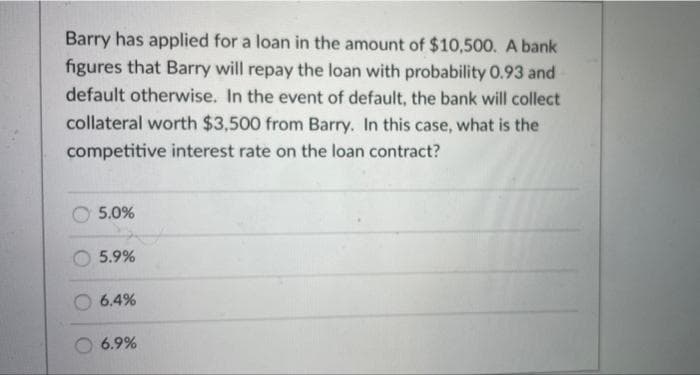

Barry has applied for a loan in the amount of $10,500. A bank figures that Barry will repay the loan with probability 0.93 and default otherwise. In the event of default, the bank will collect collateral worth $3,500 from Barry. In this case, what is the competitive interest rate on the loan contract? 5.0% 5.9% 6.4% 6.9%

Q: You are constructing a simple portfolio using two stocks A and B. Both have the same expected return...

A:

Q: the stock will be worth $25. | What is the present discounted value of the call option? | What would...

A: A call option gives the holder of the option a right, but not an obligation to buy stocks at a prede...

Q: Earned Value formulas. • SV = EV - PV; SPI = EV/PV • CV = EV - AC; CPI = EV/AC • CR = SPI x CPI Prob...

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to solve ...

Q: Based on SME’s financial statements, what is its average collection period or DSO

A: Receivables days means the average number of days a company takes to collect receivables from its cr...

Q: We learned that if the market interest rate for a given bond increased, the price of the bond would ...

A: a) When the risk aversion of investors starts decreasing, it indicates that they now assume that the...

Q: Suppose the interest rate is 6.9% APR with monthly compounding. What is the present value of an annu...

A: Interest rate = 6.9% Semi annual interest rate (r) = [1+(0.069/12)]6-1 ...

Q: Katy invests $13,000 at 6% simple interest for 38 years. Round your answers to the nearest cent. How...

A: Principal Amount = $13,000 Interest Rate = 6% Time Period = 38 Years

Q: Two mutually exclusive investment opportunities require an initial investment of $6 million. Investm...

A: Given, Two projects with initial investment of $6 million each. Investment A gives $1.5 million in ...

Q: Which of the following pairs of financial statement analysis tool will be given more emphasis by a f...

A: Solution:- Granting trade credit or selling on account to a new client are short term decisions and ...

Q: What is the amount of compensating balance would be required for a nominal interest rate of 12% to e...

A: Borrowings are the loan which is taken by the individual to meet its financial requirements. The mor...

Q: The Garraty Company has two bond issues outstanding. Both bonds pay $100 annual interest plus $1,000...

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first ...

Q: pose that Payout changes its mind and decides to issue a 5% stock dividend ins rchasing 5% of the ou...

A: A company may choose to repurchase its shares in order to increase its stock price and improve its f...

Q: You have been accepted into college. The college guarantees that your tuition will not increase for ...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: What is the accumulated value of deposits of $1020.00 made at the end of every six months for three ...

A: Accumulated deposits include the amount deposited and compounding interest accumulated over the peri...

Q: How much interest is earned in 4 years on P12,000 deposited in an account paying 4% compounded semi-...

A: Interest earned = Future value - Present value

Q: a. Calculate the initial value of the index if a price-weighting scheme is used. Indes value b. What...

A: Price-Weighted Index: In the price-weighted index, each security is weighted by the relevant price ...

Q: Brandon purchased a car using a 5-year car lease at 5.80% compounded quarterly that required her to ...

A: The cost of the car can be calculated by adding the downpayment and present value of the loan paymen...

Q: What is the yield to maturity? Round your answer to two decimal places. % What is the yield to ca...

A: Yield To Maturity: It refers to the expected rate of return for the bondholder if the bond is held ...

Q: Grady-White Boats, Inc. is considering a project that will require additional inventory of $1,131,00...

A: Solution:- Working capital refers to the difference between the entity's current assets and current ...

Q: What is the future value of $1,540 invested for 5 years at 5% interest compounded monthly? Round you...

A: Future Value of investment is calculated as: = Principal * ( 1 + rate of interest per period) ^ numb...

Q: Find the future worth factor of an annual payment for 15 years at 13 % compounded annually.

A: Time Period = 15 Years Interest Rate = 13%

Q: Assets (in KD) Liabilities (in KD) Cash 116749 Accounts payable 80000 Accounts receivable 100000 Acc...

A: To Find: Debt Ratio

Q: You buy a semiannually paying coupon bond with a face value of $1,000 and a coupon rate of 8%. The b...

A: Given, Face value of bond is $1000 Coupon rate is 8% Time to maturity is 20 years.

Q: Consider the above balance sheet and income statement. The account payable deferral period is equal ...

A: The account payable deferral period is the period of time taken by the company to pay off its accoun...

Q: 2. Linkline's stock is trading at 55 today and you have determined the outlook for the next year is ...

A: Binomial option pricing method will be used to determine the call price of the stock. Given: S0 = $5...

Q: A pair of scissors is originally priced at P55 is marked 25% off. What is the sale price?

A: To increase the sales of companies provide discount to the sales prices and these discounts increase...

Q: Select one:

A: Commissions are an important part of sales compensation.It is the money a seller earns according to ...

Q: Maria invested part of her P800,000.00 in an investment earning 12% per annum while the remaining at...

A: Solution:- When an amount is invested somewhere, it earns some interest on it and that’s why every r...

Q: SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.6...

A:

Q: How much larger will the value of an RRSP be at the end of 20 years if the contributor makes month-e...

A: Future Value of Ordinary Annuity refers to the concept which determines the sum total of all the cas...

Q: Other things equal, which of the following will decrease the WACC of a firm that has both debt and e...

A: The Weighted Average Cost of Capital and Capital Structure both are important factors in an organiza...

Q: How much money should you invest at an interest rate of 6% compounded monthly, to have P400,000 in 5...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: When a note is non-interest-bearing, the maturity value equals the _____. a.principal b.bank discou...

A: Non interest bearing note- It is type of note with no stated interest rate. But it does not mean th...

Q: Catherine obtained a loan of $40,000 at 4.5% compounded monthly. How long (rounded up to the next pa...

A: Solution:- When a loan is taken, the borrower is given the option whether to repay it in installment...

Q: Neko Inc. uses Additional Funds Needed as a plug item. If the company had forecast its additional fi...

A: The additional funds needed is calculated as difference of capital budget and the forecasted retaine...

Q: 1. On July 15, 1996, what will John receive on selling note to Ben to whom money is worth 4% compoun...

A: Note : We’ll answer the first question since the exact one wasn’t specified. Please submit a new que...

Q: If you take corporate taxes and the cost of financial distress are into consideration, the market va...

A: The cost of conducting business that a company in financial crisis faces, such as a greater cost of ...

Q: ibe the gold standard syst

A: Gold standard is system of currency management system in this system rate of currency was linked to ...

Q: John obtained a loan of $25,000 at 4.6% compounded monthly. How long (rounded up to the next payment...

A: Loan amount = $25,000 Interest rate = 4.6% Monthly payment = $2,810

Q: Suppose GENERAL MILLS issued 1,250,000 bonds with the per value of $1000 and a coupon rute of 3.8% o...

A: The price for bond implies to the consideration amount paid by investor for purchasing bond. In prov...

Q: Yusra has a term loan that she still owes $15,483.58. The annual interest rate on this loan is 3.97%...

A: Given, The amount of loan owed is $15,483.58. Annual interest rate is 3.97%. Monthly payment is $434...

Q: SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.6...

A: Price to earning ratio measures the price of stock relative to its earning. It cam be calculated Pri...

Q: Gregorio bought a car with funds borrowed from a commercial bank. He intends to repay the note with ...

A: Par value (FV) = P750,000 Discount rate (r) = 12% Period (d) = 270 days

Q: On April 1, S10,000.00 364-day treasury bills were auctioned off to yield 2.31%. (a) What is the pri...

A: Hi, since you have posted a question with multiple sub-parts, we will answer the first three as per ...

Q: which Costs are associated with various elements of working capital of companies

A: Meaning of Working Capital. Working capital is a tool to measure company's liquidity, short term fin...

Q: Fowler, Inc., just paid a dividend of $2.40 per share on its stock. The dividends are expected to gr...

A: SOLUTION : GIVEN, Dividend = $2.40 Growth rate = 6.25% Required return = 12% Now, a. Calculating ...

Q: If a company declares a $0.30 dividend and you own 100 shares, how much dividends will you receive?

A: A dividend is a monetary payment made by a company to its shareholders who are eligible to receive i...

Q: The terms of financing, whether good or bad,

A: Financing is a process used for funding business activities through purchasing or investing. Financi...

