pose that Payout changes its mind and decides to issue a 5% stock dividend ins rchasing 5% of the outstanding stock. How would this action affect a sharehold vers to the nearest dollar.) . value of the position $ pare the effects of the repurchase to the effects of the cash dividend. value of the position is (Click to select) v under the cash dividend. pare the effects of the repurchase to the effects of repurchasing 5% of the outs ralue of the position is (Click to select) ♥ under the repurchase.

pose that Payout changes its mind and decides to issue a 5% stock dividend ins rchasing 5% of the outstanding stock. How would this action affect a sharehold vers to the nearest dollar.) . value of the position $ pare the effects of the repurchase to the effects of the cash dividend. value of the position is (Click to select) v under the cash dividend. pare the effects of the repurchase to the effects of repurchasing 5% of the outs ralue of the position is (Click to select) ♥ under the repurchase.

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 11P

Related questions

Question

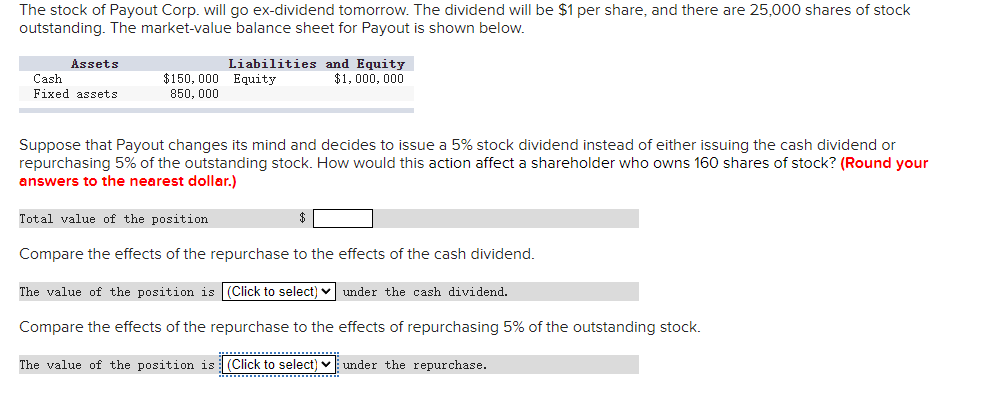

Transcribed Image Text:The stock of Payout Corp. will go ex-dividend tomorrow. The dividend will be $1 per share, and there are 25,000 shares of stock

outstanding. The market-value balance sheet for Payout is shown below.

Liabilities and Equity

$1, 000, 000

Assets

Cash

Fixed assets

$150, 000 Equity

850, 000

Suppose that Payout changes its mind and decides to issue a 5% stock dividend instead of either issuing the cash dividend or

repurchasing 5% of the outstanding stock. How would this action affect a shareholder who owns 160 shares of stock? (Round your

answers to the nearest dollar.)

Total value of the position

Compare the effects of the repurchase to the effects of the cash dividend.

The value of the position is (Click to select) v under the cash dividend.

Compare the effects of the repurchase to the effects of repurchasing 5% of the outstanding stock.

The value of the position is: (Click to select) v under the repurchase.

.......................

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning