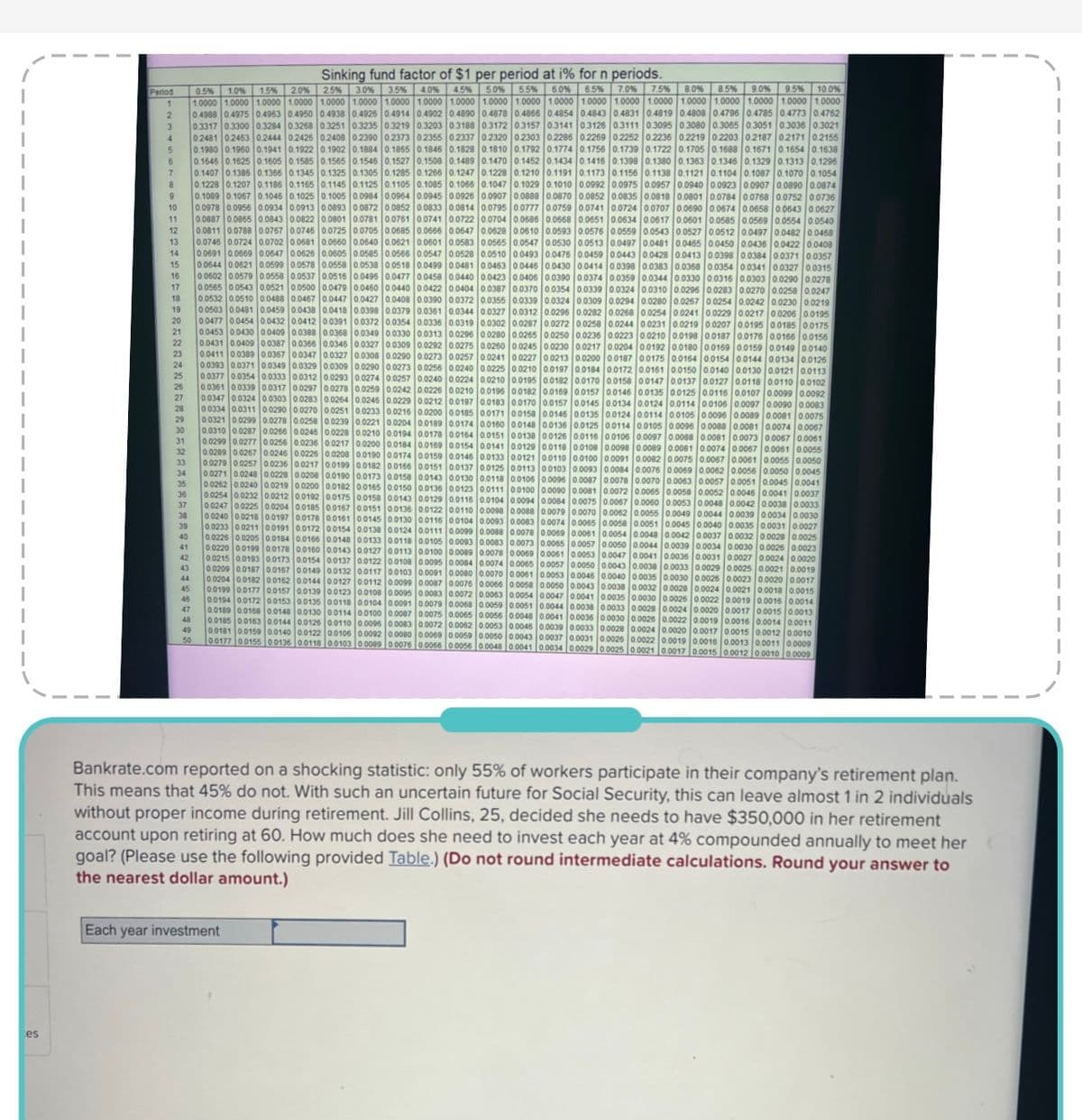

Bankrate.com reported on a shocking statistic: only 55% of workers participate in their company's retirement plan. This means that 45% do not. With such an uncertain future for Social Security, this can leave almost 1 in 2 individuals without proper income during retirement. Jill Collins, 25, decided she needs to have $350,000 in her retirement account upon retiring at 60. How much does she need to invest each year at 4% compounded annually to meet her goal? (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to the nearest dollar amount.)

Bankrate.com reported on a shocking statistic: only 55% of workers participate in their company's retirement plan. This means that 45% do not. With such an uncertain future for Social Security, this can leave almost 1 in 2 individuals without proper income during retirement. Jill Collins, 25, decided she needs to have $350,000 in her retirement account upon retiring at 60. How much does she need to invest each year at 4% compounded annually to meet her goal? (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to the nearest dollar amount.)

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:es

Period

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

43

44

45

45

47

48

49

7.5 %

Sinking fund factor of $1 per period at i% for n periods.

0.5% 1.0% 1.5% 20% 2.5% 3.0% 3.5% 4.0 % 4.5% 5.0% 55% 6.0% 6.5% 7.0 %

8.0 % 8.5 % 9.0 % 9.5 % 10.0%

1.0000 1.0000 10000 10000 10000 10000 10000 10000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

0.4988 0.4975 0.4963 0.4950 0.4938 0.4926 0.4914 0.4902 0.4890 0.4878 0.4866 0.4854 0.4843 0.4831 0.4819 0.4808 0.4796 0.4785 0.4773 0.4762

0.3317 0.3300 0.3284 0.3268 0.3251 0.3235 0.3219 0.3203 0.3188 0.3172 0.3157 0.3141 0.3126 0.3111 0.3095 0.3080 0.3065 0.3051 0.3036 0.3021

0.2481 0.2463 0.2444 0.2426 0.2408 0.2390 0.2373 0.2355 0.2337 0.2320 0.2303 0.2286 0.2269 0.2252 0.2236 0.2219 0.2203 0.2187 0.2171 0.2155

0.1980 0.1960 0.1941 0.1922 0.1902 0.1884 0.1865 0.1846 0.1828 0.1810 0.1792 0.1774 0.1756 0.1739 0.1722 0.1705 0.1688 0.1671 0.1654 0.1638

0.1646 0.1625 0.1605 0.1585 0.1565 0.1546 0.1527 0.1508 0.1489 0.1470 0.1452 0.1434 0.1416 0.1398 0.1380 0.1363 0.1346 0.1329 0.1313 0.1296

0.1407 0.1386 0.1366 0.1345 0.1325 0.1305 0.1285 0.1266 0.1247 0.1228 0.1210 0.1191 0.1173 0.1156 0.1138 0.1121 0.1104 0.1087 0.1070 0.1054

0.1228 0.1207 0.1186 0.1165 0.1145 0.1125 0.1105 0.1085 0.1066 0.1047 0.1029 0.1010 0.0992 0.0975 0.0957 0.0940 0.0923 0.0907 0.0890 0.0874

0.1089 0.1067 0.1046 0.1025 0.1005 0.0984 0.0964 0.0945 0.0926 0.0907 0.0888 0.0870 0.0852 0.0835 0.0818 0.0801 0.0784 0.0768 0.0752 0.0736

0.0978 0.0956 0.0934 0.0913 0.0893 0.0872 0.0852 0.0833 0.0814 0.0795 0.0777 0.0759 0.0741 0.0724 0.0707 0.0690 0.0674 0.0658 0.0643 0.0627

0.0887 0.0865 0.0843 0.0822 0.0801 0.0781 0.0761 0.0741 0.0722 0.0704 0.0686 0.0668 0.0651 0.0634 0.0617 0.0601 0.0585 0.0569 0.0554 0.0540

0.0811 0.0788 0.0767 0.0746 0.0725 0.0705 0.0685 0.0666 0.0647 0.0628 0.0610 0.0593 0.0576 0.0559 0.0543 0.0527 0.0512 0.0497 0.0482 0.0468

0.0745 0.0724 0.0702 0.0681 0.0660 0.0640 0.0621 0.0601 0.0583 0.0565 0.0547 0.0530 0.0513 0.0497 0.0481 0.0465 0.0450 0.0436 0.0422 0.0408

0.0691 0.0669 0.0647 0.0626 0.0605 0.0585 0.0566 0.0547 0.0528 0.0510 0.0493 0.0476 0.0459 0.0443 0.0428 0.0413 0.0398 0.0384 0.0371 0.0357

0.0644 0.0621 0.0599 0.0578 0.0558 0.0538 0.0518 0.0499 0.0481 0.0463 0.0446 0.0430 0.0414 0.0398 0.0383 0.0368 0.0354 0.0341 0.0327 0.0315

0.0602 0.0579 0.0558 0.0537 0.0516 0.0496 0.0477 0.0458 0.0440 0.0423 0.0406 0.0390 0.0374 0.0359 0.0344 0.0330 0.0316 0.0303 0.0290 0.0278

0.0565 0.0543 0.0521 0.0500 0.0479 0.0460 0.0440 0.0422 0.0404 0.0387 0.0370 0.0354 0.0339 0.0324 0.0310 0.0296 0.0283 0.0270 0.0258 0.0247

0.0532 0.0510 0.0488 0.0467 0.0447 0.0427 0.0408 0.0390 0.0372 0.0355 0.0339 0.0324 0.0309 0.0294 0.0280 0.0267 0.0254 0.0242 0.0230 0.0219

0.0503 0.0481 0.0459 0.0438 0.0418 0.0398 0.0379 0.0361 0.0344 0.0327 0.0312 0.0296 0.0282 0.0268 0.0254 0.0241 0.0229 0.0217 0.0206 0.0195

0.0477 0.0454 0.0432 0.0412 0.0391 0.0372 0.0354 0.0336 0.0319 0.0302 0.0287 0.0272 0.0258 0.0244 0.0231 0.0219 0.0207 0.0195 0.0185 0.0175

0.0453 0.0430 0.0409 0.0388 0.0368 0.0349 0.0330 0.0313 0.0296 0.0280 0.0265 0.0250 0.0236 0.0223 0.0210 0.0198 0.0187 0.0176 0.0166 0.0156

0.0431 0.0409 0.0387 0.0366 0.0346 0.0327 0.0309 0.0292 0.0275 0.0260 0.0245 0.0230 0.0217 0.0204 0.0192 0.0180 0.0169 0.0159 0.0149 0.0140

0.0411 0.0389 0.0367 0.0347 0.0327 0.0308 0.0290 0.0273 0.0257 0.0241 0.0227 0.0213 0.0200 0.0187 0.0175 0.0164 0.0154 0.0144 0.0134 0.0126

0.0393 0.0371 0.0349 0.0329 0.0309 0.0290 0.0273 0.0256 0.0240 0.0225 0.0210 0.0197 0.0184 0.0172 0.0161 0.0150 0.0140 0.0130 0.0121 0.0113

0.0377 0.0354 0.0333 0.0312 0.0293 0.0274 0.0257 0.0240 0.0224 0.0210 0.0195 0.0182 0.0170 0.0158 0.0147 0.0137 0.0127 0.0118 0.0110 0.0102

0.0361 0.0339 0.0317 0.0297 0.0278 0.0259 0.0242

0.0210 0.0196 0.0182 0.0169 0.0157 0.0146 0.0135 0.0125 0.0116 0.0107 0.0099 0.0092

0.0170 0.0157 0.0145 0.0134 0.0124

0.0158 0.0146 0.0135

0.0347 0.0324 0.0303 0.0283 0.0264 0.0246 0.0229

00334 0.0311 0.0290 0.0270 0.0251 0.0233 0.0216

0.0185

0.0321 0.0299 0.0278 0.0258

0.0310 0.0287 0.0266 0.0246 0.0226

0.0299 0.0277 0.0256 0.0236

0221 0.0204 0.0189 0.0174 0.0160 0.0148 0.0136 0.0125

0.0210 0.0194 0.0178 0.0164

0.0138 0.0126 0.0116

0.0200 0.0184 0.0169 0.0154 0.0141 0.0129 0.0118 0.0108

0.0190 0.0174

0.0182 0.0166

0.0289 0.0267 0.0246 0.0226

0.0110 0.0100

0.0279 0.0257 0.0236 0.0217 0.0199

0.0146 0.0133

0.0137 0.0125

0.0106 0.0097 0.0090 0.0083

0089 0.0081 0.0075

0.0088 0.0081 0.0074 0.0067

0.0081 0.0073 0.0067 0.0061

0.0074 0.0067 0.0061 0.0055

0.0067 0.0061 0.0055 0.0050

0.0062 0.0056 0.0050 0.0045

0.0063 0.0057 0.0051 0.0045 0.0041

0058 0.0052 0.0046 0.0041 0.0037

0053 0.0048 0.0042 0.0038 0.0033

0.0055 0.0049 0.0044 0.0039 0.0034 0.0030

0.0051 0.0045 0.0040 0.0035 0.0031 0.0027

0.0048 0.0042 0.0037 0.0032 0.0028 0.0025

0.0271 0.0248 0.0228 0.0208

0.0262 0.0240 0.0219 0.0200 0.0182

0.0254 0.0232 0.0212 0.0192 0.0175 0.0158 0.0143 0.0129

0.0050 0.0044 0.0039 0.0034 0.0030 0.0026 0.0023

0.0047 0.0041 0.0036 0.0031 0.0027 0.0024 0.0020

0.0043 0.0038 0.0033 0.0029 0.0025 0.0021 0.0019

0.0046 0.0040 0.0035 0.0030 0.0026 0.0023 0.0020 0.0017

0.0043 0.0038 0032 0.0028 0.0024 0.0021 0.0018 0.0015

0.0041 0.0035

0.0194 0.0172 0.0153 00135 0.0118 00104 0.0091 0.0079

0.0026 0.0022 0.0019 0.0016 0.0014

0.0038 0.0033 0.0028

0.0189 0.0168 0.0148 0.0130 0.0114 0.0100 0.0087 0.0075 0.0065 0.0056 0.0048

0.0024 0.0020 0.0017 0.0015 0.0013

0.0041 0.0036

0.0185 0.0163 0.0144 0.0126 0.0110 0.0096 0.0083

0026 0.0022 0.0019 0.0016 0.0014 0.0011

0.0062 0.0053 0.0046 0.0039 0.0033 0.0028 0.0024

0.0181 0.0159 0.0140 0.0122 0.0106 0.0092 0.0080 0.0069 0.0059 0.0050 0.0043 0.0037 0.0031 0.0026 0.0022 0.0019 0.0016 0.0013 0.0011 0.0009

0.0020 0.0017 0.0015 0.0012 0.0010

00177 00155 0.0136 00118 00103 0 0089 0 0076 00066 00056 0.0048 0.0041 0.0034 0.0029 00025 0.0021 0.0017 00015 0.0012 0.0010 0.0009

0173 0.0158 0.0143 00130

0.0165 0.0150 0.0136 0.0123

0.0247 0.0225 0.0204 0.0185 0.0167 0.0151 0.0136

0.0240 0.0218 0.0197 0.0178 0.0161 0.0145 0.0130

0.0233 0.0211 0.0191 0.0172 0.0154 0.0138

0.0226 0.0205 0.0184 0.0166 0.0148 0.0133 0.0118 0.010

0.0220 00199 0.0178 0.0160 0.0143 0.0127 0.0113

0.0215 0.0193 0.0173 0.0154 0.0137 0.0122 0.0108

0.0209 0.0187 0.0167 0.0149 0.0132 0.0117 0.0103 0.0091

0.0127 0.0112 0.0099 0.0087 0.0076

0.0123 0.0108 0.0095

0.0204 0.0182 0.0162 0.0144

0.0199 0.0177 0.0157 0.0139

Each year investment

0080 0.0070

0.0072 0.0063

0.0070

0.0065

0.0075 0.0067 0.0060

0090 0.0081

Bankrate.com reported on a shocking statistic: only 55% of workers participate in their company's retirement plan.

This means that 45% do not. With such an uncertain future for Social Security, this can leave almost 1 in 2 individuals

without proper income during retirement. Jill Collins, 25, decided she needs to have $350,000 in her retirement

account upon retiring at 60. How much does she need to invest each year at 4% compounded annually to meet her

goal? (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to

the nearest dollar amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education