for $11 per 10 gallons, and incurs $2 of variable costs per 10 gallons transported to the processing division doesn't incur any material fixed costs). The processing division could buy milk of the same high quality for the outside market. Jamal is trying to "whip his company into shape" by implementing a transfer pricing sys providing very strong incentives for the two divisions to work hard: The supplying division will get reimbursed of supplying the milk to the processing division; the processing division is charged the price that it would ha market.

for $11 per 10 gallons, and incurs $2 of variable costs per 10 gallons transported to the processing division doesn't incur any material fixed costs). The processing division could buy milk of the same high quality for the outside market. Jamal is trying to "whip his company into shape" by implementing a transfer pricing sys providing very strong incentives for the two divisions to work hard: The supplying division will get reimbursed of supplying the milk to the processing division; the processing division is charged the price that it would ha market.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

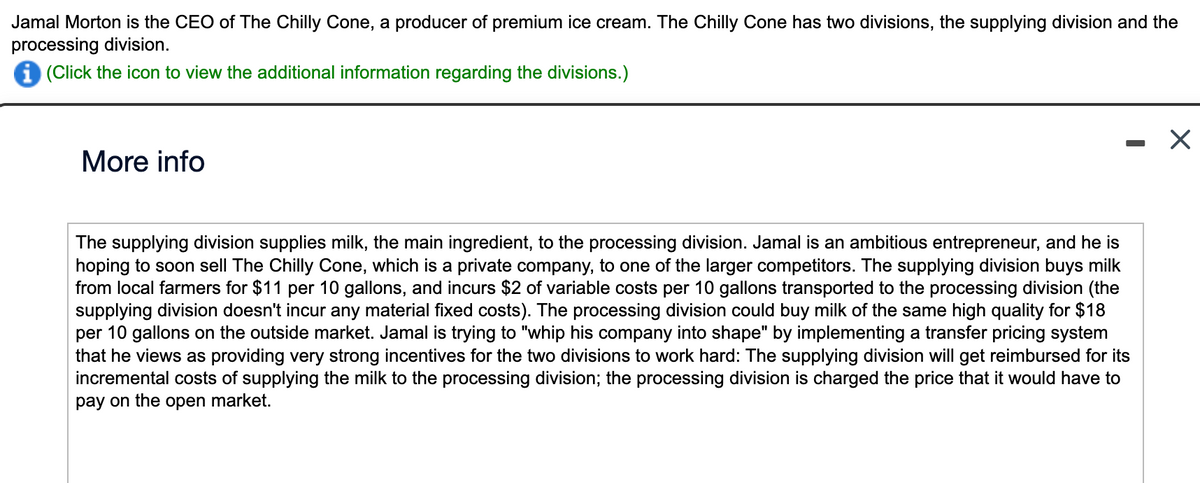

Transcribed Image Text:Jamal Morton is the CEO of The Chilly Cone, a producer of premium ice cream. The Chilly Cone has two divisions, the supplying division and the

processing division.

i (Click the icon to view the additional information regarding the divisions.)

More info

-

The supplying division supplies milk, the main ingredient, to the processing division. Jamal is an ambitious entrepreneur, and he is

hoping to soon sell The Chilly Cone, which is a private company, to one of the larger competitors. The supplying division buys milk

from local farmers for $11 per 10 gallons, and incurs $2 of variable costs per 10 gallons transported to the processing division (the

supplying division doesn't incur any material fixed costs). The processing division could buy milk of the same high quality for $18

per 10 gallons on the outside market. Jamal is trying to "whip his company into shape" by implementing a transfer pricing system

that he views as providing very strong incentives for the two divisions to work hard: The supplying division will get reimbursed for its

incremental costs of supplying the milk to the processing division; the processing division is charged the price that it would have to

pay on the open market.

X

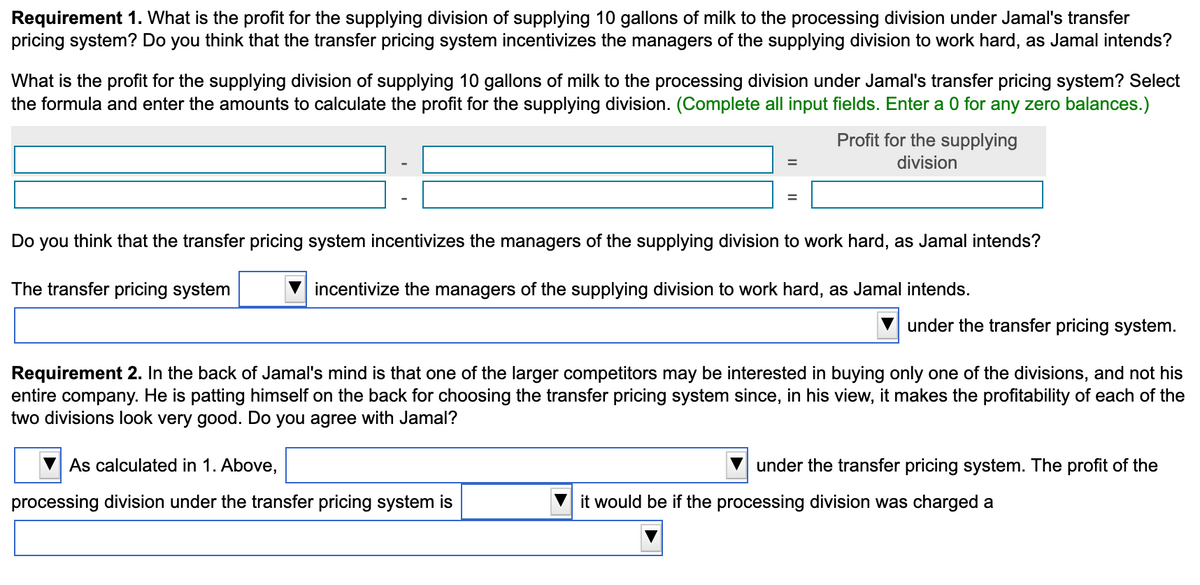

Transcribed Image Text:Requirement 1. What is the profit for the supplying division of supplying 10 gallons of milk to the processing division under Jamal's transfer

pricing system? Do you think that the transfer pricing system incentivizes the managers of the supplying division to work hard, as Jamal intends?

What is the profit for the supplying division of supplying 10 gallons of milk to the processing division under Jamal's transfer pricing system? Select

the formula and enter the amounts to calculate the profit for the supplying division. (Complete all input fields. Enter a 0 for any zero balances.)

Profit for the supplying

division

=

=

Do you think that the transfer pricing system incentivizes the managers of the supplying division to work hard, as Jamal intends?

The transfer pricing system

incentivize the managers of the supplying division to work hard, as Jamal intends.

As calculated in 1. Above,

processing division under the transfer pricing system is

under the transfer pricing system.

Requirement 2. In the back of Jamal's mind is that one of the larger competitors may be interested in buying only one of the divisions, and not his

entire company. He is patting himself on the back for choosing the transfer pricing system since, in his view, it makes the profitability of each of the

two divisions look very good. Do you agree with Jamal?

under the transfer pricing system. The profit of the

it would be if the processing division was charged a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning