Based on this information, the breakeven points for Bulldogs Co. and National Co. are: a. 5 million and 6 million units, respectively. b. 1.5 million and 0.75 million units, respectively. c. 0.75 million and 1.1 million units, respectively. d. 1 million and 1.5 million units, respectively.

Based on this information, the breakeven points for Bulldogs Co. and National Co. are: a. 5 million and 6 million units, respectively. b. 1.5 million and 0.75 million units, respectively. c. 0.75 million and 1.1 million units, respectively. d. 1 million and 1.5 million units, respectively.

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 3PB: The income statement comparison for Rush Delivery Company shows the income statement for the current...

Related questions

Question

Based on this information, the breakeven points for Bulldogs Co. and National Co. are:

a. 5 million and 6 million units, respectively.

b. 1.5 million and 0.75 million units, respectively.

c. 0.75 million and 1.1 million units, respectively.

d. 1 million and 1.5 million units, respectively.

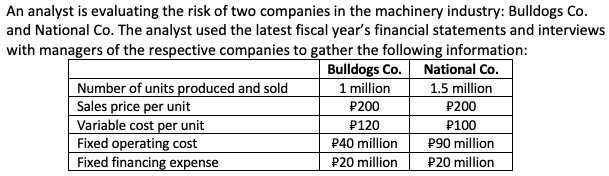

Transcribed Image Text:An analyst is evaluating the risk of two companies in the machinery industry: Bulldogs Co.

and National Co. The analyst used the latest fiscal year's financial statements and interviews

with managers of the respective companies to gather the following information:

Bulldogs Co.

National Co.

Number of units produced and sold

Sales price per unit

Variable cost per unit

Fixed operating cost

Fixed financing expense

1 million

1.5 million

P200

P200

P100

P90 million

P120

P40 million

P20 million

P20 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning