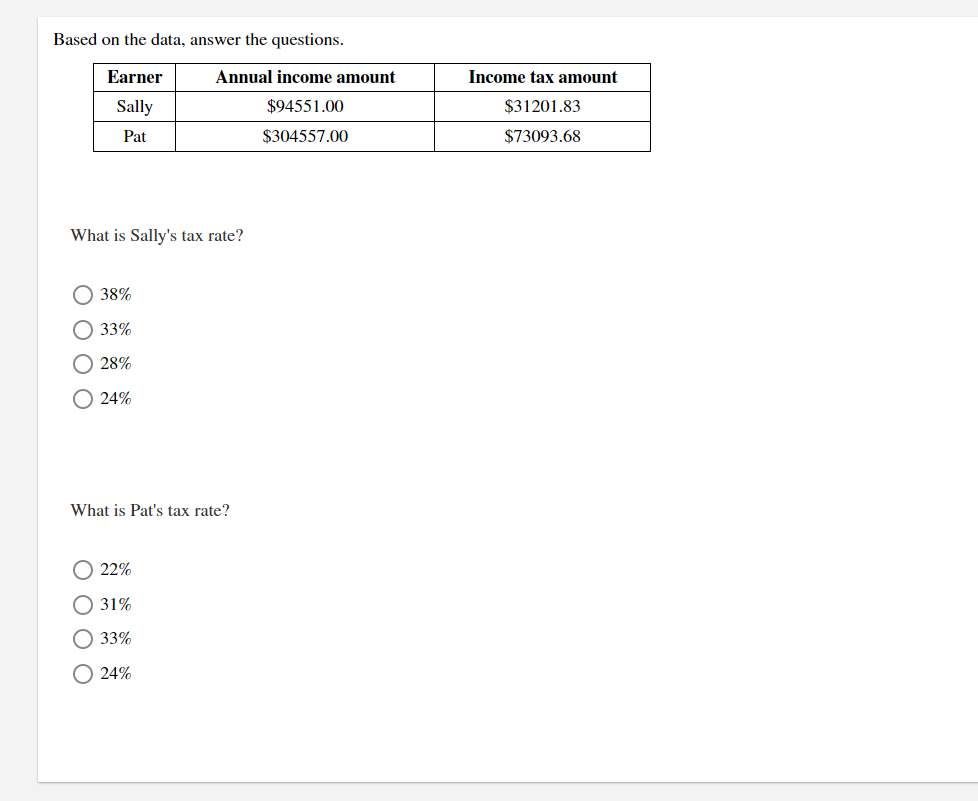

Based on the data, answer the questions. Earner Sally Pat What is Sally's tax rate? 38% 33% 28% O 24% Annual income amount $94551.00 $304557.00 What is Pat's tax rate? 22% 31% 33% O 24% Income tax amount $31201.83 $73093.68

Q: Determine and write in the space provided whether each of the following statements is true, false,…

A: GDP: It refers to the gross domestic product of the economy. The increase in the GDP shows the…

Q: What is the present value of $100 realized two years from now if the interest rate is 10%?

A: Present worth is the concept that describes an amount of money today is value greater than that same…

Q: 5. The stability advantage Suppose the United States is experiencing a financial crisis, leading…

A: Here, it is given that people loose their confidence from dollar and euro is considered as a safe…

Q: Which of the following statements best describes the relationship between Economic Growth and…

A: Economic Growth refers to the increase in the GDp of a country over a period. It is characterized by…

Q: The demand schedule for sugar is: The demand schedule for sugar is: Price (dollars per kilogram) 3 5…

A: Demand schedule shows the different quantity demanded at various price level. here price and…

Q: The graph below characterizes a simple economy with only two components of aggregate expenditures:…

A:

Q: Consider the following demand and supply functions. D(x) = 83-0.4x, S(x) = 2x + 75.8,0 ≤ x ≤ 90 Step…

A: The consumer surplus alludes to the contrast between the thing a consumer will pay and what they…

Q: Assume that the price of oranges is $2 and the price of starfruit is $1. You have $10 of income to…

A: utility is the satisfaction derived from the consumption of goods and service . Total utility TU is…

Q: 010

A: The expected value of game= P1X1+P2X2 P1= Probability of winning X1= winning amount P2= Probability…

Q: i.Methods of Theoretical Economics - State Deduction and Induction

A: "Since you have asked multiple question,we will solve first question for you.If you want specific…

Q: What are your opinions on the present stage of development and underlying technologies of the…

A: answer

Q: In a competitive market economy, how is the distribution of income primarily determined? a.By the…

A: Perfect competition refers to the type of market where there are a large number of producers and…

Q: Suppose a firm's marginal cost is increasing as it produces more output. Then the firms is said to…

A: The excess cost that is incurred by the producer to make an additional unit of output is known as…

Q: Read the excerpt from the article “ATAR cut-offs to soar without more uni places to meet surging…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a…

Q: Suppose the market supply curve in a competitive market is given by is Q-2p-10. At a price of $15,…

A: Producer surplus is the area below the price line and above the supply curve. It measures the total…

Q: Define what is a country’s gross domestic product (GDP) and list and explain its various components.

A: GDP is significant since it gives information about an economy's size and performance.Real GDP…

Q: Suppose a firm's long-run average cost is increasing as the firm produces more output. Then the firm…

A: Long-run average total cost is a business metric that represents the average cost per unit of output…

Q: Describe the European Union. How many countries are in the European Union? (You may find information…

A: European union is a group of nations which form a single market.

Q: Illustrate and discuss how a change in the price of a commodity can generate income and…

A: Substitution effect:- The substitution effect is the decline in a product's sales which results from…

Q: 5. Consider the following Extended Form game where P1 stands for Player one and P2 stands for player…

A: The Nash equilibrium is a dynamic hypothesis inside game hypothesis that expresses a player can…

Q: Marta and Sara are two students that devote part of their free time to doing surveys for a market…

A: A typical strategy for deciding subgame ideal equilibria on account of a limited game is in reverse…

Q: What is demand

A: The price of the good and the quantity desired of the good have a negative connection, in accordance…

Q: a).Explain why allocating property rights might help solve the inefficient outcomes generated by…

A: Externalities occur when the market system does not deliver an efficient result. or the demand and…

Q: 10. Team i and team j compete in a league. Each team chooses a level of talent t, which determines…

A: The equilibrium condition is that each team chooses the level of talent t that maximizes their…

Q: 1.Which part of economics focuses on the behavior of basic elements of the economy? 2. What is the…

A: The basic elements of economics:- Buyers are the most important element of an economy, they have…

Q: Consider the following data: x 44 55 66 77 88 P(X=x)P(X=x) 0.30.3 0.20.2 0.20.2 0.10.1 0.20.2 Copy…

A: Given information: X is a random variable. It takes 5 different values, i.e., 4, 5, 6, 7 and 8 The…

Q: QUESTION 27 If nominal GDP in 2014 is $20.000 billion while real GDP is $16,500 billion, then the…

A: GDP Deflator = Nominal GDPReal GDP×100Unemployment rate = Number of Unemployed personLabor…

Q: Economics please help all 3 true or false and with explain

A: Since you have asked multiple question, we will answer first question for you. If you want any…

Q: Consumer surplus for an entire market is calculated by Select one: Finding the area above the demand…

A: Here the supply curve is the curve depicting how much production of manufacturing goods is being…

Q: PART 2 Question 1 a. The following table summarizes the short-run production functions for "All…

A: ince you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Small Medium Enterprise are sn important part of any economy. describe in detail the various…

A: The Government of India established MSMEs, or Micro, Small, and Medium Enterprises, which are…

Q: The short-run result of an open market purchase of securities by the Federal Reserve is a(n)…

A: The goal of the monetary policy of the central bank is to control the amount of money in the…

Q: Money can be used to transfer purchasing power from the present to the future. Which specific…

A: Meaning of Money: The term money is all about the transaction (in terms of cash) or it can be…

Q: The following table shows the real output demanded and supplied at various price levels in a…

A: We have given the real quantity demanded and real quantity supplied at a different price level in a…

Q: pose Susan and Tom were picking the maximum number of pounds of coffee when they decided that they…

A: Disclaimer- “Since you have asked multiple question, we will solve the first three question for you…

Q: What would happen to the measured unemployment rate if individuals who had previously left the labor…

A: The unemployment rate of an economy is the percentage of the labour force that is unemployed. It is…

Q: Please complete the following sentence. One difference between a monopoly and a perfectly…

A: A firm structure where there are lots of little businesses producing the same kinds of goods, but…

Q: What is stock exchange

A: Capital is a crucial component in starting any business. The quantity of financial assets that the…

Q: Consider an economy with two people who have the utility functions and initial endowments given…

A: Given the utility function we observe both consumer 1 and 2 have perfect substitute utility…

Q: Question 4: a. The Best Computer Company just developed a new computer processor, on which it…

A: Dear student, you have asked multiple sub-part questions in a single post.In such a case, as per the…

Q: 1. According to INEC, the number of people employed, unemployed, and the adult population in…

A: The labour force is the number of people either utilized or jobless however effectively searching…

Q: The Amazing Restaurant is the only restaurant in Amazing Island. The restaurant provides dining…

A: We use the mark-up formula as mentioned above which is: P - MCP = -1e where P is the price, MC is…

Q: 30 International Trade is different from internal trade because of the A Manufactured goods involved…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Austin's total fixed cost (TFC) is $350/month at his cupcake bakery. Austin employs 10 workers and…

A: The amount of output produced determines the fluctuation in variable costs. Labor costs are one type…

Q: Which of the following Canadian markets has a four-firm concentration ratio of over 50 percent? O…

A: Concentration ratios are utilized to evaluate market concentration and depend on companies' market…

Q: The General Hospital is evaluating new office equipment offered by four companies. The useful life…

A: Total benefit from company A equipment is =(Annual benefit*4) + Salvage value - First…

Q: Suppose a person chooses to play a gamble that is free to play. In this gamble, they have a 10%…

A: Insurance is the financial instrument that insurance firms or banks offer or sell a customer in…

Q: Describe the role of repo rate and reverse repo rate in correcting deflationary gap in an economy.

A: Repo rate is the term used to describe the rate at which commercial banks borrow money by offering…

Q: Suppose the market supply curve in a competitive market is given by is Q-2p-10. At a price of 315,…

A: Meaning of Competitive Market: The term competitive market refers to the situation under which the…

Q: Consider the following demand and supply functions. D(x) = 83-0.4x, S(x) = 2x + 75.8,0 ≤ x ≤ 90 Step…

A: In the mentioned question we have been given demand and supply function. Demand function refers to…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- As a part-time college instructor, Kathy im teaches an introductory course on Mexican history. She has a biweekly gross income of $3654.75. Her before-tax deductions include a short-term disability premium of 0.5%, union dues of 3.1%, and a pension amount of 4%. If she pays federal tax at a rate of 18.5%, provincial tax at a rate of 6.2%, CPP at 4.95%, and EI at 2.2%, what is her net income?Question A An asset is sold to a non-connected party for R150 000. This asset was acquired two years ago for R225 000. The Tax value equates to R135 000. Calculate the amount (if any) to include in the gross income of the "person". IGNORE VAT. O a. R150 000 proceeds O b. R90 000 recoupment O c. R15 000 recoupment . Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line.Pls help with below homewrok, answer in 5-6 sentence only Bert contributes $3,000 to his son’s RESP during 2013. What impact does this have on Bert’s taxable income? Format: positive numbers as 100,000.00, negative numbers as (100,000.00)

- Businesses that offer repayment plans for purchases are required by law to disclose the interest rate. But that dosent mean they let you go out of there way to let you know what it is. you have to read all the paper work. Find the interest rate for the follwing purchase. For a 312 square- foot family room, you choose carpert that costs $1.44 per square foot. The tax rate is 6.1% and youre offered 24 payemnts of 27.61. Round to one decimal, if necessary.Find the equilbrium Y when C = 300 + 0.8Y and I = 1000Meena earns Tk. 9000 from her poultry firm. Over the day, equipments of egg hatcheries depreciate in value by Tk. 400.Of the remaining amount; Meena gives Tk.250 to the government in sales taxes. Later she retains 290 taka in her business for buying new machines and receives 470 as old scheme benefit. From the remaining amount that Meena takes home, she pays Tk.500 as income taxes. Based on this information, compute Meena’s contribution to the following measures of income: a. Gross Domestic product b. Net National Product c. National Income d. Personal Income e. Disposable Personal Income

- Meena earns Tk. 9000 from her poultry firm. Over the day, equipments of egg hatcheries depreciate in value by Tk. 400.Of the remaining amount; Meena gives Tk.250 to the government in sales taxes. Later she retains 290 taka in her business for buying new machines and receives 470 as old scheme benefit. From the remaining amount that Meena takes home, she pays Tk.500 as income taxes. Based on this information, compute Meena’s contribution to the following measure of income: i. Personal Income?You decide to work part-time at a local clothing store. The job pays $8.50 per hour and you work 16 hours per week. Your employer withholds 10% of your gross pay for federal taxes, 5.65% for FICA taxes, and 4% for state taxes. SUB PARTS TO BE SOLVED. How much is withheld per week for state taxes? What is your weekly net pay? What percentage of your gross pay is withheld for taxes? Round to the nearest tenth of a percent.Ay 3.

- A 173.Subject: calculus Shannon is a resident for the full year and has given you the following information for the preparation of her income tax return for current tax year: Wage income $27,000 Investment income $1,700 Allowable Deductions $175 PAYG (W) per payment summary $3,576 PAYG (I) on investment income paid $43 per quarter Calculate Shannon’s tax credits for the current tax year.4. Poch placed Php2,500,000 in a time deposit that earns 0.75% per annum simple interest. The placement was made from October 10, 2021 until February 24, 2022. How much interest did he earn net of 20% withholding tax. Apply the Banker's Rule.