*BE12-10 Data pertaining to Pelmar Co. are presented in BE12-9. Instead of payment from personal assets, assume that Fernetti receives $24,000 from partnership assets in withdrawing from the firm. Journalize the withdrawal of Fernetti.

*BE12-10 Data pertaining to Pelmar Co. are presented in BE12-9. Instead of payment from personal assets, assume that Fernetti receives $24,000 from partnership assets in withdrawing from the firm. Journalize the withdrawal of Fernetti.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 4CE

Related questions

Question

100%

Please,just solve the Queestion BE12-10>>Iam up load for you 2 pic:

the pic one is Question BE12-9MAYBE YOU NED IT.

The pic 2 is the question I need the help.

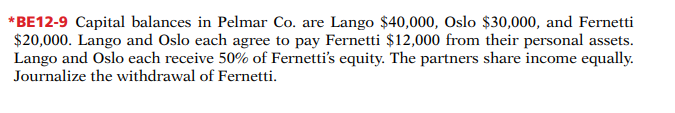

Transcribed Image Text:*BE12-9 Capital balances in Pelmar Co. are Lango $40,000, Oslo $30,000, and Fernetti

$20,000. Lango and Oslo each agree to pay Fernetti $12,000 from their personal assets.

Lango and Oslo each receive 50% of Fernetti's equity. The partners share income equally.

Journalize the withdrawal of Fernetti.

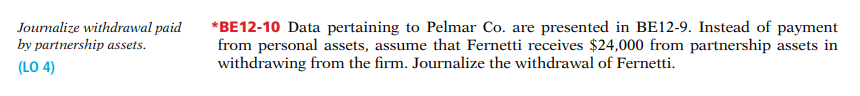

Transcribed Image Text:Journalize withdrawal paid

by partnership assets.

*BE12-10 Data pertaining to Pelmar Co. are presented in BE12-9. Instead of payment

from personal assets, assume that Fernetti receives $24,000 from partnership assets in

withdrawing from the firm. Journalize the withdrawal of Fernetti.

(LO 4)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College