Q: If a student's time value of money rate is 24%, then the student would be indifferent between $77 to...

A: Interest rate (r) = 24% Present value (PV) = $77 Period (n) = 1 year

Q: Stream Tube made $15 billion worth of revenue this year. The total market for streaming television s...

A: Solution:- Market share means the proportion of a company in the entire industry.

Please answer fast

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Hendo Corp. can borrow from its bank using a one year (a) simple interest loan with an 11.3% quoted rate and no compensating balance or (b) a discount interest loan with a quoted rate equal to 9.9% that requires a 15% compensating balance. What is the EAR of the lower cost loan? Hendo Corp. normally tries to keep its checking account balance close to $0.Company, a financial institution, allows Integrity Company to borrow P1,300,000 with 8% interest. Honesty would require a compensating balance of 8% of the face value of the loan.What is the effective interest rate of the loan (round off your answer to two decimal places)?ank A has offered you a loan worth $20,000 for 180 days whereas bank B offered you the same loan but as a compensating balance loan. Which offer would you take and why, explain Why could have bank B offered a compensating balance loan.

- Bank Phoenix gives two one-year loans of N$ 20 million loan to Mr A, and N$ 85 million to Mrs B. The joint probability of default for Mr A and Mrs B is 0.095. Mr A probability of default and LGD are respectively 0.3 and 35%. Mrs B probability of default and LGD are respectively 0.35 and 55 %. Calculate bank PHOENIX one-year expected loss of default.Bozo Bank makes a loan to Rizzo Razors. It has a base lending rate on loans of 11% and charges a risk premium of 3% on the loan. It does not charge an origination fee, but imposes compensating balances of 10%. Reserve Requirements are 10%, and they do not pay interest. a. What would be the approximate cost of the loan to Rizzo Razors? b. What would be the return to the bank?Consider a $5,000, 6%, 180-day interest-bearing note and a non-interest- bearing note for the same amount and time period with a bank discount of 6%. From the borrower’s point of view, which is the better loan and why?

- Suppose that you owe $2,000 on a credit card that charges 18% APR and you pay either the minimum 10% or $20, whichever is higher, every month. How long will it take you to eliminate the debt? Assume that the bank uses the previous-balance method to calculate your interest, meaning that the bank does not subtract the amount of your payment from the beginning balance but charges you interest on the previous balance.Pedro Gil Company must maintain a compensating balance of P50,000 in its checking account as one of the conditions of its short-term 6% bank loan of P500,000. Pedro Gil’s checking account earns 2% interest. Ordinarily, Pedro Gil would maintain a P20,000 balance in the account for transaction purposes. What is the loan’s approximate effective interest rate? Please show your solution.A bank offers your firm a revolving credit arrangement for up to $86 million at an interest rate of 2.15 percent per quarter. The bank also requires you to maintain a compensating balance of 2 percent against the unused portion of the credit line, to be deposited in a non-interest-bearing account. Assume you have a short-term investment account at the bank that pays 1.50 percent per quarter, and assume that the bank uses compound interest on its revolving credit loans. a. What is your effective annual interest rate (an opportunity cost) on the revolving credit arrangement if your firm does not use it during the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Effective annual interest rate % b. What is your effective annual interest rate on the lending arrangement if you borrow $50 million immediately and repay it in one year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2…

- merchant receives an invoice for $8000 with terms 2/10, n/50.a) What is the maximum interest rate that the merchant could borrow money at to take advantage of the discount?b) If the bank offers a loan for 15% interest, should he accept it, and if so, what will be his savings?A bank has made a 3-year $10 million dollar loan that pays annual interest of 8%. The principal is due at the end of the third year. A. The bank is willing to sell this loan with recourse at 8.5% discount rate. What should it expect for selling this loan? B. It also has the option of selling this loan without recourse at a discount rate of 8.75%. What should it expect for selling this loan? C. If the bank expects a ½% probability of default on this loan, is it better off selling this loan with or without recourse? It expects to receive no interest payments or principal if the loan is defaulted. D. Why do you think that the interest rate in part A is different from the interest rate in part B?Suppose that a bank does the following: a. Sets a loan rate on a prospective loan at 8 percent (where BR=5% and φ=3%. b. Charges a 110 percent (or 0.10 percent) loan origination fee to the borrower. c. Imposes a 5 percent compensating balance requirement to be held as non-interest-bearing demand deposits. d. Holds reserve requirements of 10 percent imposed by the Federal Reserve on the bank’s demand deposits. Calculate the bank’s ROA on this loan.