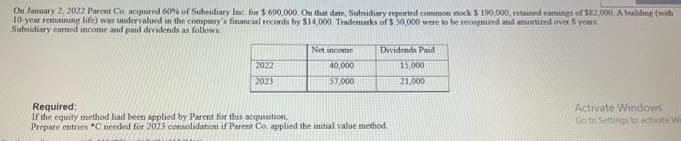

On January 2, 2022 Parent Co, acquired 60% of Subsidiary Inc. for $ 690,000. On that date, Subsidiary reported common stock $ 190,000, retained earnings of $82,000. A building (with 10-year remaining life) was undervalued in the company's financial records by $14,000. Trademarks of $ 50,000 were to be recognized and amortured over 8 years Subsidiary earned income and paid dividends as follows Net income Dividends Paid 2022 40,000 15,000 2023 $7,000 21,000 Required: If the equity method had been applied by Parent for this acquisition, Activate Windows Go to Settings to activate V Prepare entries "C needed for 2023 consolidation of Parent Co, applied the initial value method

On January 2, 2022 Parent Co, acquired 60% of Subsidiary Inc. for $ 690,000. On that date, Subsidiary reported common stock $ 190,000, retained earnings of $82,000. A building (with 10-year remaining life) was undervalued in the company's financial records by $14,000. Trademarks of $ 50,000 were to be recognized and amortured over 8 years Subsidiary earned income and paid dividends as follows Net income Dividends Paid 2022 40,000 15,000 2023 $7,000 21,000 Required: If the equity method had been applied by Parent for this acquisition, Activate Windows Go to Settings to activate V Prepare entries "C needed for 2023 consolidation of Parent Co, applied the initial value method

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 36P

Related questions

Question

Transcribed Image Text:On January 2, 2022 Parent Co. acquired 60% of Subsidiary Inc. for $ 690,000. On that date, Subsidiary reported common stock $ 190,000, retained earnings of $82,000. A building (with

10-year remaining life) was undervalued in the company's financial records by $14,000. Trademarks of $ 50,000 were to be recognized and amortized over 8 years

Subsidiary earned income and paid dividends as follows

Net income

Dividends Paid

2022

40,000

15,000

2023

$7,000

21,000

Required:

If the equity method had been applied by Parent for this acquisition,

Activate Windows

Go to Settings to activate Wi

Prepare entries "C needed for 2023 consolidation if Parent Co, applied the initial value method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning