Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March) Costs during April Direct materials used Direct labor used Overhead applied Status on April 30 Job 306 $ 29,000 20,000 10,000 135,000 85,000 ? Finished (sold) Job 307 $ 35,000 18,000 9,000 220,000 150,000 ? Finished (unsold) d. Predetermined overhead rate is 50% of direct labor cost. e. Job 306 is sold for $635,000 cash in April. Job 308 Additional Information a. Raw Materials Inventory has a March 31 balance of $80,000. b. Raw materials purchases in April are $500,000, and total factory payroll cost in April is $363,000. $ 100,000 105,000 ? In process c. Actual overhead costs incurred in April are indirect materials, $50,000; indirect labor, $23,000; factory rent, $32,000 factory utilities, $19,000; and factory equipment depreciation, $51,000. e. Indirect labor used (and paid in cash) and assigned to Factory Overhead. f. Overhead costs applied to Work in Process Inventory. a. Materials purchases (on credit). b. Direct materials used. c. Direct labor used (and paid in cash) and assigned to Work in Process Inventory. d. Indirect materials used and assigned to Factory Overhead. g. Actual other overhead costs incurred (Factory rent and utilities are paid in cash.) h. Transfer of Jobs 306 and 307 to Finished Goods Inventory. i. Cost of goods sold for Job 306. j. Revenue from the sale of Job 306 received in cash. k. Close underapplied or overapplied overhead to the Cost of Goods Sold account.

Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March) Costs during April Direct materials used Direct labor used Overhead applied Status on April 30 Job 306 $ 29,000 20,000 10,000 135,000 85,000 ? Finished (sold) Job 307 $ 35,000 18,000 9,000 220,000 150,000 ? Finished (unsold) d. Predetermined overhead rate is 50% of direct labor cost. e. Job 306 is sold for $635,000 cash in April. Job 308 Additional Information a. Raw Materials Inventory has a March 31 balance of $80,000. b. Raw materials purchases in April are $500,000, and total factory payroll cost in April is $363,000. $ 100,000 105,000 ? In process c. Actual overhead costs incurred in April are indirect materials, $50,000; indirect labor, $23,000; factory rent, $32,000 factory utilities, $19,000; and factory equipment depreciation, $51,000. e. Indirect labor used (and paid in cash) and assigned to Factory Overhead. f. Overhead costs applied to Work in Process Inventory. a. Materials purchases (on credit). b. Direct materials used. c. Direct labor used (and paid in cash) and assigned to Work in Process Inventory. d. Indirect materials used and assigned to Factory Overhead. g. Actual other overhead costs incurred (Factory rent and utilities are paid in cash.) h. Transfer of Jobs 306 and 307 to Finished Goods Inventory. i. Cost of goods sold for Job 306. j. Revenue from the sale of Job 306 received in cash. k. Close underapplied or overapplied overhead to the Cost of Goods Sold account.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 9SPA: JOB ORDER COSTING TRANSACTIONS Stonestreet Enterprises makes garage doors. During the month of...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

100%

please help with d,e,f,g

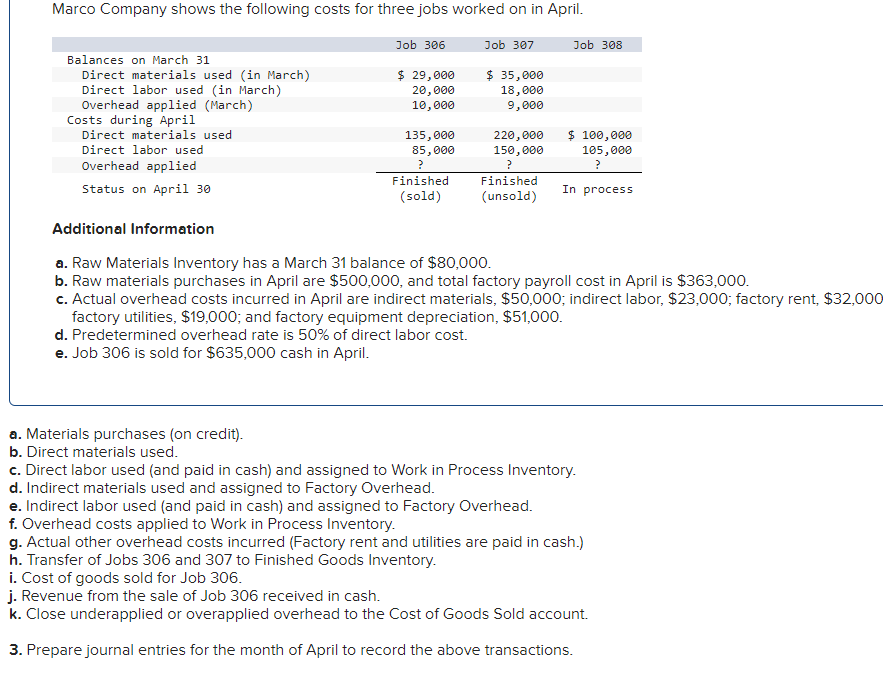

Transcribed Image Text:Marco Company shows the following costs for three jobs worked on in April.

Job 306

Job 307

$ 35,000

$ 29,000

20,000

10,000

18,000

9,000

Balances on March 31

Direct materials used (in March)

Direct labor used (in March)

Overhead applied (March)

Costs during April

Direct materials used

Direct labor used

Overhead applied

Status on April 30

135,000

85,000

?

Finished

(sold)

a. Materials purchases (on credit).

b. Direct materials used.

220,000

150,000

?

Finished

(unsold)

Job 308

$ 100,000

105,000

?

In process

Additional Information

a. Raw Materials Inventory has a March 31 balance of $80,000.

b. Raw materials purchases in April are $500,000, and total factory payroll cost in April is $363,000.

c. Actual overhead costs incurred in April are indirect materials, $50,000; indirect labor, $23,000; factory rent, $32,000

factory utilities, $19,000; and factory equipment depreciation, $51,000.

d. Predetermined overhead rate is 50% of direct labor cost.

e. Job 306 is sold for $635,000 cash in April.

c. Direct labor used (and paid in cash) and assigned to Work in Process Inventory.

d. Indirect materials used and assigned to Factory Overhead.

e. Indirect labor used (and paid in cash) and assigned to Factory Overhead.

f. Overhead costs applied to Work in Process Inventory.

g. Actual other overhead costs incurred (Factory rent and utilities are paid in cash.)

h. Transfer of Jobs 306 and 307 to Finished Goods Inventory.

i. Cost of goods sold for Job 306.

j. Revenue from the sale of Job 306 received in cash.

k. Close underapplied or overapplied overhead to the Cost of Goods Sold account.

3. Prepare journal entries for the month of April to record the above transactions.

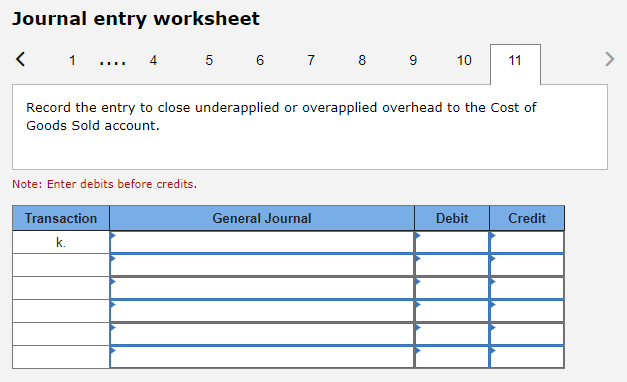

Transcribed Image Text:Journal entry worksheet

1 ... 4

Note: Enter debits before credits.

5

Transaction

k.

6 7 8 9 10

Record the entry to close underapplied or overapplied overhead to the Cost of

Goods Sold account.

General Journal

11

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College