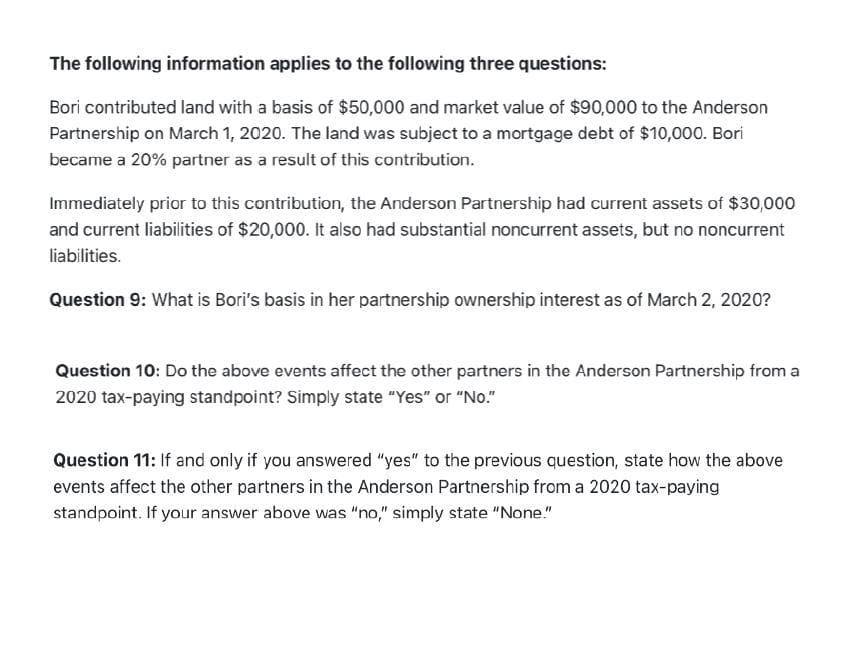

The following information applies to the following three questions: Bori contributed land with a basis of $50,000 and market value of $90,000 to the Anderson Partnership on March 1, 2020. The land was subject to a mortgage debt of $10,000. Bori became a 20% partner as a result of this contribution. Immediately prior to this contribution, the Anderson Partnership had current assets of $30,000 and current liabilities of $20,000. It also had substantial noncurrent assets, but no noncurrent liabilities. Question 9: What is Bori's basis in her partnership ownership interest as of March 2, 2020? Question 10: Do the above events affect the other partners in the Anderson Partnership from a 2020 tax-paying standpoint? Simply state "Yes" or "No." Question 11: If and only if you answered "yes" to the previous question, state how the above events affect the other partners in the Anderson Partnership from a 2020 tax-paying standpoint. If your answer above was "no," simply state "None."

The following information applies to the following three questions: Bori contributed land with a basis of $50,000 and market value of $90,000 to the Anderson Partnership on March 1, 2020. The land was subject to a mortgage debt of $10,000. Bori became a 20% partner as a result of this contribution. Immediately prior to this contribution, the Anderson Partnership had current assets of $30,000 and current liabilities of $20,000. It also had substantial noncurrent assets, but no noncurrent liabilities. Question 9: What is Bori's basis in her partnership ownership interest as of March 2, 2020? Question 10: Do the above events affect the other partners in the Anderson Partnership from a 2020 tax-paying standpoint? Simply state "Yes" or "No." Question 11: If and only if you answered "yes" to the previous question, state how the above events affect the other partners in the Anderson Partnership from a 2020 tax-paying standpoint. If your answer above was "no," simply state "None."

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 20P

Related questions

Question

Plzz answer to All Part

Transcribed Image Text:The following information applies to the following three questions:

Bori contributed land with a basis of $50,000 and market value of $90,000 to the Anderson

Partnership on March 1, 2020. The land was subject to a mortgage debt of $10,000. Bori

became a 20% partner as a result of this contribution.

Immediately prior to this contribution, the Anderson Partnership had current assets of $30,000

and current liabilities of $20,000. It also had substantial noncurrent assets, but no noncurrent

liabilities.

Question 9: What is Bori's basis in her partnership ownership interest as of March 2, 2020?

Question 10: Do the above events affect the other partners in the Anderson Partnership from a

2020 tax-paying standpoint? Simply state "Yes" or "No."

Question 11: If and only if you answered "yes" to the previous question, state how the above

events affect the other partners in the Anderson Partnership from a 2020 tax-paying

standpoint. If your answer above was "no," simply state "None."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you