Baldwin Products Company anticipates reaching a sales level of $5.1 million in one year. The company expects earnings after taxes during the next year to equal $430,000o. During the past several years, the company has been paying $50,000 in dividends to its stockholders. The company expects to continue this policy for at least the next year. The actual balance sheet and income statement for Baldwin during Year 1 follow. Baldwin Products Company Balance Sheet as of December 31, Year 1 Cash $ 240,000 Accounts payable $ 620,000 Accounts Receivable 440,000 Notes payable 32,000 Inventories 298,000 Long-term Debt 200,000 Fixed assets, net 1,152,000 Stockholders' equity 1,278,000 Total assets $2,130,000 Total liabilities and equity $2,130,000 Income Statement for the Year Ending December 31, Year 1 Sales $3,400,000 Expenses, including interest and taxes 3,200,000 Earnings after taxes 200,000 a. Using the percentage of sales method, calculate the additional financing Baldwin Products will need over the next year at the $5.10 million sales level. Show the pro forma balance sheet for the company as of December 31, Year 2, assuming that a sales level of $5.10 million is reached. Assume that the additional financing needed is obtained in the form of additional notes payable. Round your answers to the nearest dollar. Additional Financing Needed:

Baldwin Products Company anticipates reaching a sales level of $5.1 million in one year. The company expects earnings after taxes during the next year to equal $430,000o. During the past several years, the company has been paying $50,000 in dividends to its stockholders. The company expects to continue this policy for at least the next year. The actual balance sheet and income statement for Baldwin during Year 1 follow. Baldwin Products Company Balance Sheet as of December 31, Year 1 Cash $ 240,000 Accounts payable $ 620,000 Accounts Receivable 440,000 Notes payable 32,000 Inventories 298,000 Long-term Debt 200,000 Fixed assets, net 1,152,000 Stockholders' equity 1,278,000 Total assets $2,130,000 Total liabilities and equity $2,130,000 Income Statement for the Year Ending December 31, Year 1 Sales $3,400,000 Expenses, including interest and taxes 3,200,000 Earnings after taxes 200,000 a. Using the percentage of sales method, calculate the additional financing Baldwin Products will need over the next year at the $5.10 million sales level. Show the pro forma balance sheet for the company as of December 31, Year 2, assuming that a sales level of $5.10 million is reached. Assume that the additional financing needed is obtained in the form of additional notes payable. Round your answers to the nearest dollar. Additional Financing Needed:

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 7P

Related questions

Question

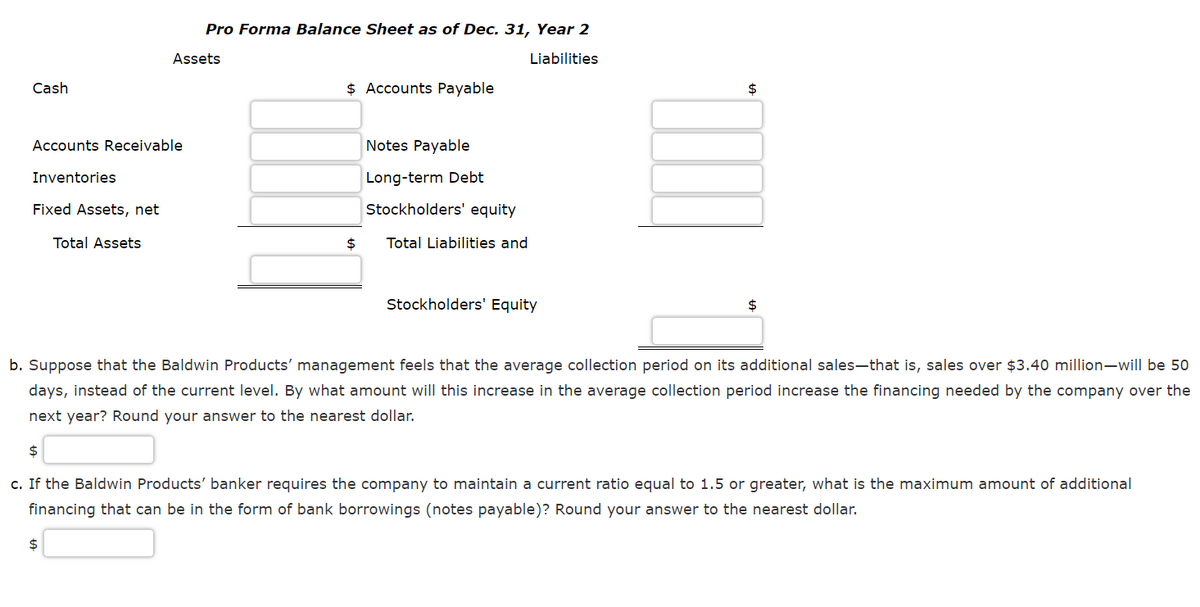

Transcribed Image Text:Pro Forma Balance Sheet as of Dec. 31, Year 2

Assets

Liabilities

Cash

$ Accounts Payable

2$

Accounts Receivable

Notes Payable

Inventories

Long-term Debt

Fixed Assets, net

Stockholders' equity

Total Assets

$

Total Liabilities and

Stockholders' Equity

2$

b. Suppose that the Baldwin Products' management feels that the average collection period on its additional sales-that is, sales over $3.40 million-will be 50

days, instead of the current level. By what amount will this increase in the average collection period increase the financing needed by the company over the

next year? Round your answer to the nearest dollar.

c. If the Baldwin Products' banker requires the company to maintain a current ratio equal to 1.5 or greater, what is the maximum amount of additional

financing that can be in the form of bank borrowings (notes payable)? Round your answer to the nearest dollar.

$

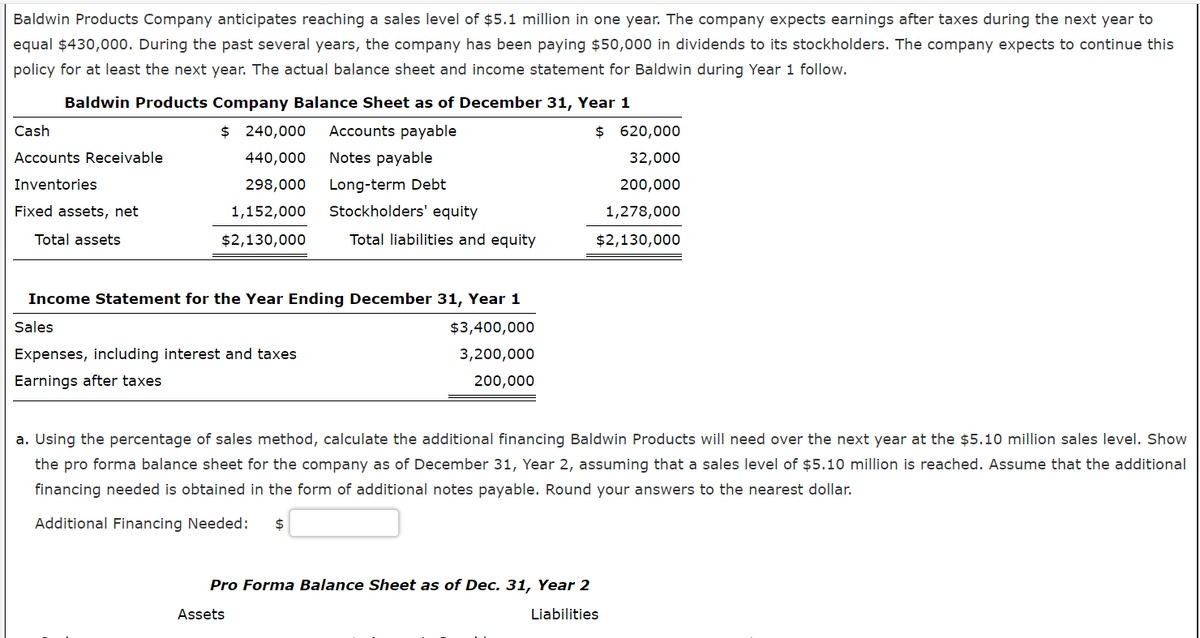

Transcribed Image Text:Baldwin Products Company anticipates reaching a sales level of $5.1 million in one year. The company expects earnings after taxes during the next year to

equal $430,000. During the past several years, the company has been paying $50,000 in dividends to its stockholders. The company expects to continue this

policy for at least the next year. The actual balance sheet and income statement for Baldwin during Year 1 follow.

Baldwin Products Company Balance Sheet as of December 31, Year 1

Cash

$ 240,000

Accounts payable

$ 620,000

Accounts Receivable

440,000

Notes payable

32,000

Inventories

298,000

Long-term Debt

200,000

Fixed assets, net

1,152,000

Stockholders' equity

1,278,000

Total assets

$2,130,000

Total liabilities and equity

$2,130,000

Income Statement for the Year Ending December 31, Year 1

Sales

$3,400,000

Expenses, including interest and taxes

3,200,000

Earnings after taxes

200,000

a. Using the percentage of sales method, calculate the additional financing Baldwin Products will need over the next year at the $5.10 million sales level. Show

the pro forma balance sheet for the company as of December 31, Year 2, assuming that a sales level of $5.10 million is reached. Assume that the additional

financing needed is obtained in the form of additional notes payable. Round your answers to the nearest dollar.

Additional Financing Needed:

$

Pro Forma Balance Sheet as of Dec. 31, Year 2

Assets

Liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning