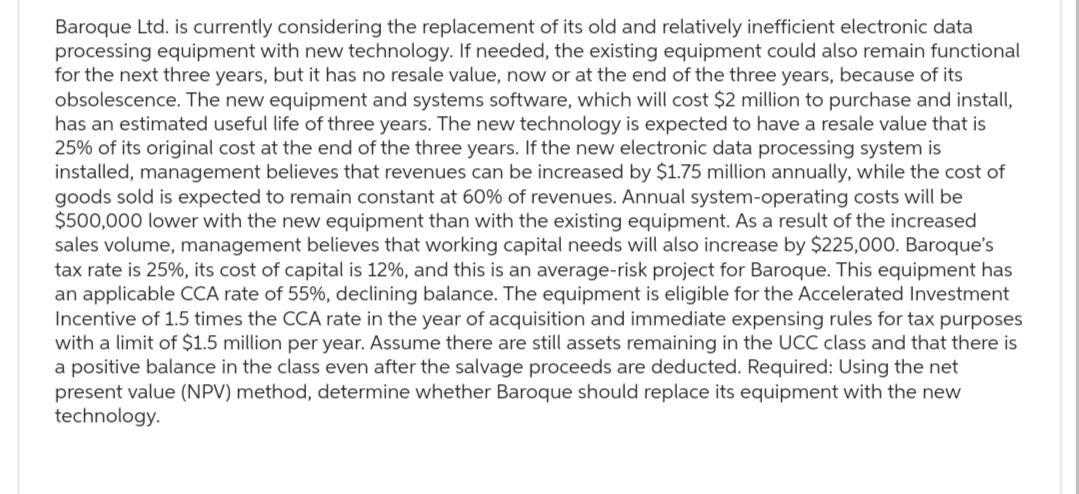

Baroque Ltd. is currently considering the replacement of its old and relatively inefficient electronic data processing equipment with new technology. If needed, the existing equipment could also remain function for the next three years, but it has no resale value, now or at the end of the three years, because of its obsolescence. The new equipment and systems software, which will cost $2 million to purchase and instal has an estimated useful life of three years. The new technology is expected to have a resale value that is 25% of its original cost at the end of the three years. If the new electronic data processing system is installed, management believes that revenues can be increased by $1.75 million annually, while the cost of goods sold is expected to remain constant at 60% of revenues. Annual system-operating costs will be $500,000 lower with the new equipment than with the existing equipment. As a result of the increased sales volume, management believes that working capital needs will also increase by $225,000. Baroque's tax rate is 25%, its cost of capital is 12%, and this is an average-risk project for Baroque. This equipment ha an applicable CCA rate of 55%, declining balance. The equipment is eligible for the Accelerated Investment

Baroque Ltd. is currently considering the replacement of its old and relatively inefficient electronic data processing equipment with new technology. If needed, the existing equipment could also remain function for the next three years, but it has no resale value, now or at the end of the three years, because of its obsolescence. The new equipment and systems software, which will cost $2 million to purchase and instal has an estimated useful life of three years. The new technology is expected to have a resale value that is 25% of its original cost at the end of the three years. If the new electronic data processing system is installed, management believes that revenues can be increased by $1.75 million annually, while the cost of goods sold is expected to remain constant at 60% of revenues. Annual system-operating costs will be $500,000 lower with the new equipment than with the existing equipment. As a result of the increased sales volume, management believes that working capital needs will also increase by $225,000. Baroque's tax rate is 25%, its cost of capital is 12%, and this is an average-risk project for Baroque. This equipment ha an applicable CCA rate of 55%, declining balance. The equipment is eligible for the Accelerated Investment

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 51P: Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new...

Related questions

Question

Please Do not Give image format

Transcribed Image Text:Baroque Ltd. is currently considering the replacement of its old and relatively inefficient electronic data

processing equipment with new technology. If needed, the existing equipment could also remain functional

for the next three years, but it has no resale value, now or at the end of the three years, because of its

obsolescence. The new equipment and systems software, which will cost $2 million to purchase and install,

has an estimated useful life of three years. The new technology is expected to have a resale value that is

25% of its original cost at the end of the three years. If the new electronic data processing system is

installed, management believes that revenues can be increased by $1.75 million annually, while the cost of

goods sold is expected to remain constant at 60% of revenues. Annual system-operating costs will be

$500,000 lower with the new equipment than with the existing equipment. As a result of the increased

sales volume, management believes that working capital needs will also increase by $225,000. Baroque's

tax rate is 25%, its cost of capital is 12%, and this is an average-risk project for Baroque. This equipment has

an applicable CCA rate of 55%, declining balance. The equipment is eligible for the Accelerated Investment

Incentive of 1.5 times the CCA rate in the year of acquisition and immediate expensing rules for tax purposes

with a limit of $1.5 million per year. Assume there are still assets remaining in the UCC class and that there is

a positive balance in the class even after the salvage proceeds are deducted. Required: Using the net

present value (NPV) method, determine whether Baroque should replace its equipment with the new

technology.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning