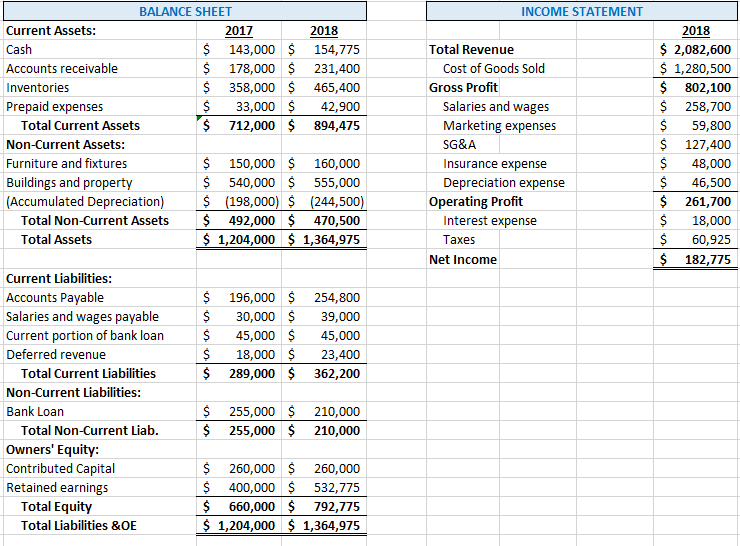

BALANCE SHEET INCOME STATEMENT Current Assets: 2017 2018 2018 Cash $ 143,000 $ 154,775 $ 178,000 $ 231,400 $ 358,000 $ 465,400 $ 33,000 $ $ 2,082,600 $ 1,280,500 $ 802,100 $ 258,700 $ Total Revenue Accounts receivable Cost of Goods Sold Inventories Prepaid expenses Gross Profit 42,900 $ 712,000 $ 894,475 Salaries and wages Marketing expenses Total Current Assets 59,800 $ 127,400 $ 24 Non-Current Assets: SG&A Furniture and fixtures Buildings and property Accumulated Depreciation) $ 150,000 $ 160,000 $ 540,000 $ 555,000 $ (198,000) $ (244,500) $ 492,000 $ 470,500 $ 1,204,000 $ 1,364,975 48,000 Insurance expense Depreciation expense Operating Profit Interest expense 46,500 $ 261,700 Total Non-Current Assets 18,000 Total Assets Тахes $ 60,925 $ 182,775 Net Income Current Liabilities: Accounts Payable $ 196,000 $ 254,800 $ Salaries and wages payable Current portion of bank loan 30,000 $ 39,000 45,000 $ 18,000 $ $ 289,000 $ 362,200 $ 45,000 Deferred revenue 23,400 Total Current Liabilities Non-Current Liabilities: $ 255,000 $ 210,000 $ 255,000 $ 210,000 Bank Loan Total Non-Current Liab. Dwners' Equity: Contributed Capital Retained earnings Total Equity $ 260,000 $ 260,000 $ 400,000 $ 532,775 $ 660,000 $ 792,775 $ 1,204,000 $ 1,364,975 Total Liabilities &OE

BALANCE SHEET INCOME STATEMENT Current Assets: 2017 2018 2018 Cash $ 143,000 $ 154,775 $ 178,000 $ 231,400 $ 358,000 $ 465,400 $ 33,000 $ $ 2,082,600 $ 1,280,500 $ 802,100 $ 258,700 $ Total Revenue Accounts receivable Cost of Goods Sold Inventories Prepaid expenses Gross Profit 42,900 $ 712,000 $ 894,475 Salaries and wages Marketing expenses Total Current Assets 59,800 $ 127,400 $ 24 Non-Current Assets: SG&A Furniture and fixtures Buildings and property Accumulated Depreciation) $ 150,000 $ 160,000 $ 540,000 $ 555,000 $ (198,000) $ (244,500) $ 492,000 $ 470,500 $ 1,204,000 $ 1,364,975 48,000 Insurance expense Depreciation expense Operating Profit Interest expense 46,500 $ 261,700 Total Non-Current Assets 18,000 Total Assets Тахes $ 60,925 $ 182,775 Net Income Current Liabilities: Accounts Payable $ 196,000 $ 254,800 $ Salaries and wages payable Current portion of bank loan 30,000 $ 39,000 45,000 $ 18,000 $ $ 289,000 $ 362,200 $ 45,000 Deferred revenue 23,400 Total Current Liabilities Non-Current Liabilities: $ 255,000 $ 210,000 $ 255,000 $ 210,000 Bank Loan Total Non-Current Liab. Dwners' Equity: Contributed Capital Retained earnings Total Equity $ 260,000 $ 260,000 $ 400,000 $ 532,775 $ 660,000 $ 792,775 $ 1,204,000 $ 1,364,975 Total Liabilities &OE

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Calculate Comfy Home’s

Transcribed Image Text:BALANCE SHEET

INCOME STATEMENT

Current Assets:

2017

2018

2018

$ 2,082,600

$ 1,280,500

$ 802,100

$ 258,700

$

$ 127,400

$

$

$

143,000 $

$

Cash

154,775

Total Revenue

178,000 $

358,000 $ 465,400

$

Accounts receivable

231,400

Cost of Goods Sold

Inventories

Gross Profit

Prepaid expenses

33,000 $

42,900

Salaries and wages

Total Current Assets

$ 712,000 $ 894,475

Marketing expenses

59,800

Non-Current Assets:

SG&A

150,000 $ 160,000

540,000 $ 555,000

$ (198,000) $ (244,500)

$ 492,000 $ 470,500

$ 1,204,000 $ 1,364,975

Furniture and fixtures

Insurance expense

48,000

Buildings and property

|(Accumulated Depreciation)

Depreciation expense

46,500

Operating Profit

Interest expense

$ 261,700

$

Total Non-Current Assets

18,000

Total Assets

Таxes

60,925

Net Income

$ 182,775

Current Liabilities:

Accounts Payable

Salaries and wages payable

$

196,000 $

$

254,800

30,000 $

45,000 $

$

39,000

Current portion of bank loan

45,000

18,000 $

$ 289,000 $ 362,200

Deferred revenue

23,400

Total Current Liabilities

Non-Current Liabilities:

255,000 $ 210,000

$ 255,000 $ 210,000

Bank Loan

$

Total Non-Current Liab.

Owners' Equity:

Contributed Capital

Retained earnings

Total Equity

$ 260,000 $ 260,000

$ 400,000 $

$ 660,000 $ 792,775

$ 1,204,000 $ 1,364,975

532,775

Total Liabilities &OE

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning