Bank Reconciliation REQUIRED: A. Based on the application of the necessary procedures and appreciation of the above data, you are to provide the answers to the following: 1. How much is the unadjusted book receipts for August? 2. How much is the unadjusted book disbursements for August? 3. How much is the adjusted book receipts for August?

Bank Reconciliation REQUIRED: A. Based on the application of the necessary procedures and appreciation of the above data, you are to provide the answers to the following: 1. How much is the unadjusted book receipts for August? 2. How much is the unadjusted book disbursements for August? 3. How much is the adjusted book receipts for August?

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

Bank Reconciliation

REQUIRED:

A. Based on the application of the necessary procedures and appreciation of the above data, you

are to provide the answers to the following:

1. How much is the unadjusted book receipts for August?

2. How much is the unadjusted book disbursements for August?

3. How much is the adjusted book receipts for August?

4. How much is the adjusted book disbursements for August?

5. How much is the adjusted cash balance as of August 31, 2022?

B. Show the four column proof of cash as of August 31, 2022.

C. Show the correct bank reconciliation, in good form, on August 31, 2022.

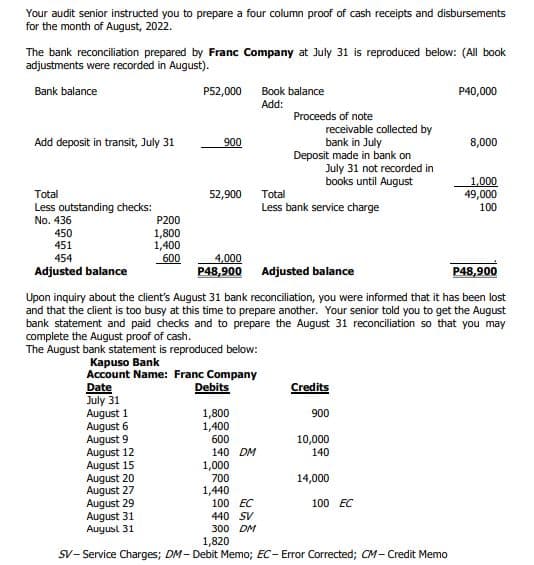

Transcribed Image Text:Your audit senior instructed you to prepare a four column proof of cash receipts and disbursements

for the month of August, 2022.

The bank reconciliation prepared by Franc Company at July 31 is reproduced below: (All book

adjustments were recorded in August).

Bank balance

Add deposit in transit, July 31

Total

Less outstanding checks:

No. 436

450

451

454

Adjusted balance

Date

July 31

August 1

August 6

August 9

P200

1,800

1,400

600

August 12

August 15

August 20

August 27

P52,000

August 29

August 31

August 31

900

52,900

Kapuso Bank

Account Name: Franc Company

Debits

1,800

1,400

600

140 DM

1,000

700

Book balance

Add:

1,440

Proceeds of note

4,000

P48,900 Adjusted balance

100 EC

440 SV

300 DM

receivable collected by

bank in July

P48,900

Upon inquiry about the client's August 31 bank reconciliation, you were informed that it has been lost

and that the client is too busy at this time to prepare another. Your senior told you to get the August

bank statement and paid checks and to prepare the August 31 reconciliation so that you may

complete the August proof of cash.

The August bank statement is reproduced below:

Deposit made in bank on

July 31 not recorded in

books until August

Total

Less bank service charge

Credits

900

10,000

140

14,000

100 EC

P40,000

1,820

SV-Service Charges; DM-Debit Memo; EC-Error Corrected; CM-Credit Memo

8,000

1,000

49,000

100

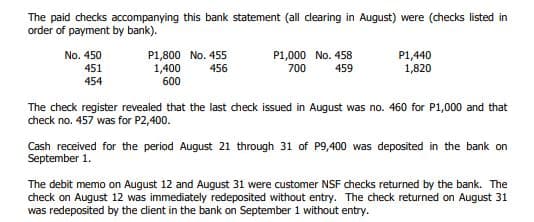

Transcribed Image Text:The paid checks accompanying this bank statement (all clearing in August) were (checks listed in

order of payment by bank).

No. 450

451

454

P1,800 No. 455

456

1,400

600

P1,000 No. 458

459

700

P1,440

1,820

The check register revealed that the last check issued in August was no. 460 for P1,000 and that

check no. 457 was for P2,400.

Cash received for the period August 21 through 31 of P9,400 was deposited in the bank on

September 1.

The debit memo on August 12 and August 31 were customer NSF checks returned by the bank. The

check on August 12 was immediately redeposited without entry. The check returned on August 31

was redeposited by the client in the bank on September 1 without entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning