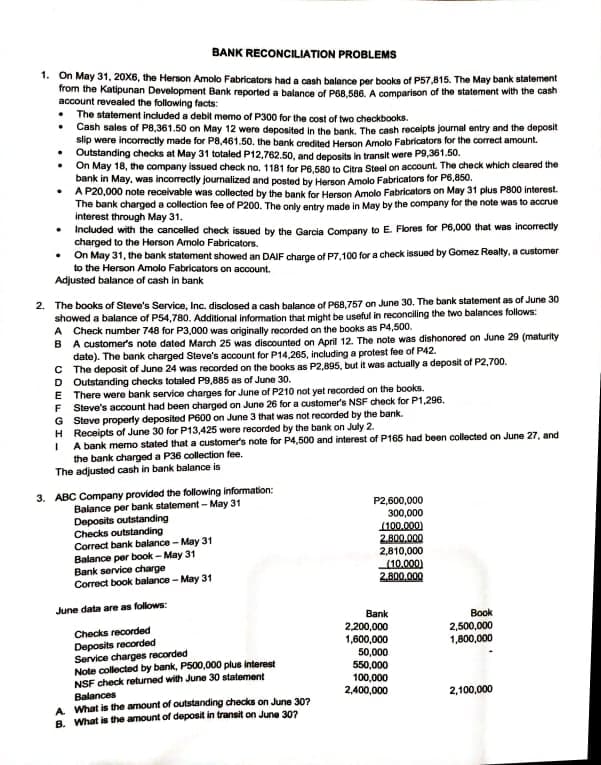

BANK RECONCILIATION PROBLEMS 1. On May 31, 20X6, the Herson Amolo Fabricators had a cash balance per books of P57,815. The May bank statement from the Katipunan Development Bank reported a balance of P68.586, A comparison of the statement with the cash account revealed the following facts: The statement included a debilt memo of P300 for the cost of two checkbooks. Cash sales of P8,361.50 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for P8,461.50. the bank credited Herson Amolo Fabricators for the correct amount. Outstanding checks at May 31 totaled P12,762.50, and deposits in transit were P9,361.50. On May 18, the company issued check no. 1181 for P6,580 to Citra Steel on account. The check which cleared the bank in May, was incorrectly journalized and posted by Herson Amolo Fabricators for P6,850. A P20,000 note receivable was collected by the bank for Herson Amolo Fabricators on May 31 plus P800 interest. The bank charged a collection fee of P200. The only entry made in May by the company for the note was to accrue interest through May 31. • Included with the cancelled check issued by the Garcia Company to E. Flores for P6,000 that was incorrectly charged to the Herson Amolo Fabricators. • On May 31, the bank statement showed an DAIF charge of P7,100 for a check issued by Gomez Realty, a customer to the Herson Amolo Fabricators on account. Adjusted balance of cash in bank

BANK RECONCILIATION PROBLEMS 1. On May 31, 20X6, the Herson Amolo Fabricators had a cash balance per books of P57,815. The May bank statement from the Katipunan Development Bank reported a balance of P68.586, A comparison of the statement with the cash account revealed the following facts: The statement included a debilt memo of P300 for the cost of two checkbooks. Cash sales of P8,361.50 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for P8,461.50. the bank credited Herson Amolo Fabricators for the correct amount. Outstanding checks at May 31 totaled P12,762.50, and deposits in transit were P9,361.50. On May 18, the company issued check no. 1181 for P6,580 to Citra Steel on account. The check which cleared the bank in May, was incorrectly journalized and posted by Herson Amolo Fabricators for P6,850. A P20,000 note receivable was collected by the bank for Herson Amolo Fabricators on May 31 plus P800 interest. The bank charged a collection fee of P200. The only entry made in May by the company for the note was to accrue interest through May 31. • Included with the cancelled check issued by the Garcia Company to E. Flores for P6,000 that was incorrectly charged to the Herson Amolo Fabricators. • On May 31, the bank statement showed an DAIF charge of P7,100 for a check issued by Gomez Realty, a customer to the Herson Amolo Fabricators on account. Adjusted balance of cash in bank

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:BANK RECONCILIATION PROBLEMS

1. On May 31, 20X6, the Herson Amolo Fabricators had a cash balance per books of P57,815. The May bank statement

from the Katipunan Development Bank reported a balance of P68.586. A comparison of the statement with the cash

account revealed the following facts:

• The statement included a debit memo of P300 for the cost of two checkbooks.

• Cash sales of P8,361.50 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit

slip were incorrectly made for P8,461.50. the bank credited Herson Amolo Fabricators for the correct amount.

Outstanding checks at May 31 totaled P12,762.50, and deposits in transit were P9,361.50.

On May 18, the company issued check no, 1181 for P6.580 to Citra Steel on account. The check which cleared the

bank in May, was incorrectly journalized and posted by Herson Amolo Fabricators for P6,850.

A P20,000 note receivable was collected by the bank for Herson Amolo Fabricators on May 31 plus P800 interest.

The bank charged a collection fee of P200. The only entry made in May by the company for the note was to accrue

interest through May 31.

Included with the cancelled check issued by the Garcia Company to E. Flores for P6,000 that was incorrectly

charged to the Herson Amolo Fabricators.

• On May 31, the bank statement showed an DAIF charge of P7,100 for a check issued by Gomez Realty, a customer

to the Herson Amolo Fabricators on account.

Adjusted balance of cash in bank

2. The books of Steve's Service, Inc. disclosed a cash balance of P68,757 on June 30. The bank statement as of June 30

showed a balance of P54,780. Additional information that might be useful in reconciling the two balances follows:

A Check number 748 for P3,000 was originally recorded on the books as P4,500.

B A customer's note dated March 25 was discounted on April 12. The note was dishonored on June 29 (maturity

date). The bank charged Steve's account for P14,265, including a protest fee of P42.

C The deposit of June 24 was recorded on the books as P2,895, but it was actually a deposit of P2,700.

D Outstanding checks totaled P9,885 as of June 30.

E There were bank service charges for June of P210 not yet recorded on the books.

Steve's account had been charged on June 26 for a customer's NSF check for P1,296.

G Steve property deposited P600 on June 3 that was not recorded by the bank.

H Receipts of June 30 for P13,425 were reorded by the bank on July 2.

A bank memo stated that a customer's note for P4,500 and interest of P165 had been collected on June 27, and

the bank charged a P36 collection fee.

The adjusted cash in bank balance is

3. ABC Company provided the following information:

Balance per bank statement - May 31

Deposits outstanding

Checks outstanding

Correct bank balance - May 31

Balance per book - May 31

Bank service charge

Correct book balance - May 31

P2,600,000

300,000

1100.000)

2.800,000

2,810,000

(10,000)

2.800.000

June data are as follows:

Bank

2,200,000

1,600,000

50,000

550,000

100,000

2,400,000

Book

2,500,000

1,800,000

Checks recorded

Deposits recorded

Service charges recorded

Note collected by bank, P500,000 plus interest

NSF check retumed with June 30 statement

Balances

A What is the amount of outstanding checks on June 30?

B. What is the amount of deposit in transit on June 307

2,100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning