bank

On 30 September 2022, Piston Limited had a balance in its ‘Cash in Bank’ general ledger account of $13,034.30 debit. The bank statement from ANZ bank on that date showed a credit balance of $19,495.00. A comparison of the September 2022 bank statement with the ‘Cash in Bank’ general ledger account and the bank reconciliation for August 2022 revealed the following facts (ignore GST):

Ref:

(1) Electronic Funds Transfers (EFTs), totalling $1,770.10, from the August 2022 bank reconciliation has still not been presented to the bank.

(2) Cash sales of $2,945 on 20 September 2022 were deposited in the bank. The general

(3) From the review of the September 2022 cash journals, it was established that outstanding EFTs totalled $3,567.10, and outstanding deposits were $1,190.40.

(4) On 24 September 2022 Piston Limited made a payment (EFT no. 3485) for $540.80 to J. Smith for an accounts payable payment. The EFT no. 3485, which showed up on the bank statement on 25 September 2022, was incorrectly recorded in the ‘Cash in Bank’ general ledger account as $450.80.

(5) A $3,000 note receivable was collected by the bank for Piston Limited on 15 September 2022, plus $80 interest. The bank charged a bank fee of $20 for this transaction. These items were not accounted for in the ‘Cash in Bank’ general ledger account.

(6) The bank statement showed that the bank returned a dishonoured

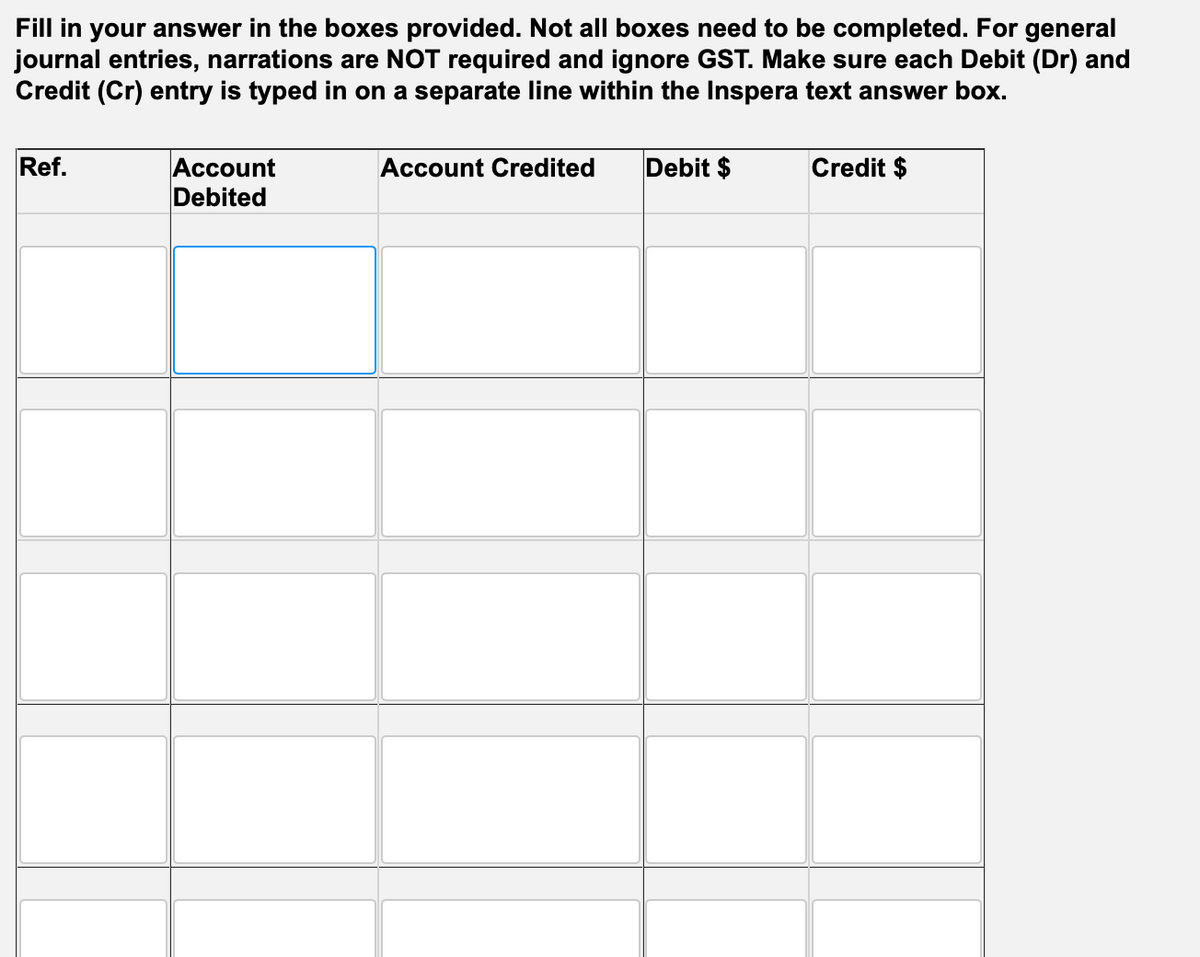

Prepare any

Step by step

Solved in 2 steps