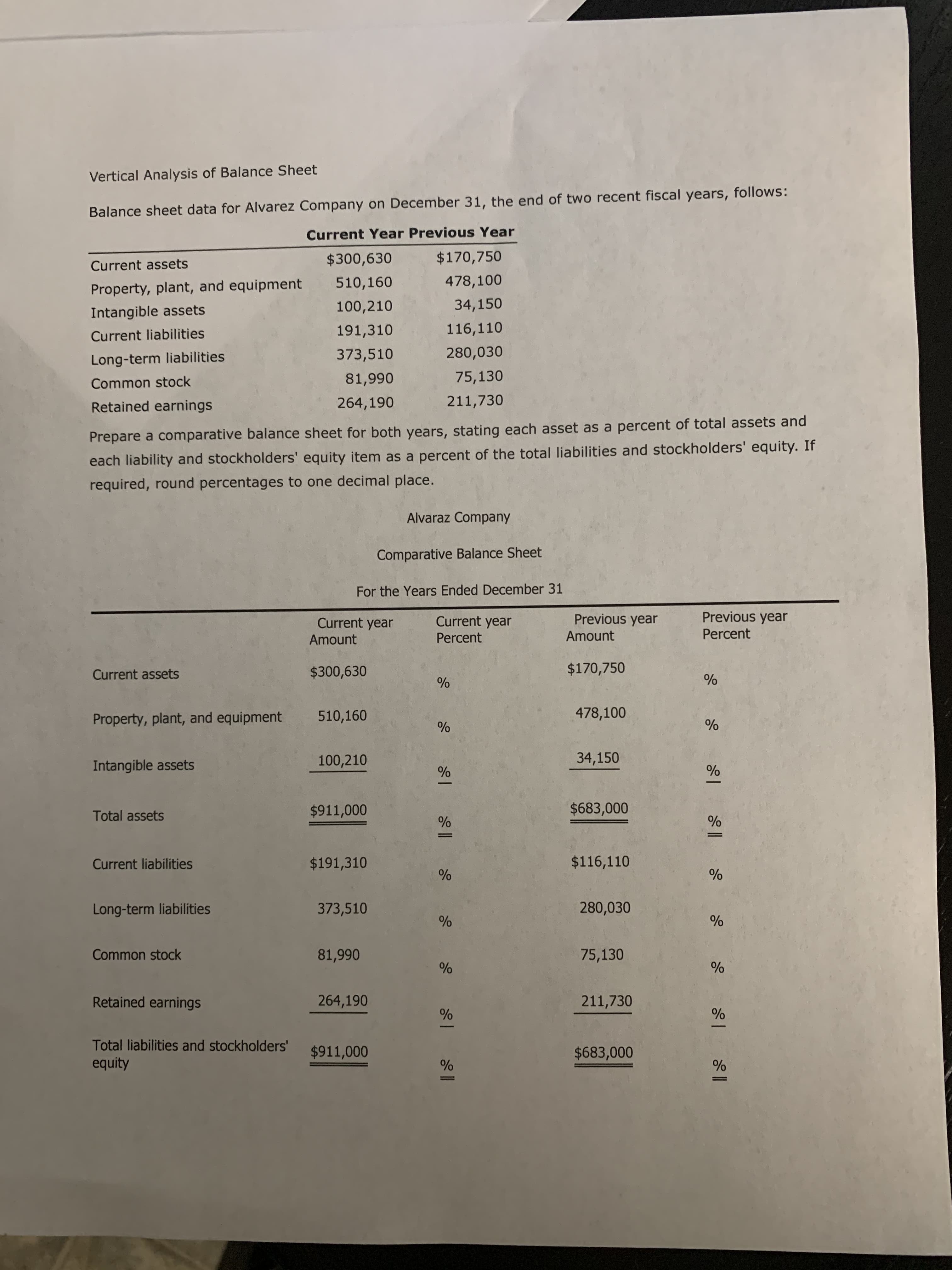

Vertical Analysis of Balance Sheet Balance sheet data for Alvarez Company on December 31, the end of two recent fiscal years, follows: Current Year Previous Year $300,630 $170,750 Current assets 510,160 478,100 Property, plant, and equipment 100,210 34,150 Intangible assets 191,310 116,110 Current liabilities 373,510 280,030 Long-term liabilities Common stock 81,990 75,130 Retained earnings 264,190 211,730 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Alvaraz Company Comparative Balance Sheet For the Years Ended December 31 Previous year Previous year Current year Percent Current year Amount Amount Percent Current assets $300,630 $170,750 Property, plant, and equipment 510,160 478,100 100,210 34,150 Intangible assets Total assets $911,000 $683,000 Current liabilities $191,310 $116,110 Long-term liabilities 373,510 280,030 Common stock 81,990 75,130 Retained earnings 264,190 211,730 Total liabilities and stockholders' $911,000 $683,000 equity 96

Vertical Analysis of Balance Sheet Balance sheet data for Alvarez Company on December 31, the end of two recent fiscal years, follows: Current Year Previous Year $300,630 $170,750 Current assets 510,160 478,100 Property, plant, and equipment 100,210 34,150 Intangible assets 191,310 116,110 Current liabilities 373,510 280,030 Long-term liabilities Common stock 81,990 75,130 Retained earnings 264,190 211,730 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Alvaraz Company Comparative Balance Sheet For the Years Ended December 31 Previous year Previous year Current year Percent Current year Amount Amount Percent Current assets $300,630 $170,750 Property, plant, and equipment 510,160 478,100 100,210 34,150 Intangible assets Total assets $911,000 $683,000 Current liabilities $191,310 $116,110 Long-term liabilities 373,510 280,030 Common stock 81,990 75,130 Retained earnings 264,190 211,730 Total liabilities and stockholders' $911,000 $683,000 equity 96

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

100%

Transcribed Image Text:Vertical Analysis of Balance Sheet

Balance sheet data for Alvarez Company on December 31, the end of two recent fiscal years, follows:

Current Year Previous Year

$300,630

$170,750

Current assets

510,160

478,100

Property, plant, and equipment

100,210

34,150

Intangible assets

191,310

116,110

Current liabilities

373,510

280,030

Long-term liabilities

Common stock

81,990

75,130

Retained earnings

264,190

211,730

Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and

each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If

required, round percentages to one decimal place.

Alvaraz Company

Comparative Balance Sheet

For the Years Ended December 31

Previous year

Previous year

Current year

Percent

Current year

Amount

Amount

Percent

Current assets

$300,630

$170,750

Property, plant, and equipment

510,160

478,100

100,210

34,150

Intangible assets

Total assets

$911,000

$683,000

Current liabilities

$191,310

$116,110

Long-term liabilities

373,510

280,030

Common stock

81,990

75,130

Retained earnings

264,190

211,730

Total liabilities and stockholders'

$911,000

$683,000

equity

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT