Based upon the given financial statement, would you provide a credit line to this company? Support your decision by reference to your work in parts (1) through (4)

Based upon the given financial statement, would you provide a credit line to this company? Support your decision by reference to your work in parts (1) through (4)

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Topic Video

Question

Based upon the given financial statement, would you provide a credit line to this company? Support your decision by reference to your work in parts (1) through (4).

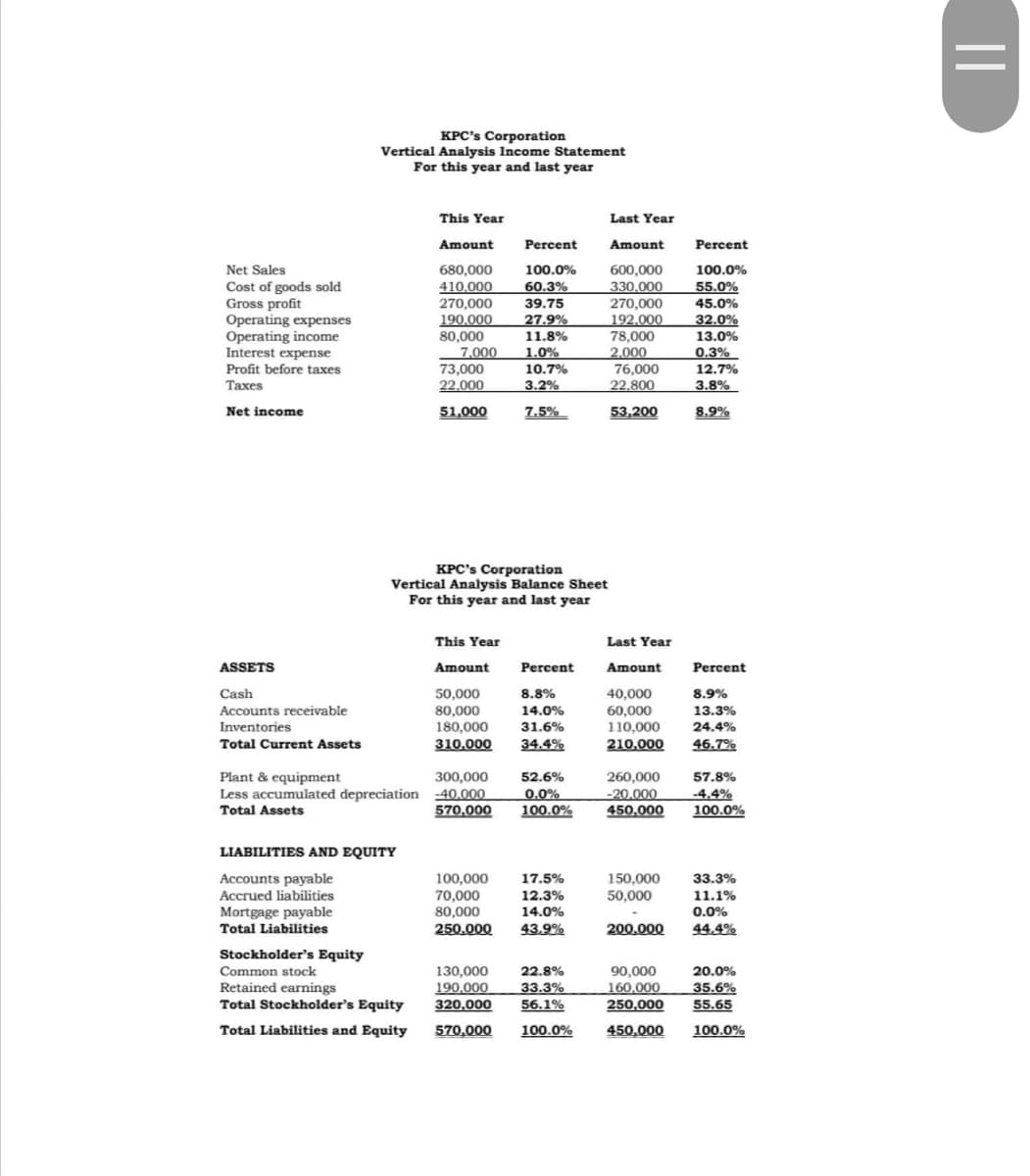

Transcribed Image Text:KPC's Corporation

Vertical Analysis Income Statement

For this year and last year

This Year

Amount

Percent

680,000

100.0%

410,000

60.3%

270,000

39.75

190,000

27.9%

80,000

11.8%

1.0%

73,000

10.7%

22,000

3.2%

51,000

7.5%

KPC's Corporation

Vertical Analysis Balance Sheet

For this year and last year

This Year

Amount

Percent

50,000

8.8%

80,000

14.0%

180,000

31.6%

310,000 34.4%

300,000

52.6%

0.0%

-40.000

570,000 100.0%

100,000

17.5%

70,000

12.3%

80,000

14.0%

250.000

43.9%

130,000

22.8%

190.000

33.3%

320,000

56.1%

570,000 100.0%

Net Sales

Cost of goods sold

Gross profit

Operating expenses

Operating income

Interest expense

Profit before taxes

Taxes

Net income

ASSETS

Cash

Accounts receivable

Inventories

Total Current Assets

Plant & equipment

Less accumulated depreciation

Total Assets

LIABILITIES AND EQUITY

Accounts payable

Accrued liabilities

Mortgage payable

Total Liabilities

Stockholder's Equity

Common stock

Retained earnings

Total Stockholder's Equity

Total Liabilities and Equity

7,000

Last Year

Amount

600,000

330,000

270,000

192,000

78,000

2,000

76,000

22,800

53,200

Last Year

Amount

40,000

60,000

110,000

210.000

260,000

-20.000

450,000

150,000

50,000

200,000

90,000

160.000

250,000

450,000

Percent

100.0%

55.0%

45.0%

32.0%

13.0%

0.3%

12.7%

3.8%

8.9%

Percent

8.9%

13.3%

24.4%

46.7%

57.8%

-4.4%

100.0%

33.3%

11.1%

0.0%

44.4%

20.0%

35.6%

55.65

100.0%

=

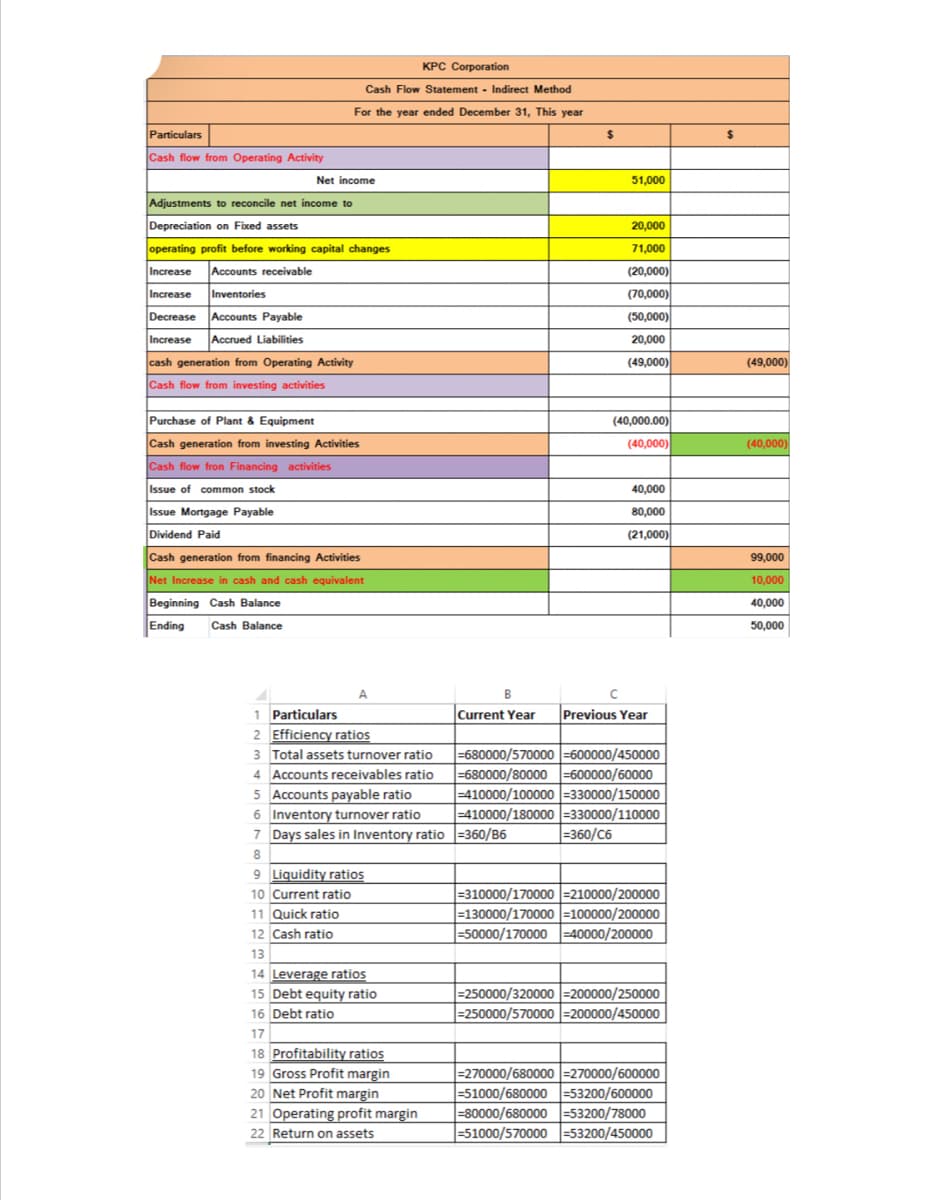

Transcribed Image Text:KPC Corporation

Cash Flow Statement Indirect Method

For the year ended December 31, This year

Particulars

Cash flow from Operating Activity

Adjustments to reconcile net income to

Depreciation on Fixed assets

operating profit before working capital changes

Increase Accounts receivable

Increase Inventories

Decrease Accounts Payable

Increase Accrued Liabilities

cash generation from Operating Activity

Cash flow from investing activities

Purchase of Plant & Equipment

Cash generation from investing Activities

Cash flow fron Financing activities

Issue of common stock

Issue Mortgage Payable

Dividend Paid

Cash generation from financing Activities

Net Increase in cash and cash equivalent

Beginning Cash Balance

Ending Cash Balance

A

1 Particulars

2 Efficiency ratios

3 Total assets turnover ratio

4 Accounts receivables ratio

5 Accounts payable ratio

6 Inventory turnover ratio

7

Days sales in Inventory ratio=360/B6

8

9 Liquidity ratios

10 Current ratio

11 Quick ratio

12 Cash ratio

13

14 Leverage ratios

15 Debt equity ratio

16 Debt ratio

17

18 Profitability ratios

19 Gross Profit margin

20 Net Profit margin

21 Operating profit margin

22 Return on assets

Net income

$

51,000

20,000

71,000

(20,000)

(70,000)

(50,000)

20,000

(49,000)

(40,000.00)

(40,000)

40,000

80,000

(21,000)

B

с

Current Year Previous Year

-680000/570000-600000/450000

-680000/80000=600000/60000

-410000/100000-330000/150000

-410000/180000 -330000/110000

=360/C6

=310000/170000=210000/200000

=130000/170000-100000/200000

-50000/170000-40000/200000

=250000/320000-200000/250000

=250000/570000-200000/450000

=270000/680000 -270000/600000

-51000/680000 -53200/600000

-80000/680000 -53200/78000

-51000/570000-53200/450000

$

(49,000)

(40,000)

99,000

10,000

40,000

50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you