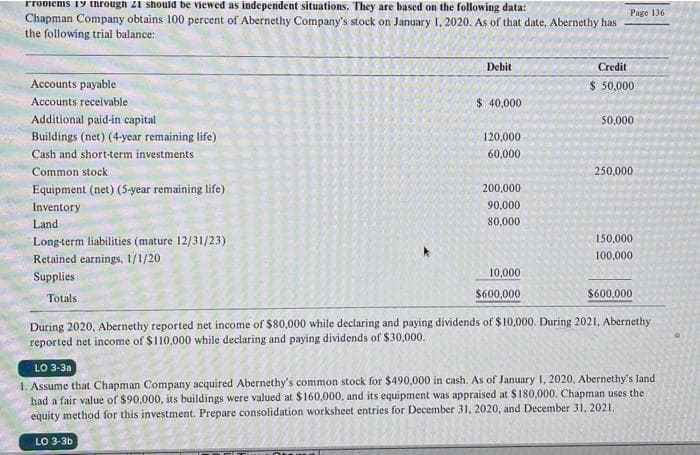

based on the following data: Page 136 Chapman Company obtains 100 percent of Abernethy Company's stock on January I, 2020. As of that date, Abernethy has the following trial balance: Debit Credit Accounts payable $ 50,000 Accounts receivable $ 40,000 Additional paid-in capital 50,000 Buildings (net) (4-year remaining life) 120,000 Cash and short-term investments 60,000 Common stock 250,000 Equipment (net) (5-year remaining life) 200,000 Inventory 90,000 Land 80,000 Long-term liabilities (mature 12/31/23) 150,000 Retained earnings, 1/1/20 100,000 10,000 Supplies Totals $600,000 $600,000 During 2020, Abernethy reported net income of $80,000 while declaring and paying dividends of $ 10,000. During 2021, Abernethy reported net income of $110,000 while declaring and paying dividends of $30,000. LO 3-30 1. Assume that Chapman Company acquired Abernethy's common stock for $490,000 in cash. As of January 1, 2020, Abernethy's land had a fair value of $90,000, its buildings were valued at $160,000, and its equipment was appraised at $180,000. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021.

based on the following data: Page 136 Chapman Company obtains 100 percent of Abernethy Company's stock on January I, 2020. As of that date, Abernethy has the following trial balance: Debit Credit Accounts payable $ 50,000 Accounts receivable $ 40,000 Additional paid-in capital 50,000 Buildings (net) (4-year remaining life) 120,000 Cash and short-term investments 60,000 Common stock 250,000 Equipment (net) (5-year remaining life) 200,000 Inventory 90,000 Land 80,000 Long-term liabilities (mature 12/31/23) 150,000 Retained earnings, 1/1/20 100,000 10,000 Supplies Totals $600,000 $600,000 During 2020, Abernethy reported net income of $80,000 while declaring and paying dividends of $ 10,000. During 2021, Abernethy reported net income of $110,000 while declaring and paying dividends of $30,000. LO 3-30 1. Assume that Chapman Company acquired Abernethy's common stock for $490,000 in cash. As of January 1, 2020, Abernethy's land had a fair value of $90,000, its buildings were valued at $160,000, and its equipment was appraised at $180,000. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021.

Chapter7: Corporations: Reorganizations

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:rroDiems 19 through 21 should be viewed as independent situations. They are based on the following data:

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2020. As of that date, Abernethy has

the following trial balance:

Page 136

Debit

Credit

Accounts payable

$ 50,000

Accounts receivable

$ 40,000

Additional paid-in capital

Buildings (net) (4-year remaining life)

50,000

120,000

Cash and short-term investments

60,000

Common stock

250,000

Equipment (net) (5-year remaining life)

Inventory

200,000

90,000

Land

80,000

Long-term liabilities (mature 12/31/23)

150,000

Retained earnings, 1/1/20

100,000

Supplies

10,000

$600,000

$600,000

Totals

During 2020, Abernethy reported net income of $80,000 while declaring and paying dividends of $ 10,000. During 2021, Abernethy

reported net income of $110,000 while declaring and paying dividends of $30,000.

LO 3-3a

1. Assume that Chapman Company acquired Abernethy's common stock for $490,000 in cash. As of January 1, 2020, Abernethy's land

had a fair value of $90,000, its buildings were valued at $160,000, and its equipment was appraised at $180,000. Chapman uses the

equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021.

LO 3-3b

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning