

463,640

%

Intangible assets

119,860

48,440

Total assets

$922,000

$692,000

Current liabilities

$175,180

%

$96,880

%

Long-term liabilities

378,020

%

283,720

%

Common stock

92,200

89,960

%

Retained earnings

276,600

%

221,440

Total liabilities and stockholders' equity $922,000

$692,000

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning