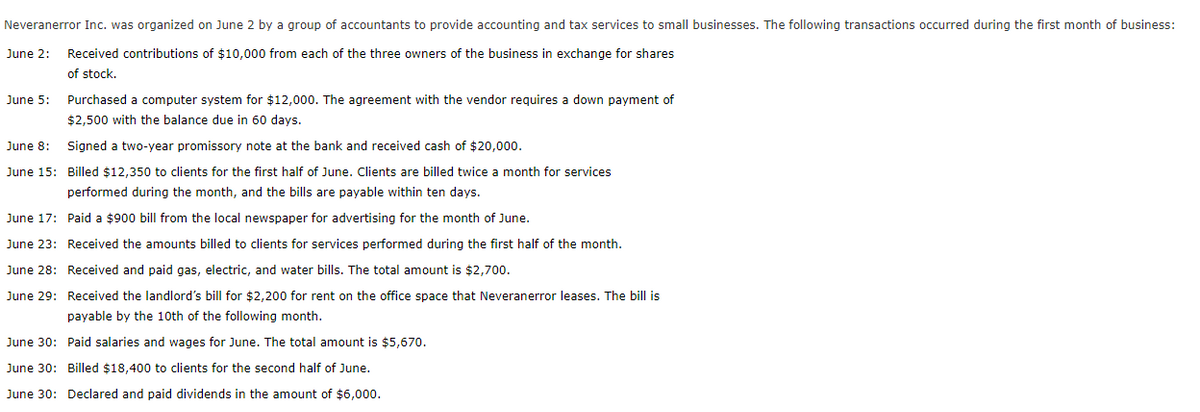

Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred during the first month of business: June 2: Received contributions of $10,000 from each of the three owners of the business in exchange for shares of stock. June 5: June 8: June 15: Purchased a computer system for $12,000. The agreement with the vendor requires a down payment of $2,500 with the balance due in 60 days. Signed a two-year promissory note at the bank and received cash of $20,000. Billed $12,350 to clients for the first half of June. Clients are billed twice a month for services performed during the month, and the bills are payable within ten days. June 17: Paid a $900 bill from the local newspaper for advertising for the month of June. June 23: June 28: June 29: Received the amounts billed to clients for services performed during the first half of the month. Received and paid gas, electric, and water bills. The total amount is $2,700. Received the landlord's bill for $2,200 for rent on the office space that Neveranerror leases. The bill is payable by the 10th of the following month. June 30: Paid salaries and wages for June. The total amount is $5,670. June 30: Billed $18,400 to clients for the second half of June. June 30: Declared and paid dividends in the amount of $6,000.

Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred during the first month of business: June 2: Received contributions of $10,000 from each of the three owners of the business in exchange for shares of stock. June 5: June 8: June 15: Purchased a computer system for $12,000. The agreement with the vendor requires a down payment of $2,500 with the balance due in 60 days. Signed a two-year promissory note at the bank and received cash of $20,000. Billed $12,350 to clients for the first half of June. Clients are billed twice a month for services performed during the month, and the bills are payable within ten days. June 17: Paid a $900 bill from the local newspaper for advertising for the month of June. June 23: June 28: June 29: Received the amounts billed to clients for services performed during the first half of the month. Received and paid gas, electric, and water bills. The total amount is $2,700. Received the landlord's bill for $2,200 for rent on the office space that Neveranerror leases. The bill is payable by the 10th of the following month. June 30: Paid salaries and wages for June. The total amount is $5,670. June 30: Billed $18,400 to clients for the second half of June. June 30: Declared and paid dividends in the amount of $6,000.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

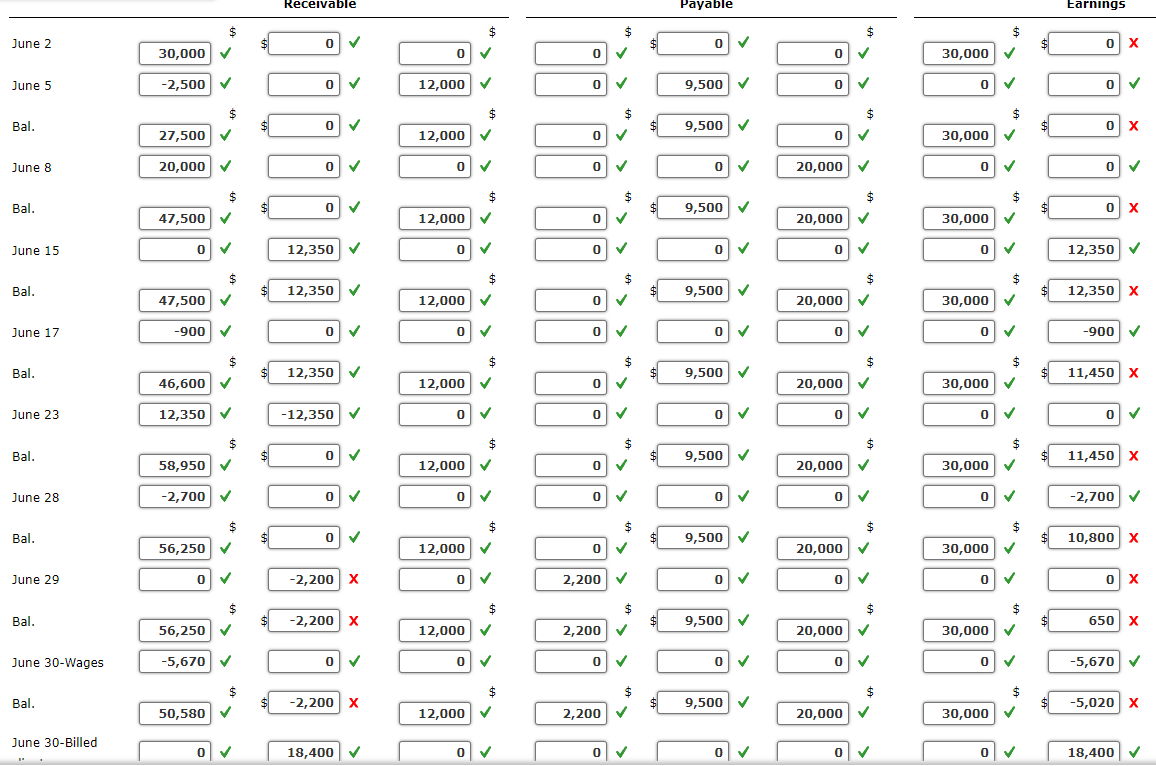

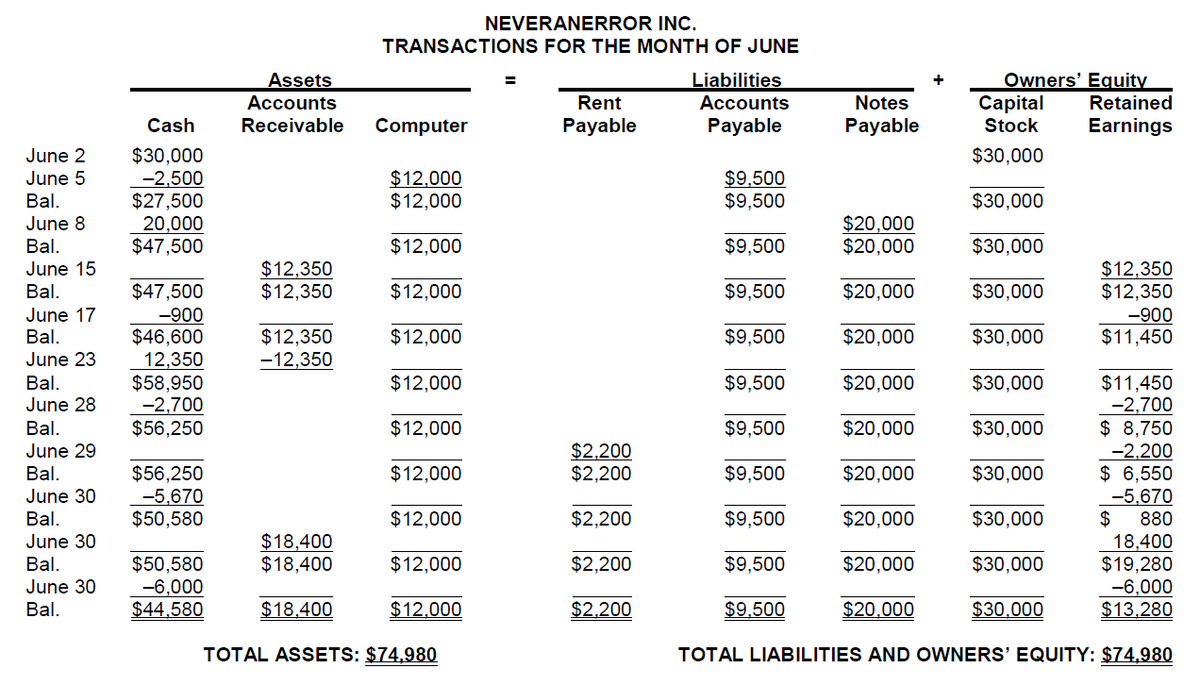

Last one, Can you see what I'm doing wrong and help me fill out this chart?

Transcribed Image Text:Neveranerror Inc. was organized on June 2 by a group of accountants to provide accounting and tax services to small businesses. The following transactions occurred during the first month of business:

June 2:

Received contributions of $10,000 from each of the three owners of the business in exchange for shares

of stock.

June 5:

June 8:

June 15:

June 17:

June 23:

June 28:

June 29:

Purchased a computer system for $12,000. The agreement with the vendor requires a down payment of

$2,500 with the balance due in 60 days.

Signed a two-year promissory note at the bank and received cash of $20,000.

Billed $12,350 to clients for the first half of June. Clients are billed twice a month for services

performed during the month, and the bills are payable within ten days.

Paid a $900 bill from the local newspaper for advertising for the month of June.

Received the amounts billed to clients for services performed during the first half of the month.

Received and paid gas, electric, and water bills. The total amount is $2,700.

Received the landlord's bill for $2,200 for rent on the office space that Neveranerror leases. The bill is

payable by the 10th of the following month.

June 30:

Paid salaries and wages for June. The total amount is $5,670.

June 30: Billed $18,400 to clients for the second half of June.

June 30: Declared and paid dividends in the amount of $6,000.

Transcribed Image Text:June 2

June 5

Bal.

June 8

Bal.

June 15

Bal.

June 17

Bal.

June 23

Bal.

June 28

Bal.

June 29

Bal.

June 30-Wages

Bal.

June 30-Billed

30,000 ✓

-2,500

27,500 ✓

20,000 ✓

47,500 ✓

0 ✓

47,500 ✓

-900 ✓

$

46,600 ✓

12,350 ✓

58,950

$

-2,700 ✔

56,250 ✓

圍

0 ✓

$

✓

56,250

-5,670 ✓

50,580 ✓

0 ✓

Receivable

0

0 ✓

0 ✓

0 ✓

0

12,350 ✓

12,350

0

✓

12,350 ✓

-12,350 ✓

0 ✓

0 ✓

0 ✓

-2,200 X

-2,200 X

0 ✓

-2,200 X

18,400 ✔

0 ✓

12,000 ✓

12,000

0

12,000

0

0

$

12,000 ✓

12,000

✓

✓

0 ✓

12,000

$

12,000 ✓

✓

0 ✓

12,000

0 ✓

12,000

$

✓

0 ✓

✓

0 ✓

0

0

0

0

0

0

0

0

0 ✓

✓

✓

0 ✓

0

✓

$

0 ✓

0

2,200 ✓

2,200 ✓

2,200 ✓

0 ✓

Payable

0

9,500

9,500

0

✓

9,500 ✔

✓

0 ✓

9,500 ✓

0 ✓

9,500 ✓

0 ✓

9,500 ✓

0 ✓

9,500 ✓

9,500

0 ✓

0

9,500 ✓

0 ✓

0

0

0

20,000 ✓

$

20,000 ✓

0

$

20,000 ✓

✓

0

$

20,000 ✓

0

20,000

0

20,000

0

0

20,000 ✓

20,000

✓

0

$

✓

✓

30,000

0

30,000

0

0

30,000 ✓

✓

0

$

30,000 ✓

30,000

✓

✓

30,000

✓

D

0 ✓

30,000

✓

$

0 ✓

0 ✓

30,000 ✓

✓

0

30,000 ✓

0 ✓

$

Earnings

0 X

0

0

0

12,350

>

X

0 X

>

12,350 X

0

-900 ✓

11,450 X

✓

11,450 X

-2,700 ✓

10,800 X

0 X

650 X

-5,670 ✔

-5,020 X

18,400 ✓

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education